Xerox 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

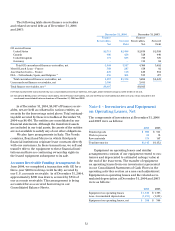

Note 10 – Liability to Subsidiary Trusts

Issuing Preferred Securities

The Liability to Subsidiary Trusts Issuing Preferred

Securities included in our Consolidated Balance

Sheets reflects the obligations to our subsidiaries that

have issued preferred securities. These subsidiaries

are not consolidated in our financial statements

because we are not the primary beneficiary of the

trusts. As of December 31, 2004 and 2003, the compo-

nents of our liabilities to the trusts were as follows:

2004 2003

Trust II $— $1,067

Trust I 629 665

Xerox Capital LLC 88 77

Total $ 717 $1,809

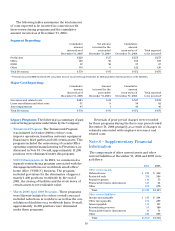

Trust II: In 2001, Xerox Capital Trust II (“Trust II”)

issued 20.7 million of 7.5 percent convertible trust pre-

ferred securities (the “Trust Preferred Securities”) to

investors for $1,035 and 0.6 million shares of common

securities to us for $32. With the proceeds from these

securities, Trust II purchased $1,067 of 7.5 percent con-

vertible junior subordinated debentures due 2021 of

one of our wholly-owned consolidated subsidiaries.

The subsidiary purchased $1,067 aggregate principal

amount of 7.5 percent convertible junior subordinated

debentures due 2021 of the Company. Trust II’s assets

consisted principally of our subsidiary’s debentures

and our subsidiary’sassets consisted principally of our

debentures. On a consolidated basis, we received net

proceeds of $1,004. Fees of $31 were capitalized as debt

issuance costs and were amortized to interest expense

over three years to the earliest put date. Interest expense

was $83 and $89 in 2004 and 2003, respectively.

The Trust Preferred Securities accrued and paid

cash distributions quarterly at a rate of 7.5 percent per

year of the stated amount of fifty dollars per security.

The Trust Preferred Securities were convertible at any

time, at the option of the investors, into 5.4795 shares

of our common stock per Trust Preferred Security

(equivalent share price of $9.125 per common share)

(“the Conversion Ratio”). The Trust Preferred

Securities were mandatorily redeemable upon the

maturity of the debentures on November 27, 2021 at

fifty dollars per Trust Preferred Security plus accrued

and unpaid distributions.

In December 2004, Trust II redeemed 20.7 million

of the issued and outstanding Trust Preferred

Securities. In lieu of cash redemption, holders of sub-

stantially all of the securities converted $1,035aggre-

gate principal amount of securities into 113,414,658

shares of Xerox common stock. As a result of the con-

version and redemption, there is no remaining

outstanding principal. The issuance of Xerox shares

upon conversion had no impact on diluted earnings

per share as they were previously included in the

company’s diluted EPS calculation in accordance with

the “if converted” accounting methodology.

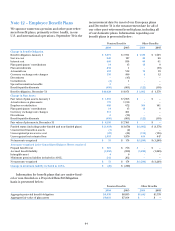

Trust I: In 1997, Xerox Capital Trust I (“Trust I”) issued

650 thousand of 8.0 percent preferred securities (the

“Preferred Securities”) to investors for $644 ($650 liqui-

dation value) and 20,103 shares of common securities

to us for $20. With the proceeds from these securities,

Trust I purchased $670 principal amount of 8.0 percent

Junior Subordinated Debentures due 2027 of the

Company (“the Debentures”). The Debentures repre-

sent all of the assets of Trust I. On a consolidated basis,

we received net proceeds of $637 which was net of fees

and discounts of $13. Interest expense, together with

the amortization of debt issuance costs and discounts,

amounted to $54 and $52 in 2004 and 2003, respectively.

In the first quarter of 2004, we entered into pay variable

/receive fixed interest rate swaps with a notional

amount of $600 associated with the 2027 liability to

Trust I. These swaps were designated and accounted

for as fair value hedges and resulted in a fair value

adjustment to reduce the Trust I liability by$36 as of

December 31, 2004. Asof December 31, 2004, the inter-

est rates on these swaps ranged from approximately

5.28% to 5.68% and are based on the 6 month LIBOR

rate plus an applicable margin. Wehaveguaranteed

(the “Guarantee”), on a subordinated basis, distributions

and other payments due on the Preferred Securities.

The Guarantee and our obligations under the

Debentures and in the indenture pursuant to which

the Debentures were issued and our obligations

under the Amended and Restated Declaration of Trust

governing the trust, taken together, provide a full and

unconditional guarantee of amounts due on the

Preferred Securities. The Preferred Securities accrue

and pay cash distributions semiannually at a rate of 8

percent per year of the stated liquidation amount of one

thousand dollars per Preferred Security. The Preferred

Securities are mandatorily redeemable upon the matu-

rity of the Debentures on February 1, 2027, or earlier to

the extent of any redemption by us of any Debentures.

The redemption price in either such case will be one

thousand dollars per share plus accrued and unpaid

distributions to the date fixed for redemption.

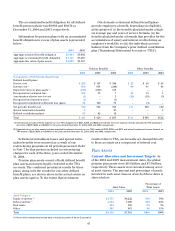

Xerox Capital LLC: In 1996, Xerox Capital LLC,

issued 2 million deferred preferred shares for

Canadian (Cdn.) $50 ($42 U.S.) to investors and all of

its common shares to us. The total proceeds of Cdn.

$63 ($52 U.S.) were loaned to us. The deferred

preferred shares are mandatorily redeemable on

February 28, 2006 for Cdn. $90 (equivalent to $75 U.S.

at December 31, 2004). Our liability to the subsidiary

trust of $88includes the current amount of the

deferred preferred shares of $69.