Xerox 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

The term loan and the revolving loans bear inter-

est at LIBOR plus a spread that varies between 1.75

percent and 3.00 percent or, at our election, at a base

rate plus a spread that depends on the then-current

Leverage Ratio, as defined, in the 2003 Credit Facility.

The interest rate on the debt as of December 31, 2004,

was 3.92 percent.

The 2003 Credit Facility contains affirmative and

negative covenants as well as financial maintenance

covenants. Subject to certain exceptions, we cannot

pay cash dividends on our common stock during the

facility term, although we can pay cash dividends on

our preferred stock, provided there is then no event of

default. Among defaults customary for facilities of this

type, defaults on our other debt, bankruptcy of certain

of our legal entities, or a change in control of Xerox

Corporation, would all constitute events of default.

At December 31, 2004, we were in compliance with

the covenants of the 2003 Credit Facility and we

expect to remain in compliance for at least the next

twelve months.

2011 Senior Notes: In August 2004, we issued $500

aggregate principal amount of Senior Notes due 2011,

at par value, and received net proceeds of approximately

$492. In September 2004, weissued an additional $250

aggregate principal amount Senior Notes due 2011,

at 104.25percent of par, resulting in net proceeds of

approximately $258. These notes form a single series

of debt. Interest on the Senior Notes accrues at the

annual rate of 6.875percent and is payable semiannu-

ally and, as a result of the premium wereceived on

the second issuance of Senior Notes, have a weighted

average effective interest rate of 6.6 percent. In

conjunction with the issuance of the Senior Notes,

debt issuance costs of $11 were deferred.

2010 and 2013 Senior Notes: In June 2003, we

issued $700 aggregate principal amount of Senior

Notes due 2010 and $550 aggregate principal amount

of Senior Notes due 2013. Interest on the Senior Notes

due 2010 and 2013 accrues at the rate of 7.125 percent

and 7.625 percent, respectively, per annum and is

payable semiannually on June 15 and December 15.

In conjunction with the issuance of the 2010 and 2013

Senior Notes, debt issuance costs of $32 were deferred.

The senior notes also contain negative covenants

(but no financial maintenance covenants) similar to

those contained in the 2003 Credit Facility. However,

they generally provide us with more flexibility than

the 2003 Credit Facility covenants, except that

payment of cash dividends on the Series C Mandatory

Convertible Preferred Stock is subject to the conditions

that there is then no default under the senior notes,

that the fixed charge coverage ratio (as defined) is

greater than 2.25to 1.0, and that the amount of the

cash dividend does not exceed the then amount avail-

able under the restricted payments basket (as

defined). The Senior Notes are guaranteed by our

wholly-owned subsidiaries, Intelligent Electronics,

Inc. and Xerox International Joint Marketing, Inc.

Guarantees: At December 31, 2004, we have guaran-

teed $206 of indebtedness of our foreign subsidiaries.

This debt is included in our Consolidated Balance

Sheet as of such date.

Interest: Interest paid by us on our short-term debt,

long-term debt and liabilities to subsidiary trusts issu-

ing preferred securities amounted to $710, $867 and

$903 for the years ended December 31, 2004, 2003 and

2002, respectively.

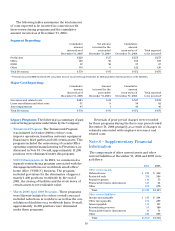

Interest expense and interest income consisted of:

Year Ended December 31, 2004 2003 2002

Interest expense (1) $708 $ 884 $ 896

Interest income (2) (1,009) (1,062) (1,077)

(1) Includes Equipment financing interest of $345, $362 and $401 for the

years ended December 31, 2004, 2003 and 2002, respectively, as well as

non-financing interest expense of $363, $522 and $495 for the years

ended December 31, 2004, 2003 and 2002, respectively, that is included in

Other expenses, net in the Consolidated Statements of Income.

(2) Includes Finance income, as well as other interest income that is included

in Other expenses, net in the Consolidated Statements of Income.

Equipment financing interest is determined based

on a combination of actual interest expense incurred on

financing debt, as well as an estimated cost of funds,

applied against the estimated level of debt required to

support our financed receivables. The estimate is based

on an assumed ratio of debt as compared to our finance

receivables. This ratio ranges from 80-90 percent of our

average finance receivables. This methodology has

been consistently applied for all periods presented.

Asummary of the Net cash payments on debt as

shown on the Consolidated Statements of Cash Flows

for the three years ended December 31, 2004 follows:

2004 2003 2002

Cash (payments) proceeds

on notes payable, net $ (6) $ 22 $ (33)

Net cash proceeds from

issuance of long-term debt (1) 974 1,580 1,053

Cash payments on long-term debt (2,390) (5,646) (5,639)

$(1,422) $(4,044) $(4,619)

(1) Includes payment of debt issuance costs.