Xerox 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

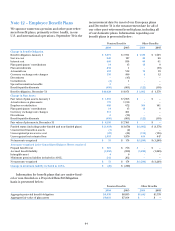

Weighted-average assumptions used to

determine net periodic benefit cost Pension Benefits Other Benefits

for years ended December 31 2005 2004 2003 2002 2005 2004 2003 2002

Discount rate 5.6% 5.8% 6.2% 6.8% 5.8% 6.0% 6.5% 7.2%

Expected return on plan assets 8.0 8.1 8.3 8.8 — (1) —(1) —(1) —(1)

Rate of compensation increase 4.0 3.9 3.9 3.8 — (2) —(2) —(2) —(2)

(1) Expected return on plan assets is not applicable to our other benefits as these plans are unfunded.

(2) Rate of compensation increase is not applicable to our other benefits as compensation levels do not impact earned benefits.

Assumed health care cost trend rates at

December 31

2004 2003

Health care cost trend rate

assumed for next year 11.9% 11.4%

Rate to which the cost trend

rate is assumed to decline

(the ultimate trend rate) 5.2% 5.2%

Year that the rate reaches

the ultimate trend rate 2011 2008

Assumed health care cost trend rates have a

significant effect on the amounts reported for the

health care plans. A one-percentage-point change in

assumed health care cost trend rates would have

the following effects:

One-percentage- One-percentage-

point increase point decrease

Effect on total service and

interest cost components $ 4 $ (3)

Effect on post-retirement

benefitobligation $ 60 $(52)

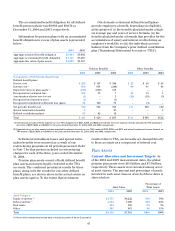

Medicare Prescription Drug, Improvement and

Modernization Act of 2003: In December 2003,

the Medicare Prescription Drug, Improvement and

Modernization Act of 2003 (“Act”) was signed into law.

The Act will provide prescription drug coverage to

retirees beginning in 2006 and will provide subsidies

to sponsors of post-retirement medical plans that pro-

vide actuarially equivalent prescription drug coverage.

We currently provide post-retirement benefits to a

group of retirees under twoplans whereby retirees

have little or no cost sharing for the prescription bene-

fits. For these retirees, the prescription drug benefit

provided by us would be considered to be actuarially

equivalent to the benefit provided under the Act. We

havereduced our Accumulated Projected Benefit

Obligation (“APBO”) by $64 for the subsidy related to

benefits attributed to past service under these plans.

This reduction will be reflected through the reduction

of the amortization of actuarial losses over an effective

amortization period of 12 years, which reflects the

average remaining service period of the employees in

the plan. We also provide postretirement benefits to

another group of retirees. We have not treated the

employer paid drug coverage under this plan as actu-

arially equivalent to the benefits provided under the

Act. This assessment was made prior to the recent

issuance of final regulations regarding the Act. When

we have completed our final review of these regula-

tions, we may determine that the benefits under this

plan are actuarially equivalent for a period of time.

Berger Litigation: Our Retirement Income

Guarantee Plan (“RIGP”) represents the primary U.S.

pension plan for salaried employees. In 2003, we

recorded a $239 provision for litigation relating to the

court approved settlement of the Berger v. RIGP litiga-

tion. The settlement is being paid from RIGP assets

and has been reflected in our 2004actuarial valuation.

The obligation related to this settlement has been

included in plan amendments in the change in the

benefitobligation noted above.

Employee Stock Ownership Plan (“ESOP”)

Benefits: In 1989, we established an ESOP and sold

to it 10 million shares of our Series B Convertible

Preferred Stock (the “Convertible Preferred”) for a

purchase price of $785. Each Convertible Preferred

share was convertible into 6 shares of our common

stock. The Convertible Preferred had a $1 par value

and a guaranteed minimum value of $78.25 per share

and accrued annual dividends of $6.25per share,

which were cumulativeif earned. The dividends were

payable in cash or additional Convertible Preferred

shares, or in a combination thereof.

In May 2004, all 6.2 million of our Convertible

Preferred shares were redeemed for 37 million

common shares in accordance with the original con-

version provisions of the Convertible Preferred shares.

The redemption was accounted for through a transfer

of $483 from preferred stock to common stock and

additional paid-in-capital. Dividends were paid

through the redemption date. The redemption had no

impact on net income or diluted earnings per share

(“EPS”) as such shares were previously included

in our EPScomputation in accordance with the “if

converted” methodology.