Xerox 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

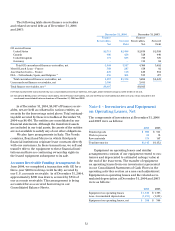

restructuring program activity during the three years

ended December 31, 2004 is outlined below.

Ongoing Legacy

Restructuring Activity Programs Programs (1) Total

Ending Balance

December 31, 2001 $ — $ 282 $ 282

Provision 357 291 648

Reversals of prior accruals — (33) (33)

Charges against reserve

and currency (71) (403) (474)

Ending Balance

December 31, 2002 $ 286 $ 137 $ 423

Provision 193 11 204

Reversals of prior accruals (16) (13) (29)

Charges against reserve

and currency (284) (93) (377)

Ending Balance

December 31, 2003 $ 179 $ 42 $ 221

Provision 103 2 105

Reversals of prior accruals (11) (9) (20)

Charges against reserve

and currency (178) (11) (189)

Ending Balance

December 31, 2004 $ 93 $ 24 $ 117

(1) Legacy Programs, as explained further below, include the Turnaround,

SOHO and 1998/2000 Programs.

Reconciliation to Statements of Income

For the year ended December 31, 2004 2003 2002

Restructuring provision $105 $204 $648

Restructuring reversal (20) (29) (33)

Asset impairment charges 1155

(1)

Restructuring and asset

impairment charges $86 $ 176 $ 670

(1) Asset impairment charges consisted of $45 and $10 for the Ongoing and

Legacy Programs, respectively.

Reconciliation to Statements of Cash Flows

For the year ended December 31, 2004 2003 2002

Charges to reserve $(189) $(377) $ (474)

Pension curtailment,

special termination

benefits and settlements 833 59

Effects of foreign currency

and other noncash (6) (1) 23

Cash payments for

restructurings $(187) $(345) $(392)

Restructuring — Ongoing Programs: Beginning

in the fourth quarter of 2002, we initiated a series of

ongoing restructuring initiatives designed to continue

to achieve the cost savings resulting from realized

productivity improvements. These ongoing initiatives

included downsizing our employee base and the

outsourcing of certain internal functions. These

initiatives are not individually significant and primarily

include severance actions and impact all geographies

and segments. We recorded an initial provision of

$402 associated with these ongoing programs in the

fourth quarter 2002. The provision consisted of $312 for

severance and related costs, $45 of net costs associated

with lease terminations and future rental obligations

and $45 for asset impairments. The severance and

related costs related to the elimination of approximately

4,700 positions worldwide. During 2003, we provided

an additional $177 for restructuring programs, net of

reversals of $16, related to changes in estimates for

severance costs from previously recorded actions. The

additional provision consisted of net charges of $138

primarily related to the elimination of over 2,000

positions worldwide, $33 for pension settlements and

post-retirement medical benefit curtailments and $6 for

lease terminations. During 2004, weprovided an

additional $93for ongoing restructuring programs, net

of reversals of $11 related to changes in estimates for

severance costs from previously recorded actions. The

additional provision consisted of a net charge of $76

related to the elimination of over 1,900 positions

primarily in North America and Latin America, $8 for

pension settlements, $8 for lease terminations and

$1 for asset impairments. The reservebalance for these

Restructuring Programs at December 31, 2004 was $93.

The majority of this balance will be spent during 2005

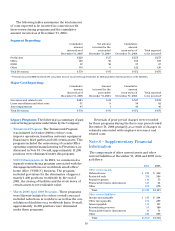

and is summarized as follows:

Lease

Severance Cancella-

and Related tion and

Costs Other Costs Total

Initial Provision (1) $ 312 $ 45 $ 357

Charges against reserve (71) — (71)

Balance at December 31, 2002 $ 241 $ 45 $ 286

Provisions (1) 186 7 193

Reversals (15) (1) (16)

Charges (269) (15) (284)

Balance at December 31, 2003 $ 143 $ 36 $ 179

Provisions (1) 95 8 103

Reversals (11) — (11)

Charges (157) (21) (178)

Balance at December 31, 2004 $ 70 $ 23 $ 93

(1) These amounts exclude cumulative asset impairment charges of $46

through December 31, 2004.