Xerox 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

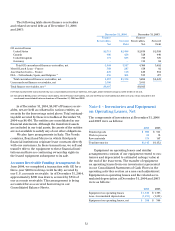

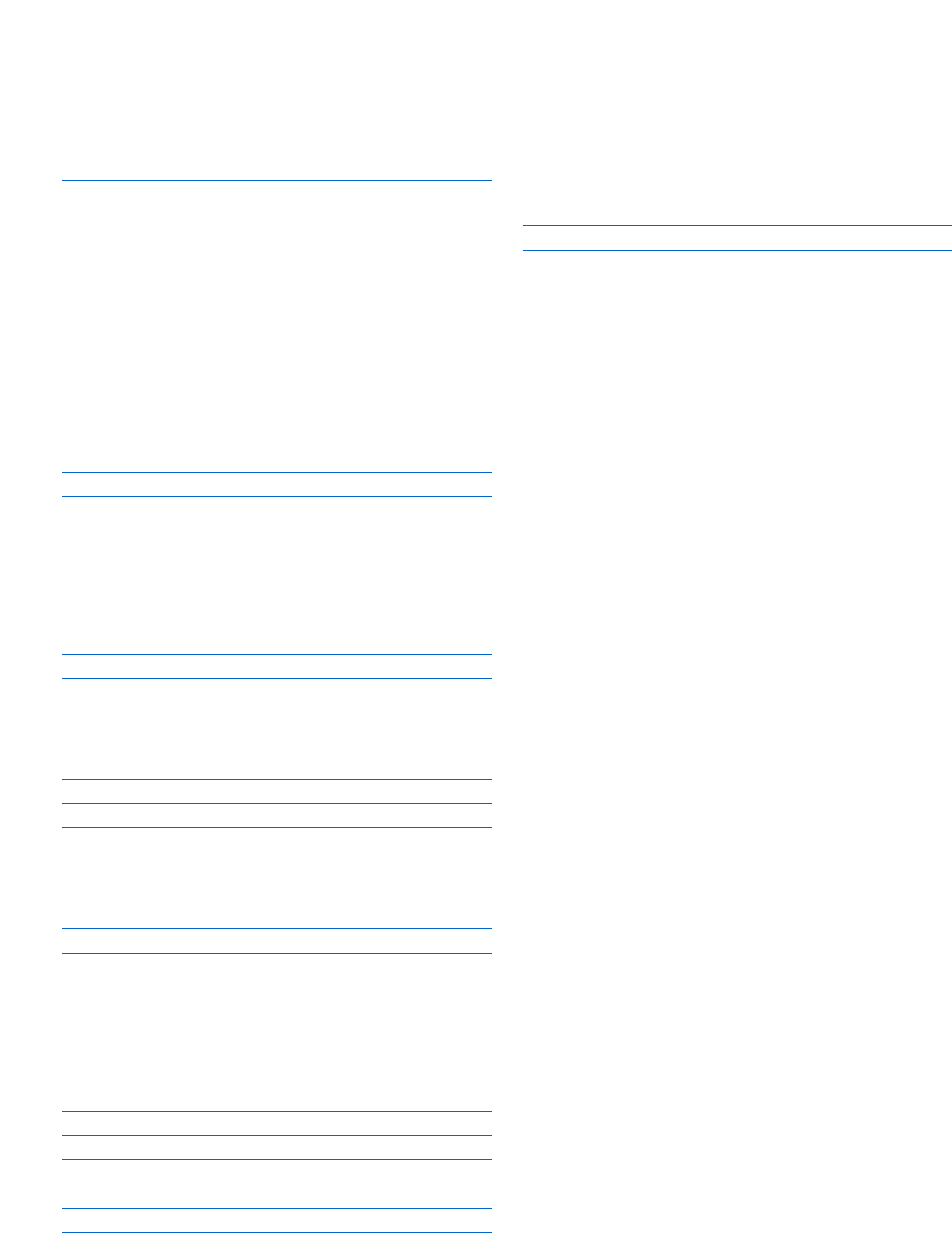

58

Weighted Average

Interest Rates at

U.S. Operations December 31, 2004 2004 2003

Xerox Corporation

Notes due 2004 —% $—$194

Euro notes due 2004 — —377

Notes due 2006 7.25 15 15

Notes due 2007 7.38 25 25

Notes due 2008 1.31 27 27

Senior Notes due 2009 9.75 627 616

Euro Senior Notes due 2009 9.75 297 272

Senior Notes due 2010 7.13 704 701

Notes due 2011 7.01 50 50

Senior Notes due 2011 6.88 758 —

Senior Notes due 2013 7.63 550 548

Convertible Notes due 2014 9.00 19 19

Notes due 2016 7.20 252 254

2003 Credit Facility 3.92 300 300

Subtotal 3,624 3,398

Xerox Credit Corporation

Yen notes due 2005 1.50 970 936

Yen notes due 2007 2.00 292 281

Notes due 2008 6.50 25 25

Notes due 2012 7.12 125125

Notes due 2013 6.50 59 59

Notes due 2014 6.06 50 50

Notes due 2018 7.00 25 25

Subtotal 1,546 1,501

Other US Operations

Borrowings secured by

finance receivables (1) 4.812,486 2,598

Borrowings secured by

other assets 4.18 257 70

Subtotal 2,743 2,668

Total U.S. operations $ 7,913 $ 7,567

International Operations

Xerox Capital (Europe) plc:

Euros due 2004 —% $—$ 942

Japanese yen due 20051.3097 93

U.S. dollars due 2004-2008 6.25 25 525

Subtotal 1221,560

Other International Operations

Pound Sterling secured

borrowings due 2008 (1) 6.95 685 570

Euro secured borrowings

due 2005-2009 (1) 3.61 839 817

Canadian dollars secured

borrowings due 2004-2007 (1) 5.78426 440

Other debt due 2004-2010 4.93103 170

Subtotal 2,053 1,997

Total international operations 2,175 3,557

Subtotal 10,088 11,124

Less current maturities (3,038) (4,194)

Total long-term debt $7,050 $ 6,930

(1) Refer to Note 3 for further discussion of borrowings secured by finance

receivables, net.

Consolidated Long-Term Debt Maturities:

Scheduled payments due on long-term debt for the

next five years and thereafter follow:

2005 2006 2007 2008 2009 Thereafter Total

$3,038 $951 $1,366 $1,041 $959 $2,733 $10,088

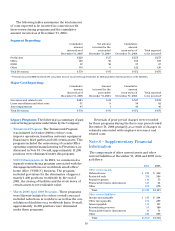

Credit Facility: In June 2003, we entered into the

2003 Credit Facility. The 2003 Credit Facility consists

of a fully drawn $300 term loan and a $700 revolving

credit facility that includes a $200 letter of credit sub-

