Xerox 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

included higher interest rates and borrowing costs in

the first half of the year associated with the terms of

the 2002 Credit Facility. These increased expenses

were offset by lower borrowing costs in the second

half of 2003 following the June 2003 Recapitalization.

Interest income: Interest income is derived primarily

from our invested cash and cash equivalent balances

and interest resulting from periodic tax settlements.

2004 interest income was $10 million higher than

2003 reflecting interest income of $26 million related

to a domestic tax refund claim in 2004, partially

offset by the absence of $13 million of interest income

related to Brazilian tax credits in 2003. 2003 interest

income was $12 million lower than 2002 reflecting

declining interest rates and lower average cash

balances, partially offset by the $13 million of interest

income related to the Brazilian tax credits.

Net currency losses: Net currency losses primarily

result from the spot/forward premiums on foreign

exchange forward contracts, the re-measurement of

unhedged foreign currency-denominated assets and

liabilities and the mark-to-market impact of economic

hedges of anticipated transactions for which wedo not

qualify for cash flowhedge accounting treatment. In

2004, the majority of the exchange losses of $73 mil-

lion related to spot/forward premiums on foreign

exchange forward contracts as well as the mark-to-

market of derivatives economically hedging the cost of

future inventory purchases. The increase from 2003

was primarily due to the weakening of the U.S. Dollar

against the Euro and the Yen. In 2003, exchange losses

of $11 million were due largely to spot/forward premi-

ums on foreign exchange forward contracts and unfa-

vorable currency movements on economic hedges of

anticipated transactions not qualifying for hedge

accounting treatment. In the first half of 2002, we

incurred $57 million of exchange losses, primarily in

Brazil and Argentina due to the devaluation of the

underlying currencies. In the latter half of 2002, we

were able to restore hedging capability in the majority

of our key markets. Therefore, the $20 million of cur-

rency losses in the second half of 2002 primarily rep-

resented the spot/forward premiums on foreign

exchange forward contracts and unfavorable currency

movements on economic hedges of anticipated trans-

actions not qualifying for hedge accounting treatment.

Legal and regulatory matters: Legal and regulato-

ry matters for 2004 reflect expenses associated with

the resolution of various legal matters, none of which

was individually material, partially offset by the

adjustment of an estimate associated with a previous-

ly recorded litigation accrual. See Note 14 to the

Consolidated Financial Statements for additional

information regarding litigation against the Company.

Legal and regulatory matters for 2003 primarily

reflects a $239 million provision for litigation relating

to the court approved settlement of the Berger v.

Retirement Income Guarantee Plan (RIGP) litigation.

Legal and regulatory matters for 2002 includes

$27 million of expenses related to certain litigation,

indemnifications and associated claims, as well as

the $10 million penalty incurred in connection with

our settlement with the SEC.

Loss (gain) on early extinguishment of debt:

In 2003, we recorded a $73 million loss on early

extinguishment of debt reflecting the write-off of the

remaining unamortized fees associated with the 2002

Credit Facility. The 2002 Credit Facility was repaid

upon completion of the June 2003 Recapitalization.

Business divestiture and asset sale losses

(gains): Business divestitures and asset sales in all

years included miscellaneous land, buildings and

equipment sales. The 2004 amount primarily reflects

the $38 million gain from the sale of our interest in

ScanSoft, gains of $14 million primarily related to the

sale of certain excess land and buildings in Europe

and Mexico and a $7 million favorable purchase price

adjustment associated with a prior year business sale.

The 2003amount primarily included losses related to

the sale of XESsubsidiaries in France and Germany,

which were partially offset by a gain on the sale of

our investment in XeroxSouth Africa.

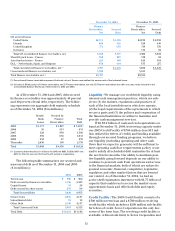

Income Taxes: The following table summarizes our

consolidated income taxes and the related effectivetax

rate for each respectiveperiod ($ in millions):

Year Ended December 31,

20042003 2002

Pre-tax income $965 $436 $104

Income taxes 340 134 4

Effectivetax rate (1) 35.2% 30.7% 3.8%

(1) A detailed reconciliation of the consolidated effective tax rate to the U.S.

federal statutory income tax rate is included in Note 13.

The 2004 consolidated effective income tax rate

of 35.2 percent was comparable to the U.S. federal

statutory income tax rate. The effectiveincome tax

rate reflects the impact of nondeductible expenses and

$20million of unrecognized tax benefits primarily

related to recurring losses in certain jurisdictions

where we continue to maintain deferred tax asset

valuation allowances. This tax expense was partially

offset bytax benefits from other foreign adjustments,

including earnings taxed at different rates, tax law

changes of $14 million and other items that are

individually insignificant.