Xerox 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

Note 16 – Common Stock

We have 1.75 billion authorized shares of common

stock, $1 par value. At December 31, 2004, 131 million

shares were reserved for issuance under our incentive

compensation plans. In addition, at December 31, 2004,

90 million common shares were reserved for the con-

version of the Series C Mandatory Convertible Preferred

Stock, 48 million common shares were reserved for

debt to equity exchanges, and 2 million common shares

were reserved for the conversion of convertible debt.

Stock Option and Long-term Incentive Plans:

We have a long-term incentive plan whereby eligible

employees may be granted non-qualified stock options,

shares of common stock (restricted or unrestricted)

and stock appreciation rights (“SARs”). Stock options

and stock awards are settled with newly issued shares

of our common stock, while SARs are settled with cash.

We granted 2.5 million, 1.6 million and 1.6 million

shares of restricted stock to key employees for the years

ended December 31, 2004, 2003 and 2002, respectively.

No monetary consideration is paid by employees who

receive restricted shares. Compensation expense for

restricted grants is based upon the grant date market

price and is recorded over the vesting period, which is

generally three years. Compensation expense recorded

for restricted grants was $22, $15 and $17 in 2004, 2003

and 2002, respectively.

Stock options generally vest over a period of three

years and expire between eight and ten years from the

date of grant. The exercise price of the options is equal

to the market value of our common stock on the effec-

tive date of grant.

At December 31, 2004 and 2003, 33.9 million

and 21.4 million shares, respectively, were available

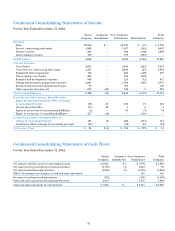

for grant of options or awards. The following table

provides information relating to the status of, and

changes in, stock options granted for each of the three

years ended December 31, 2004 (stock options in

thousands):

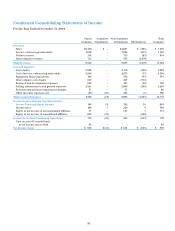

2004 2003 2002

Average Average Average

Stock Option Stock Option Stock Option

Employee Stock Options Options Price Options Price Options Price

Outstanding at January 1 97,839 $21 76,849 $26 68,829 $ 29

Granted 11,216 14 31,106 10 14,286 10

Cancelled (8,071) 32 (6,840) 21 (5,668) 34

Exercised (9,151) 7 (3,276) 6 (598) 5

Outstanding at December 31 91,833 $21 97,839 $21 76,849 $ 26

Exercisable at end of year 65,199 58,652 45,250

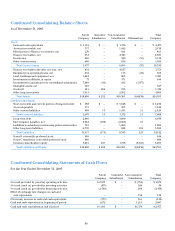

Options Outstanding Options Exercisable

Weighted

Number Average Remaining Weighted Average Number Weighted Average

Range of Exercise Prices Outstanding Contractual Life Exercise Price Exercisable Exercise Price

$4.75 to $6.98 8,058 5.97 $ 4.86 7,348 $ 4.82

7.13 to 10.69 34,920 7.34 9.09 21,342 9.30

10.70 to 15.27 11,507 6.97 13.66 396 13.06

16.91 to 22.88 12,545 5.00 21.77 11,310 21.77

25.38 to 36.70 7,830 2.93 31.58 7,830 31.58

41.72 to 60.95 16,973 2.72 52.60 16,973 52.60

91,833 5.62 $20.98 65,199 $ 24.93

Options outstanding and exercisable at December

31, 2004 were as follows (stock options in thousands):