facility, under which $15 of letters of credit were out-

standing at December 31, 2004. Xerox is the only

borrower of the term loan. The revolving credit facility

is available, without sub-limit, to Xerox and certain

foreign subsidiaries of Xerox, including Xerox Canada

Capital Limited, Xerox Capital (Europe) plc and other

qualified foreign subsidiaries (excluding Xerox, the

“Overseas Borrowers”). The 2003 Credit Facility

matures on September 30, 2008. In conjunction with

the 2003 Credit Facility, debt issuance costs of $29

were deferred. As of December 31, 2004, the $300 term

loan and $15 of letters of credit were outstanding and

there were no outstanding borrowings under the

revolving credit facility. Since inception of the 2003

Credit Facility in June 2003, there havebeen no

borrowings under the revolving credit facility.

Subject to certain limits described in the following

paragraph, the obligations under the 2003 Credit

Facility are secured by liens on substantially all the

assets of Xeroxand each of our U.S.subsidiaries that

have a consolidated net worth from time to time of

$100 or more (the “Material Subsidiaries”), excluding

Xerox Credit Corporation (“XCC”) and certain other

finance subsidiaries, and are guaranteed by certain

Material Subsidiaries. Xerox is required to guarantee

the obligations of the Overseas Borrowers. At

December 31, 2004, Xerox is the only borrower

under the 2003 Credit Facility.

Under the terms of certain of our outstanding

public bond indentures, the amount of obligations

under the 2003 Credit Facility that can be (1) secured

by assets (the “Restricted Assets”) of (a) Xerox and (b)

our non-financing subsidiaries that have a consolidat-

ed net worth of at least $100, without (2) triggering a

requirement to also secure those indentures, is limited

to the excess of (x) 20 percent of our consolidated net

worth (as defined in the public bond indentures) over

(y) the outstanding amount of certain other debt that

is secured by the Restricted Assets. Accordingly, the

amount of 2003 Credit Facility debt secured by the

Restricted Assets will vary from time to time with

changes in our consolidated net worth. The amount of

security provided under this formula accrues ratably

to the benefit of both the term loan and revolving

loans under the 2003 Credit Facility.