Xerox 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

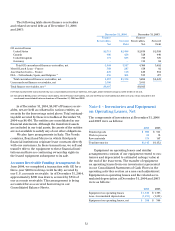

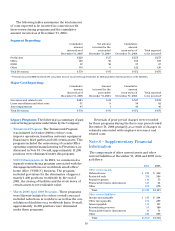

Production Office DMO Other Total

2004(1)

Information about profit or loss:

Revenues $4,238 $ 7,075 $1,697 $1,778 $14,788

Finance income 352 552 10 20 934

Total segment revenues $4,590 $ 7,627 $1,707 $1,798 $15,722

Interest expense (2) $115 $ 163 $ 12 $ 418 $ 708

Segment profit (loss) (3)(4) 388 798 43 (29) 1,200

Equity in net income of unconsolidated affiliates — — 3 148 151

2003 (1)

Information about profit or loss:

Revenues $4,131 $7,048 $1,751 $1,774 $14,704

Finance income 376 594 12 15 997

Total segment revenues $4,507 $7,642 $1,763 $1,789 $15,701

Interest expense (2) $ 121 $ 181 $ 34 $ 548 $ 884

Segment profit (loss) (3)(4) 401 742 172 (327) 988

Equity in net income of unconsolidated affiliates — 1 6 51 58

2002 (1)

Information about profit or loss:

Revenues $4,089 $6,888 $1,866 $2,006 $14,849

Finance income 393 599 19 (11) 1,000

Total segment revenues $4,482 $ 7,487 $1,885 $1,995 $15,849

Interest expense (2) $157$ 223 $ 17 $ 499 $ 896

Segment profit (loss) (3)(4) 436 612 120 (335) 833

Equity in net income of unconsolidated affiliates — — 5 49 54

(1) Asset information on a segment basis is not disclosed as this information is not separately identified and internally reported to our chief executive officer.

(2) Interest expense includes equipment financing interest as well as non-financing interest, which is a component of Other expenses, net.

(3) Other segment profit (loss) includes net corporate expenses of $524, $529 and $362 for the years ended December 31, 2004, 2003 and 2002, respectively.

(4) Depreciation and amortization expense is recorded in cost of sales, research and development expenses and selling, administrative and general expenses and

is included in the segment profit (loss) above. This information is neither identified nor internally reported to our chief executive officer. The separate identifica-

tion of this information for purposes of segment disclosure is impracticable, as it is not readily available and the cost to develop it would be excessive.

products, color laser, solid ink and monochrome laser

desktop printers, digital and light-lens copiers and fac-

simile products. These products are sold through direct

and indirect sales channels in North America and

Europe to global, national and mid-size commercial

customers as well as government, education and other

public sector customers.

The DMO segment includes our operations in

Latin America, Central and Eastern Europe, the

Middle East, India, Eurasia, Russia and Africa. This

segment includes sales of products that are typical to

the aforementioned segments; however, management

serves and evaluates these markets on an aggregate

geographic basis, rather than on a product basis.

The segment classified as Other includes several

units, none of which met the thresholds for separate

segment reporting. This group primarily includes

Xerox Supplies Business Group (predominantly

paper), Small Office/Home Office (“SOHO”), Wide

Format Systems, Xerox Technology Enterprises and

value-added services, royalty and license revenues.

Other segment profit(loss) includes the operating

results from these entities, other less significant

businesses, our equity income from Fuji Xerox, and

certain costs which have not been allocated to the

Production, Office and DMO segments, including

non-financing interest and other corporate costs.

Operating segment financial information for 2003

and 2002 has been restated to reflect changes in operat-

ing segment structure made during 2004. The changes

made in 2004 relate to the reclassification of the opera-

tions of our Central and Eastern European entities to

DMO to align our segment reporting with how we

manage our business. Operating profit was reclassified

for this change, as well as for certain other expense

allocations. The adjustments (decreased) increased full

year 2003 revenues as follows: Production-$(40), Office-

$(61), DMO-$147 and Other-$(46). The full year 2003

segment profit was (decreased) increased as follows:

Production-$(21), Office-$(11), DMO-$21, and Other-

$11. The adjustments (decreased) increased full year

2002 revenues as follows: Production-$(40), Office-

$(54), DMO-$127, and Other-$(33). The full year 2002

segment profit was (decreased) increased as follows:

Production-$(14), Office-$(9), DMO-$29, and Other-

$(6). Selected financial information for our operating

segments for each of the three years ended December

31, 2004 was as follows: