Xerox 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

The difference between the actual return on plan

assets and the expected return on plan assets is added

to, or subtracted from, any cumulative differences

that arose in prior years. This amount is a component

of the unrecognized net actuarial (gain) loss and is

subject to amortization to net periodic pension cost

over the remaining service lives of the employees

participating in the pension plan.

Another significant assumption affecting our pen-

sion and post-retirement benefit obligations and the

net periodic pension and other post-retirement benefit

cost is the rate that we use to discount our future

anticipated benefit obligations. In estimating this rate,

we consider rates of return on high quality fixed-income

investments over the period to expected payment of

the pension and other post-retirement benefits.

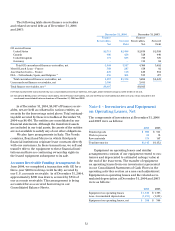

Stock-Based Compensation: We do not recognize

compensation expense relating to employee stock

options because the exercise price is equal to the market

price at the date of grant. If we had elected to recognize

compensation expense using a fair value approach, and

therefore determined the compensation based on the

value as determined by the modified Black-Scholes

option pricing model, our pro forma income and

income per share would have been as follows:

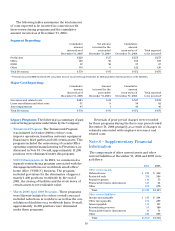

20042003 2002

Net income – as reported (1) $ 859 $ 360 $ 91

Deduct: Stock – based employee

compensation expense

determined under fair value

based method for awards,

net of tax (69) (85) (83)

Net income – pro forma $790 $275 $ 8

Basic EPS – as reported $0.94 $ 0.38 $ 0.02

Basic EPS – pro forma 0.86 0.27 (0.09)

Diluted EPS – as reported $0.86$ 0.36 $ 0.02

Diluted EPS – pro forma 0.80 0.25 (0.09)

(1) Amounts include compensation expense for restricted stock grants of

$22 ($13 after-tax), $15 ($9 after-tax) and $17 ($10 after-tax) in 2004, 2003,

and 2002, respectively.

The pro forma periodic compensation expense

amounts are not representativeof future amounts

since we will begin granting employees restricted

stock awards with time-and performance-based

restrictions in 2005 in lieu of stock options. As reflected

in the pro forma amounts in the previous table, the

weighted-average fair value of options granted in

2004, 2003 and 2002 was $8.38, $5.39 and $6.34,

respectively. The fair values were estimated on the

date of grant using the following weighted average

assumptions:

