Xerox 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

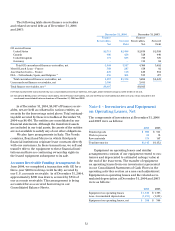

Note 3 – Receivables, Net

Finance Receivables: Finance receivables result

from installment arrangements and sales-type leases

arising from the marketing of our equipment. These

receivables are typically collateralized by a security

interest in the underlying assets. The components of

Finance receivables, net at December 31, 2004 and

2003follow:

2004 2003

Gross receivables $10,267 $10,599

Unearned income (1,619) (1,651)

Unguaranteed residual values 125 180

Allowance for doubtful accounts (276) (315)

Finance receivables, net 8,497 8,813

Less: Billed portion of finance

receivables, net (377) (461)

Current portion of finance

receivables not billed, net (2,932) (2,981)

Amounts due after one year, net $ 5,188 $ 5,371

Contractual maturities of our gross finance

receivables subsequent to December 31, 2004 follow

(including those already billed of $377):

There-

2005 2006 2007 2008 2009 after Total

$4,045 $2,793 $1,921 $1,097 $377 $34 $10,267

Customer Financing Arrangements

GE Secured Borrowings: In 2002, we completed an

agreement (the “Loan Agreement”) under which GE

Vendor Financial Services, a subsidiary of GE, became

the primary equipment financing provider in the U.S.,

through monthly fundings of our new lease origina-

tions. In March 2003, this agreement was amended to

allow for the inclusion of state and local governmental

contracts in future fundings.

Under this agreement, GE funds a significant

portion of new U.S. lease originations at over-

collateralization rates, which vary over time, but are

expected to approximate 10 percent at the inception of

each funding. The secured loans are subject to interest

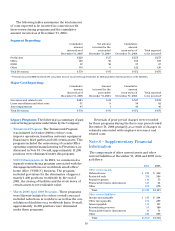

Geographic area data was as follows:

Revenues Long-Lived Assets

(1)

2004 2003 2002 2004 2003 2002

United States $ 8,346 $ 8,547 $ 9,096 $1,427 $ 1,477 $1,524

Europe 5,281 4,863 4,425 585 616 718

Other Areas 2,095 2,291 2,328 434 460 379

Total $15,722 $15,701 $15,849 $2,446 $ 2,553 $ 2,621

(1) Long-lived assets are comprised of (i) land, buildings and equipment, net, (ii) equipment on operating leases, net, (iii) internal use software, net and (iv)

capitalized software costs, net.

The following is a reconciliation of segment profit

to total company pre-tax income:

Years ended December 31,

2004 2003 2002

Total segment profit $1,200 $ 988 $ 833

Unallocated items:

Restructuring and asset

impairment charges (86) (176) (670)

2002 credit facility fee write-off (1) —(73) —

Other unallocated expenses, net (2) 2(245) (5)

Allocated item:

Equity in net income of

unconsolidated affiliates (151) (58) (54)

Pre-tax income $965 $ 436 $ 104

(1) The $73 loss associated with extinguishment of debt on the 2002 Credit

Facility, previously reflected in Other segment profit (loss), has been

reclassified in the current year presentation.

(2) 2003 unallocated expenses include a $239 provision for litigation related

to the court approved settlement of the Berger v.RIGP litigation

discussed in Note 12.