Xerox 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

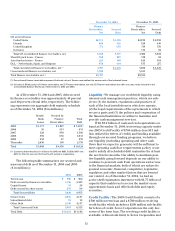

As of December 31, 2004 and 2003, debt secured

by finance receivables was approximately 44 percent

and 40 percent of total debt, respectively. The follow-

ing represents our aggregate debt maturity schedule

as of December 31, 2004 ($ in millions):

Bonds/ Secured by

Bank Finance Total

Loans Receivables Debt

2005 $ 1,177 $ 1,897 $ 3,074(1)

2006 36 915 951

2007 528 838 1,366

2008 385 656 1,041

2009 932 27 959

Thereafter 2,630 103 2,733

Total $ 5,688 $4,436 $ 10,124

(1) Quarterly debt maturities (in millions) for 2005 are $681, $1,500, $421 and

$472 for the first, second, third and fourth quarters, respectively.

The following table summarizes our secured and

unsecured debt as of December 31, 2004 and 2003

($ in millions):

2004 2003

Term Loan $300$300

Debt secured by finance receivables 4,436 4,425

Capital leases 58 29

Debt secured by other assets 235 99

Total Secured Debt 5,029 4,853

Senior Notes 2,936 2,137

Subordinated debt 19 19

Other Debt 2,140 4,157

Total Unsecured Debt 5,095 6,313

Total Debt $10,124 $11,166

Liquidity: Wemanage our worldwide liquidity using

internal cash management practices, which are sub-

ject to (1) the statutes, regulations and practices of

each of the local jurisdictions in which weoperate,

(2) the legal requirements of the agreements to which

weare a party and (3) the policies and cooperation of

the financial institutions we utilize to maintain and

provide cash management services.

With $3.2 billion of cash and cash equivalents on

hand at December 31, 2004, borrowing capacity under

our 2003 Credit Facility of $700 million (less $15 mil-

lion utilized for letters of credit) and funding available

through our secured funding programs, we believe

our liquidity (including operating and other cash

flows that we expect to generate) will be sufficient to

meet operating cash flow requirements as they occur

and to satisfy all scheduled debt maturities for at least

the next twelve months. Our ability to maintain posi-

tiveliquidity going forward depends on our ability to

continue to generate cash from operations and access

to the financial markets, both of which are subject to

general economic, financial, competitive, legislative,

regulatory and other market factors that are beyond

our control. As of December 31, 2004, we had an

active shelf registration statement with $1.75 billion of

capacity that enables us to access the market on an

opportunistic basis and offer both debt and equity

securities.

Credit Facility: The 2003 Credit Facility consists of a

$300 million term loan and a $700 million revolving

credit facility which includes a $200 million sub-facility

for letters of credit. Xerox Corporation is the only bor-

rower of the term loan. The revolving credit facility is

available, without sub-limit, to Xerox Corporation and

December 31, 2004 December 31, 2003

Finance Finance

Receivables, Secured Receivables, Secured

Net Debt Net Debt

GE secured loans:

United States $2,711 $2,486 $2,939 $ 2,598

Canada 486 426 528 440

United Kingdom 771 685 719 570

Germany –– 114 84

Total GE encumbered finance receivables, net 3,968 3,597 4,300 3,692

Merrill Lynch Loan – France 368 287 138 92

Asset-backed notes – France 225 148 429 364

DLL – Netherlands, Spain, and Belgium 436 404 335 277

Total encumbered finance receivables, net (1) 4,997 $4,436 5,202 $ 4,425

Unencumbered finance receivables, net 3,500 3,611

Total finance receivables, net (2) $8,497 $8,813

(1) Encumbered finance receivables represent the book value of finance receivables that secure each of the indicated loans.

(2) Includes (i) Billed portion of finance receivables, net (ii) Finance receivables, net and (iii) Finance receivables due after one year, net as included in the

Consolidated Balance Sheets as of December 31, 2004 and 2003.