Xerox 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

In substantially all instances, deferred income

taxes have not been provided on the undistributed

earnings of foreign subsidiaries and other foreign

investments carried at equity. The amount of such

earnings included in consolidated retained earnings

at December 31, 2004 was approximately $6 billion.

These earnings have been indefinitely reinvested and

we currently do not plan to initiate any action that

would precipitate the payment of income taxes there-

on. However, as discussed below, upon completion of

our evaluation of the American Jobs Creation Act of

2004 (“the Act”), we will reassess these plans. It is not

practicable to estimate the amount of additional tax

that might be payable on the foreign earnings. As a

result of the March 31, 2001 disposition of one-half of

our ownership interest in Fuji Xerox, the investment

no longer qualified as a foreign corporate joint venture.

Accordingly, deferred taxes are required to be provided

on the undistributed earnings of Fuji Xerox, arising

subsequent to such date, as we no longer have the

ability to ensure indefinite reinvestment.

The United States Congress passed the Act, which

the President signed into law on October 22, 2004. The

Act allows a temporary incentive of an 85 percent divi-

dends received deduction for certain dividends from

controlled foreign corporations. Weare in the process

of evaluating whether we will repatriate foreign earn-

ings under the Act and weare awaiting the issuance of

further regulatory guidance with respect to certain

provisions prior to making a definitive decision. Based

on our preliminary analysis, webelievethere will not

be a material benefitfrom this temporary incentive

and accordingly, we do not expect to repatriate foreign

earnings as a result of the provision. The Act also pro-

vides a deduction for income from qualified domestic

production activities, which will be phased in from

2005 through 2010. Based on guidance received from

the U.S. government with respect to this provision of

the Act, we do not anticipate recognizing a significant

tax benefit from this provision for the next several

years due to U.S. taxable income limitations. However,

we will continue to evaluate this provision as new

guidance is issued.

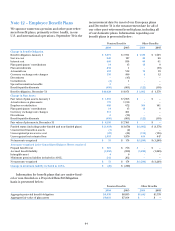

The tax effects of temporary differences that give

rise to significant portions of the deferred taxes at

December 31, 2004 and 2003 were as follows:

2004 2003

Tax effect of future tax deductions

Research and development $ 1,281 $ 1,238

Post-retirement medical benefits 499 491

Depreciation 247 311

Net operating losses 450 442

Other operating reserves 333 262

Tax credit carryforwards 289 237

Deferred compensation 198 182

Allowance for doubtful accounts 149 151

Restructuring reserves 43 69

Other 40 340

3,529 3,723

Valuation allowance (567) (577)

Total deferred tax assets $ 2,962 $ 3,146

Tax effect of future taxable income

Unearned income and installment sales $(1,293) $(1,250)

Other (79) (112)

Total deferred tax liabilities (1,372) (1,362)

Total deferred taxes, net $1,590 $ 1,784

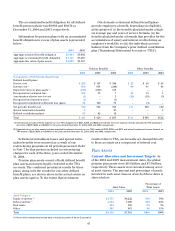

The above amounts are classified as current or

long-term in the Consolidated Balance Sheets in

accordance with the asset or liability to which they

relate or, when applicable, based on the expected

timing of the reversal. Current deferred tax assets at

December 31, 2004 and 2003 amounted to $289 and

$402, respectively.

The deferred tax assets for the respective periods

were assessed for recoverability and, where applica-

ble, a valuation allowance was recorded to reduce the

total deferred tax asset to an amount that will, more

likely than not, be realized in the future. The valuation

allowance for deferred tax assets as of January 1, 2003

was $524. The net change in the total valuation

allowance for the years ended December 31, 2004 and

2003 was a decrease of $10 and an increase of $53,

respectively. The valuation allowance relates primarily

to certain net operating loss carryforwards, tax credit

carryforwards and deductible temporary differences

for which wehaveconcluded it is more likely than not

that these items will not be realized in the ordinary

course of operations.

Although realization is not assured, we have con-

cluded that it is more likely than not that the deferred

tax assets for which a valuation allowance was deter-

mined to be unnecessary will be realized in the

ordinary course of operations based on the available

positive and negative evidence, including scheduling of

deferred tax liabilities and projected income from oper-

ating activities. The amount of the net deferred tax

assets considered realizable, however, could be reduced