Xerox 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

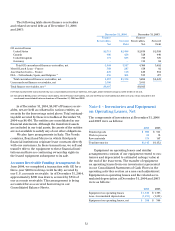

Our equity in net income of our unconsolidated

affiliates for the three years ended December 31, 2004

was as follows:

2004 2003 2002

Fuji Xerox $134 $41 $37

Other investments 17 17 17

Total $151 $58 $54

Equity income for 2004 included $38 related to

our share of a pension settlement gain recorded by

Fuji Xerox due to a non-recurring opportunity given to

Japanese companies by the Japanese government in

accordance with the Japan Welfare Pension Insurance

Law. This law allowed Japanese companies to transfer

aportion of their pension obligations to the Japanese

government. Fuji Xerox completed this transfer and

recognized a corresponding settlement gain in 2004.

Equity in net income of Fuji Xerox is affected by

certain adjustments to reflect the deferral of profit

associated with intercompanysales. These adjustments

mayresult in recorded equity income that is different

than that implied by our 25 percent ownership interest.

Condensed financial data of Fuji Xeroxas of and

for the three calendar years ended December 31, 2004

follow:

2004 2003 2002

Summary of Operations:

Revenues $9,461 $ 8,430 $7,539

Costs and expenses 8,606 8,011 7,181

Income before income taxes 855 419 358

Income taxes 331 194 134

Minorities’ interests 18 34 36

Net income $ 506 $ 191 $ 188

Balance Sheet Data:

Assets:

Current assets $3,613 $ 3,273 $ 2,976

Long-term assets 4,606 4,766 3,862

Total assets $8,219 $ 8,039 $6,838

Liabilities and

Shareholders’ Equity:

Current liabilities $ 2,757 $ 2,594 $ 2,152

Long-term debt 616 443 868

Other long-term liabilities 1,383 2,391 1,084

Minorities’ interests in

equity of subsidiaries 104 118 227

Shareholders’ equity 3,359 2,493 2,507

Total liabilities and

shareholders’ equity $8,219 $ 8,039 $6,838

We have a technology agreement with Fuji Xerox

whereby we receive royalty payments and rights to

access their patent portfolio in exchange for access

to our patent portfolio. In 2004, 2003 and 2002, we

earned royalty revenues under this agreement of $119,

$110 and $99, respectively. Additionally, in 2004, 2003

and 2002, we received dividends of $50, $20 and $29,

respectively. We also have arrangements with Fuji

Xerox whereby we purchase inventory from and sell

inventory to Fuji Xerox. Pricing of the transactions

under these arrangements is based upon negotiations

conducted at arm’s length. Certain of these inventory

purchases and sales are the result of mutual research

and development arrangements. Our purchase com-

mitments with Fuji Xerox are in the normal course of

business and typically have a lead time of three

months. Purchases from and sales to Fuji Xerox for the

three years ended December 31, 2004 were as follows:

2004 2003 2002

Sales $143 $ 129 $113

Purchases $1,135 $871 $727

In addition to the payments described above, in

2004, 2003 and 2002, we paid Fuji Xerox $27, $33 and

$20, respectively, and in 2004, 2003 and 2002 Fuji

Xerox paid us $9, $9 and $10, respectively, for unique

research and development. As of December 31, 2004

and 2003, amounts due to Fuji Xerox were $155 and

$111, respectively.

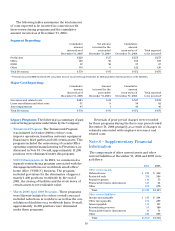

Note 7 – Restructuring Programs

Wehave engaged in a series of restructuring programs

related to downsizing our employee base, exiting cer-

tain activities, outsourcing certain internal functions

and engaging in other actions designed to reduce our

cost structure and improve productivity. Management

continues to evaluate the business and, therefore,

there maybe supplemental provisions for new plan

initiatives as well as changes in estimates to amounts

previously recorded, as payments are made or actions

are completed. Asset impairment charges were also

incurred in connection with these restructuring

actions for those assets made obsolete or redundant as

aresult of these programs. The restructuring and asset

impairment charges in the Consolidated Statements of

Income totaled $86, $176 and $670 in 2004, 2003 and

2002, respectively. Detailed information related to