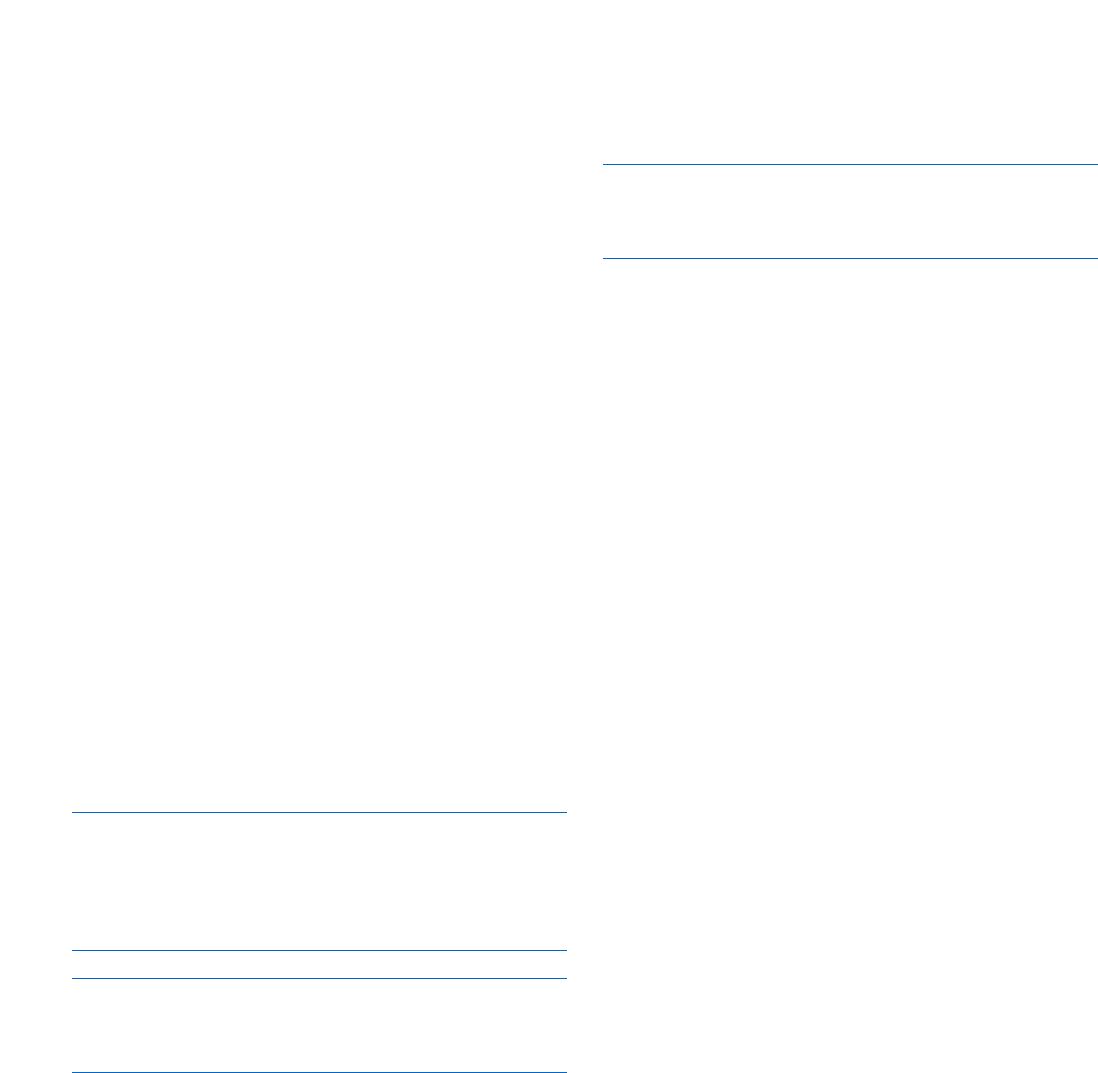

2004 2003 2002

Risk-free interest rate 3.2% 3.3% 4.8%

Expected life in years(1) 5.7 7.2 6.5

Expected price volatility 66.5% 66.2% 61.5%

Expected dividend yield —— —

(1) Options granted in 2004 expire eight years from date of grant, resulting

in an expected life shorter than previous grants.

Foreign Currency Translation: The functional cur-

rency for most foreign operations is the local currency.

Net assets are translated at current rates of exchange,

and income, expense and cash flow items are

translated at average exchange rates for the applicable

period. The translation adjustments are recorded in

Accumulated Other Comprehensive Loss. The U.S.

dollar is used as the functional currency for certain

subsidiaries that conduct their business in U.S. dollars

or operate in hyperinflationary economies. A combina-

tion of current and historical exchange rates is used in

remeasuring the local currency transactions of these

subsidiaries and the resulting exchange adjustments

are included in income. Aggregate foreign currency

losses were $73, $11 and $77 in 2004, 2003 and 2002,

respectively, and are included in Other expenses, net in

the accompanying Consolidated Statements of Income.

Note 2 – Segment Reporting

Our reportable segments are consistent with how we

manage the business and view the markets we serve.

Our reportable segments are Production, Office,

Developing Markets Operations (“DMO”) and Other.

The Production and Office segments are centered

around strategic product groups which share common

technology, manufacturing and product platforms, as

well as classes of customers. The accounting policies

of all of our segments are the same as those described

in the summary of significant accounting policies

included in Note 1.

The Production segment includes black and white

products which operate at speeds over 90 pages per

minute and color products which operate at speeds

over 40 pages per minute. Products include the

Xerox iGen3 digital color production press, Xerox

Nuvera, DocuTech, DocuPrint, Xerox 2101 and

DocuColor families, as well as older technology light-

lens products. These products are sold predominantly

through direct sales channels in North America and

Europe to Fortune 1000, graphic arts, government,

education and other public sector customers.

The Office segment includes black and white

products which operate at speeds up to 90 pages per

minute and color devices which operate at speeds up

to 40 pages per minute. Products include the suite of

CopyCentre, WorkCentre, and WorkCentre Pro digital

multifunction systems, DocuColor color multifunction