Xerox 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

Depreciable lives generally vary from three to

four years consistent with our planned and historical

usage of the equipment subject to operating leases.

Depreciation and obsolescence expense was $210, $271

and $408 for the years ended December 31, 2004, 2003

and 2002, respectively. Our equipment operating lease

terms vary, generally from 12 to 36 months. Scheduled

minimum future rental revenues on operating leases

with original terms of one year or longer are:

2005 2006 2007 2008 Thereafter

$401 $219 $111 $45 $17

Total contingent rentals on operating leases,

consisting principally of usage charges in excess of

minimum contracted amounts, for the years ended

December 31, 2004, 2003 and 2002 amounted to $137,

$235 and $187, respectively.

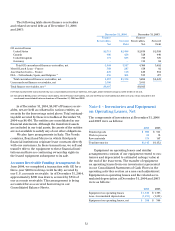

Note 5 – Land, Buildings and

Equipment, Net

The components of land, buildings and equipment, net

at December 31, 2004 and 2003 were as follows:

Estimated

Useful Lives

(Years) 2004 2003

Land $53$56

Buildings and building

equipment 25 to 50 1,167 1,194

Leasehold improvements Lease term 313 383

Plant machinery 5to 12 1,667 1,588

Office furniture and

equipment 3 to 15 1,072 1,081

Other 4 to 20 74 74

Construction in progress 96 114

Subtotal 4,442 4,490

Less: Accumulated

depreciation (2,683) (2,663)

Land, buildings and

equipment, net $ 1,759 $ 1,827

Depreciation expense was $305, $299 and $341 for

the years ended December 31, 2004, 2003 and 2002,

respectively. We lease certain land, buildings and

equipment, substantially all of which are accounted for

as operating leases. Total rent expense under operating

leases for the years ended December 31, 2004, 2003 and

2002 amounted to $316, $287, and $299, respectively.

Future minimum operating lease commitments that

have remaining non-cancelable lease terms in excess

of one year at December 31, 2004 follow:

2005 2006 2007 2008 2009 Thereafter

$222 $181 $143 $109 $94 $256

In certain circumstances, we sublease space not

currently required in operations. Future minimum

sublease income under leases with non-cancelable

terms in excess of one year amounted to $17 at

December 31, 2004.

We have an information technology contract with

Electronic Data Systems Corp. (“EDS”) through June

30, 2009. Services to be provided under this contract

include support of global mainframe system process-

ing, application maintenance, desktop and helpdesk

support, voice and data network management and

server management. There are no minimum payments

due EDSunder the contract. Payments to EDS, which

are recorded in selling, administrativeand general

expenses, were $328, $340, and $385 for the years

ended December 31, 2004, 2003and 2002, respectively.

In December 2003, STHQ Realty LLC was formed

to finance the acquisition of the Company’s headquar-

ters in Stamford, Connecticut. While the assets and

liabilities of this special purpose entity are included in

the Company’s Consolidated Financial Statements,

STHQRealty LLCis a bankruptcy remote separate

legal entity. As a result, its assets of $42 at December

31, 2004, are not available to satisfy the debts and

other obligations of the Company.

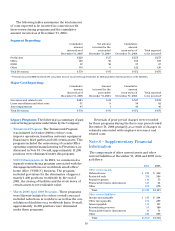

Note 6 – Investments in Affiliates,

at Equity

Investments in corporate joint ventures and other

companies in which wegenerally have a 20 to 50 per-

cent ownership interest at December 31, 2004 and

2003 were as follows:

2004 2003

Fuji Xerox (1) $772 $556

Investment in subsidiary trusts

issuing preferred securities 39 69

Other investments 34 19

Investments in affiliates, at equity $845 $644

(1) Fuji Xerox is headquartered in Tokyo and operates in Japan and other

areas of the Pacific Rim, Australia and New Zealand. Our investment in

Fuji Xerox of $772 at December 31, 2004, differs from our implied 25 per-

cent interest in the underlying net assets, or $840, due primarily to our

deferral of gains resulting from sales of assets by us to Fuji Xerox, par-

tially offset by goodwill related to the Fuji Xerox investment established

at the time we acquired our remaining 20 percent of Xerox Limited from

The Rank Group (plc). Such gains would only be realizable if Fuji Xerox

sold a portion of the assets we previously sold to it or if we were to sell

aportion of our ownership interest in Fuji Xerox.