Xerox 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

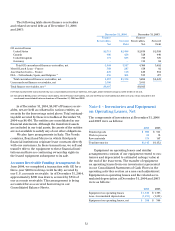

The following tables summarize the total amount

of costs expected to be incurred in connection with

these restructuring programs and the cumulative

amount incurred as of December 31, 2004:

Legacy Programs: The following is a summary of past

restructuring programs undertaken by the Company:

• Turnaround Program: The Turnaround Program

was initiated in October 2000 to reduce costs,

improveoperations, transition customer equipment

financing to third parties and sell certain assets. This

program included the outsourcing of certain Office

operating segment manufacturing to Flextronics, as

discussed in Note 18. Overall, approximately 11,200

positions were eliminated under this program.

• SOHO Disengagement: In 2001, we commenced a

separate restructuring program associated with the

disengagement from our worldwide small office/

home office (“SOHO”) business. The program

included provisions for the elimination of approxi-

mately 1,200 positions worldwide by the end of

2001, the closing of facilities and the write down of

certain assets to net realizable value.

• March 2000/April 1998 Programs: These programs

were likewise initiated to reduce overall costs and

included reductions in workforce as well as the con-

solidation of facilities on a worldwide basis. Overall,

approximately 14,200 positions were eliminated

under these programs.

Reversals of prior period charges were recorded

for these programs during the three-year period ended

December 31, 2004 primarily as a result of changes in

estimates associated with employee severance and

related costs.

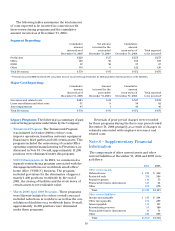

Note 8 – Supplementary Financial

Information

The components of other current assets and other

current liabilities at December 31, 2004 and 2003 were

as follows:

2004 2003

Other current assets

Deferred taxes $ 289 $ 402

Restricted cash 370 386

Prepaid expenses 142 35

Financial derivative instruments 125 24

Other 256 258

Total $1,182 $1,105

Other current liabilities

Income taxes payable $183 $ 264

Other taxes payable 234 289

Interest payable 113 147

Restructuring reserves 93 180

Financial derivative instruments 46 51

Other 640 609

Total $1,309 $1,540

Segment Reporting:

Cumulative Net amount Cumulative

amount incurred for the amount

incurred as of year ended incurred as of Total expected

December 31, 2003 December 31, 2004 December 31, 2004 to be incurred*

Production $228 $ 27 $255 $255

Office 168 30 198 198

DMO 67 30 97 97

Other 116 6 122 126

Total Provisions $ 579 $ 93 $ 672 $ 676

*The total amount of $676 represents the cumulative amount incurred through December 31, 2004 plus $4 for interest accretion on the liabilities.

Major Cost Reporting:

Cumulative Amount Cumulative

amount incurred for the amount

incurred as of year ended incurred as of Total expected

December 31, 2003December 31, 2004 December 31, 2004 to be incurred*

Severance and related costs $483 $ 84 $ 567 $568

Lease cancellation and other costs 51 8 59 62

Asset impairments 45 1 46 46

Total Provisions $ 579 $ 93 $ 672 $ 676