Xerox 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

rates calculated at each monthly loan occurrence at

yield rates consistent with average rates for similar

market based transactions. Refer to Note 9 for further

information on interest rates. New lease originations,

including the bundled service and supply elements,

are transferred to a wholly-owned consolidated

subsidiary which receives funding from GE. The

funds received under this agreement are recorded as

secured borrowings and together with the associated

lease receivables are included in our Consolidated

Balance Sheet. We and GE intend the transfers of the

lease contracts to be “true sales at law” and that the

wholly-owned consolidated subsidiary be bankruptcy

remote and have received opinions to that effect from

outside legal counsel. As a result, the transferred

receivables are not available to satisfy any of our

other obligations. GE’s funding commitment is not

subject to our credit ratings. There are no credit rating

defaults that could impair future funding under this

agreement. This agreement contains cross default pro-

visions related to certain financial covenants contained

in the 2003 Credit Facility and other significant debt

facilities. Any default would impair our ability to

receivesubsequent funding until the default was

cured or waived but does not accelerate previous

borrowings. However, in the event of a default, we

could be replaced as the maintenance service

provider for the associated equipment under lease.

During 2003, weentered into similar long-term

lease funding arrangements with GE in both the U.K.

and Canada. These agreements contain similar terms

and conditions as those contained in the U.S. Loan

Agreement with respect to funding conditions and

covenants. The final funding date for all facilities is

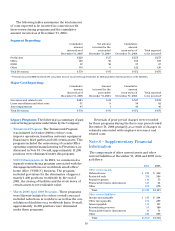

currently December 2010. The following is a summary

of the facility amounts for the arrangements with GE

in these countries.

Facility Amount Maximum Facility Amount (1)

U.S. $5 billion $8 billion

U.K. £400 million £600 million

(U.S. $770) (U.S. $1.2 billion)

Canada Cdn. $850 million Cdn. $2 billion

(U.S. $706) (U.S. $1.7 billion)

(1) Subject to mutual agreement by the parties.

France Secured Borrowings: In July 2003, we secu-

ritized receivables of $443, previously funded under a

364-day warehouse financing facility established in

December 2002 with subsidiaries of Merrill Lynch,

with a three-year public secured financing arrange-

ment. In addition, we established a new warehouse

financing facility to fund future lease originations in

France. This facility can provide funding for new lease

originations up to ?350 million (U.S. $477), outstand-

ing at any time, and balances may be securitized

through a similar public offering within two years.

The DLL Secured Borrowings: Beginning in the

second half of 2002, we received a series of fundings

through our consolidated joint venture with DLL

from DLL’s parent, De Lage Landen Ireland Company.

The fundings are secured by our lease receivables in

The Netherlands which were transferred to the DLL

joint venture. In addition, the DLL joint venture also

became our primary equipment financing provider in

The Netherlands for all new lease originations and

continues to receivefunding for those lease originations

from DLL’s parent. In the fourth quarter of 2003, the

DLL joint venture expanded its operations to include

Spain and Belgium. Our DLL joint venture has been

consolidated as weare deemed to be the primary

beneficiary of the joint venture’s financial results.

Germany Secured Borrowings: In May 2002, we

entered into an agreement to transfer part of our

financing operations in Germanyto a GEentity in

order to finance certain prospective leasing business.

In conjunction with this transaction, wealso received

loans from GE secured by existing lease receivables

that were transferred to this entity. At December 31,

2003, we consolidated this entity because we retained

substantive rights related to the transferred finance

receivables and were therefore deemed to be the

primary beneficiary. During the first quarter 2004,

the entity was deconsolidated because we were no

longer deemed to be the primary beneficiary, as the

transferred finance receivables had been reduced to a

level whereby we no longer retained significant risks

relativeto the total assets of the entity. Further, we are

not providing loss protection on the new leasing busi-

ness entered into by the entity. The entity’s total assets

and debt at December 31, 2003 were $114 and $84,

respectively.