Xerox 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

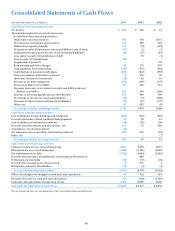

$258 million reflecting the increase in equipment sale

revenue in 2003 and an increased on-lease equipment

investment of $39 million. These items were partially

offset by increased pre-tax income of $332 million,

lower tax payments of $235 million and increased

cash proceeds from the early termination of interest

rate swaps of $80 million. The lower tax payments

reflect the absence of the $346 million tax payment

associated with the 2001 sale of a portion of our

ownership interest in Fuji Xerox.

We expect operating cash flows to be between

$1.0 billion and $1.5 billion in 2005, as compared to

$1.8 billion in 2004. The reduction includes the expected

change in finance receivables consistent with expected

equipment sales expansion, along with expected on-

lease equipment growth as well as the absence of early

derivative contract termination cash flow.

Investing: Investing cash flows for the year ended

December 31, 2004 of $203 million included $191 mil-

lion proceeds from the sale of businesses and invest-

ments, primarily consisting of $66million from the

ContentGuard sale, $79 million from the ScanSoft sale

and $36million from a preferred stock investment. In

addition, $223million was released from restricted

cash during the period primarily related to the renego-

tiation of certain secured borrowing arrangements

and scheduled releases from an escrowaccount sup-

porting interest payments on our liability to a trust

issuing preferred securities. We also received $53 mil-

lion of proceeds from the sale of certain excess land

and buildings. These aggregate proceeds were partially

offset by capital and internal use software spending of

$252 million. We expect 2005 capital expenditures to

approximate $250 million.

Investing cash flows for the year ended

December 31, 2003 of $49 million consisted primarily

of $235 million released from restricted cash related

to former reinsurance obligations associated with our

discontinued operations, $35 million of aggregate cash

proceeds from the divestiture of our investment in

Xerox South Africa, XES France and Germany and

other minor investments, partially offset by capital

and internal use software spending of $250 million.

Financing: Cash usage from financing activities for

the year ended December 31, 2004 of $1.3 billion

included payments of scheduled maturities on Euro

and Dollar denominated term debt of $2.1 billion,

net payments of other debt totaling $101 million and

preferred stock dividends of $83 million. These net

payments were partially offset by net proceeds of

$750 million from the issuance of the 2011 Senior

Notes, net proceeds from secured borrowing activity

of $155 million and proceeds from stock options

exercises of $73 million.

Cash usage from financing activities for the year

ended December 31, 2003 of $2.5 billion included net

payments on our 2002 credit facility of $3.5 billion,

net payments on term and other debt of $2.0 billion

and preferred stock dividends of $57 million. These

payments were partially offset by net proceeds from

secured borrowing activity of $269 million and the

following activity related to the completion of our

June 2003 recapitalization plan-net proceeds from the

convertible preferred stock offering of $889 million,

net proceeds from the common stock offering of

$451 million, net proceeds from the 2010 and 2013

Senior Notes of $1.2 billion and net proceeds from

the 2003 Credit Facility of $271 million.

Customer Financing Activities and Debt: We

provide equipment financing to the majority of our

customers. Because the finance leases allow our cus-

tomers to payfor equipment over time rather than at

the date of installation, wemaintain a certain level of

debt to support our investment in these customer

finance leases. We have funded a significant portion

of our finance receivables through third-party secured

funding arrangements. Under these arrangements,

debt is secured by the finance receivables it supports,

which eliminates certain significant refinancing, pric-

ing and duration risks associated with our debt. In

addition to these third party arrangements, we support

our customer finance leasing with cash generated

from operations and through capital markets offerings.

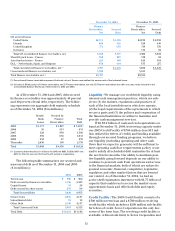

During the years ended December 31, 2004 and

2003, we borrowed $2.1 billion and $2.5 billion,

respectively, under third-party secured funding

arrangements. Approximately 60 percent of our total

finance receivable portfolio has been pledged to

secure funding at both December 31, 2004 and

December 31, 2003. The following table compares

finance receivables to financing-related debt as of

December 31, 2004 and 2003 ($ in millions):