Xerox 2004 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

limit on the amount of indemnification, we may have

recourse against our insurance carriers for certain

payments made by us. The litigation matters and

regulatory actions described below involve certain of

our current and former directors and officers, all of

whom are covered by the aforementioned indemnity

and if applicable, current and prior period insurance

policies. However, certain indemnification payments

may not be covered under our directors’ and officers’

insurance coverage. In addition, we indemnify certain

fiduciaries of our employee benefit plans for liabilities

incurred in their service as fiduciary whether or not

they are officers of the Company.

The Securities and Exchange Commission

(“SEC”) announced on June 5, 2003 that it had

reached a settlement with several individuals who

are former officers of Xerox Corporation regarding

the same accounting and disclosure matters which

were involved in its investigation of Xerox Corporation.

These individuals neither admitted nor denied wrong-

doing and agreed to pay fines, disgorgement and

interest. These individuals are responsible for paying

their own fines. However, because all of the individuals

who settled were officers of Xerox Corporation, we

were required under our by-lawsto reimburse the

individuals for the disgorgement, interest and legal

fees of $19. This amount was accrued in 2002.

Product Warranty Liabilities: In connection with

our normal sales of equipment, including those under

sales-type leases, wegenerally do not issue product

warranties. Our arrangements typically involve a

separate full service maintenance agreement with the

customer.The agreements generally extend over a

period equivalent to the lease term or the expected

useful life under a cash sale. The service agreements

involve the payment of fees in return for our perform-

ance of repairs and maintenance. As a consequence,

we do not have any significant product warranty

obligations including any obligations under customer

satisfaction programs. In a few circumstances,

particularly in certain cash sales, we may issue

alimited product warranty if negotiated by the

customer. We also issue warranties for certain of our

lower-end products in the Office segment, where full

service maintenance agreements are not available.

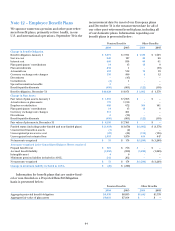

In these instances, we record warranty obligations at

the time of the sale. The following table summarizes

product warranty activity for the three years ended

December 31, 2004:

2004 2003 2002

Balance as of January 1 $19 $ 25 $ 46

Provisions and adjustments 45 47 51

Payments (41) (53) (72)

Balance as of December 31 $23 $19 $25

Tax Related Contingencies: AtDecember 31, 2004,

our Brazilian operations had received assessments

levied against it for indirect and other taxes which,

inclusive of interest, were approximately $559. The

change since the December 31, 2003 disclosed amount

of $449 is primarily due to indexation and interest,

additional assessments and currency. The assessments

principally relate to the internal transfer of inventory.

We are disputing these assessments and intend to

vigorously defend our position. Based on the opinion

of legal counsel, we do not believe that the ultimate

resolution of these assessments will materially impact

our results of operations, financial position or cash

flows. In connection with these proceedings, we may

be required to make cash deposits and other security

of up to half of the total amount in dispute. Generally,

any such amounts would be refundable to the extent

the matter is resolved in our favor.

Weare subject to ongoing tax examinations and

assessments in various jurisdictions. Accordingly, we

may record incremental tax expense based upon the

probable outcomes of such matters. In addition, when

applicable, weadjust the previously recorded tax

expense to reflect examination results. Our ongoing

assessments of the probable outcomes of the examina-

tions and related tax positions require judgment and

can materially increase or decrease our effective tax

rate, as well as impact our operating results.

Legal Matters: As more fully discussed below,

weare involved in a variety of claims, lawsuits,

investigations and proceedings concerning securities

law, intellectual property law, environmental law,

employment law and the Employee Retirement Income

Security Act (“ERISA”). We determine whether an

estimated loss from a contingency should be accrued

by assessing whether a loss is deemed probable and

can be reasonably estimated. Weassess our potential

liability by analyzing our litigation and regulatory

matters using available information. We develop our

views on estimated losses in consultation with outside

counsel handling our defense in these matters, which

involves an analysis of potential results, assuming a

combination of litigation and settlement strategies.

Should developments in any of these matters cause

achange in our determination as to an unfavorable

outcome and result in the need to recognize a material

accrual, or should any of these matters result in a

final adverse judgment or be settled for significant

amounts, they could have a material adverse effect

on our results of operations, cash flows and financial

position in the period or periods in which such change

in determination, judgment or settlement occurs.

In 2002, we reached a settlement with the SEC, in

which we neither admitted nor denied wrongdoing,

with respect to previously disclosed allegations relat-