Xerox 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

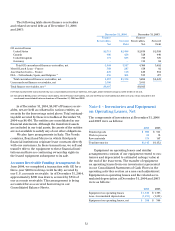

Year ended December 31,

2004 2003 2002

Restructuring provisions and

asset impairments $86 $176 $670

Amortization and impairment of

goodwill and intangible assets 38 36 99

Provisions for receivables 86 224 353

Provisions for obsolete and

excess inventory 73 78 115

Depreciation and obsolescence of

equipment on operating leases 210 271 408

Depreciation of buildings

and equipment 305 299 341

Amortization of capitalized

software 134 143 249

Pension benefits — net periodic

benefit cost 350 364 168

Other post-retirement benefits —

net periodic benefit cost 111 108 120

Deferred tax asset valuation

allowance provisions 12 (16) 15

Changes in Estimates: In the ordinary course of

accounting for items discussed above, wemake

changes in estimates as appropriate, and as we

become aware of circumstances surrounding those

estimates. Such changes and refinements in estima-

tion methodologies are reflected in reported results of

operations in the period in which the changes are

made and, if material, their effects are disclosed in the

Notes to the Consolidated Financial Statements.

New Accounting Standards and

Accounting Changes

Stock-Based Compensation: In December 2004,

the FASB issued Statement of Financial Accounting

Standards No. 123R, “Share-Based Payment” (“FAS

123R”), an amendment of FAS No. 123, “Accounting

for Stock-Based Compensation.” FAS 123R eliminates

the ability to account for share-based payments

using Accounting Principles Board Opinion No. 25,

“Accounting for Stock Issued to Employees,” and

instead requires companies to recognize compensa-

tion expense using a fair-value based method for costs

related to share-based payments including stock

options and employee stock purchase plans. The

expense will be measured as the fair value of the

award at its grant date based on the estimated number

of awards that are expected to vest, and recorded over

the applicable service period. In the absence of an

observable market price for a share-based award, the

fair value would be based upon a valuation methodol-

ogy that takes into consideration various factors,

including the exercise price of the award, the expected

term of the award, the current price of the underlying

shares, the expected volatility of the underlying share

price, the expected dividends on the underlying shares

and the risk-free interest rate. The requirements of

FAS 123R are effective for our third quarter beginning

July 1, 2005 and apply to all awards granted, modified

or cancelled after that date.

The standard also provides for different transition

methods for past award grants, including the restate-

ment of prior period results. We have elected to apply

the modified prospective transition method to all past

awards outstanding and unvested as of the effective

date of July 1, 2005 and will recognize the associated

expense over the remaining vesting period based on

the fair values previously determined and disclosed as

part of our pro-forma disclosures. We will not restate

the results of prior periods. Prior to the effective date of

FAS 123R, we will continue to provide the pro-forma

disclosures for past award grants as required under

FAS 123 and as shown below.

In January 2005, we implemented changes in our

stock-based compensation programs designed to help

us continue to attract and retain the best employees,

and to better align employee interests with those of our

shareholders. In 2005, we began granting employees

restricted stock awards with time- and performance-

based restrictions in lieu of stock options. The time-

based restricted stock awards offer employees the

opportunity to earn shares of our stock over time,

rather than options that giveemployees the right to

purchase stock at a set price. The performance-based

restricted stock awards are a form of stock award in

which the number of shares ultimately received

depends on our performance against certain specified

and predetermined financial performance targets.

The issuance of FAS 123R is expected to result in

stock option-based compensation expense in 2005 of

approximately $28 ($17 after-tax or $0.02 per diluted

share). The effect of the changes in our stock-based

compensation program is not expected to be material

in 2005.

Inventory: In November 2004, the FASB issued FAS

151, “Inventory Costs, an amendment of ARB 43,

Chapter 4” (“FAS 151”). This statement amends previ-

ous guidance as it relates to inventory valuation to

clarify that abnormal amounts of idle facility expense,

freight, handling costs and spoilage should be record-

ed as current-period charges. The effective date of FAS

151 is January 1, 2006. Since the guidance in FAS 151

reflects our current practices, we do not expect there

to be any impact on our results of operations, financial

position or liquidity.