Xerox 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

The difference between the 2003 consolidated

effective tax rate of 30.7 percent and the U.S. federal

statutory income tax rate of 35 percent relates prima-

rily to $35 million of tax benefits arising from the

reversal of valuation allowances on deferred tax assets

following a re-evaluation of their future realization

due to improved financial performance, other foreign

adjustments, including earnings taxed at different

rates, the impact of Series B Convertible Preferred

Stock dividends and state tax benefits. Such benefits

were partially offset by tax expense for audit and other

tax return adjustments, as well as $19 million of

unrecognized tax benefits primarily related to recur-

ring losses in certain jurisdictions where we continue

to maintain deferred tax asset valuation allowances.

The difference between the 2002 consolidated

effective tax rate of 3.8 percent and the U.S. federal

statutory income tax rate of 35 percent relates prima-

rily to the recognition of tax benefits resulting from

the favorable resolution of a foreign tax audit of

approximately $79 million, tax law changes of

approximately $26million and the impact of Series B

Convertible Preferred Stock dividends. Such benefits

were offset, in part, by tax expense recorded for the

on-going examination in India, the sale of our interest

in Katun Corporation, as well as recurring losses in

certain jurisdictions where weare not providing tax

benefits and continue to maintain deferred tax asset

valuation allowances.

Our consolidated effective income tax rate will

change based on discrete events (such as audit

settlements) as well as other factors including the

geographical mix of income before taxes and the

related tax rates in those jurisdictions. Weanticipate

that our 2005annual consolidated effective tax rate

will approximate 38 percent.

Equity in Net Income of Unconsolidated

Affiliates: Equity in net income of unconsolidated

affiliates increased $93 million in 2004 as compared to

2003. This account is principally related to our 25 per-

cent share of Fuji Xerox income. As discussed in Note

6to the Consolidated Financial Statements, equity

income for 2004 included $38 million related to our

share of a pension settlement gain recorded by Fuji

Xerox due to a non-recurring opportunity given to

Japanese companies by the Japanese government in

accordance with the Japan Welfare Pension Insurance

Law. This law allowed Japanese companies to transfer

aportion of their pension obligations to the Japanese

government. The remainder of the 2004 increase is

primarily due to the improved operational perform-

ance of Fuji Xerox. Our 2003 equity in net income of

$58 million was comparable with the 2002 result of

$54million.

In 2004, we recorded a Gain on sale of

ContentGuard relating to the sale of all but 2 percent

of our 75 percent ownership interest in ContentGuard.

The sale, which is disclosed in Note 18 to the

Consolidated Financial Statements, resulted in an

after-tax gain of approximately $83 million ($109 mil-

lion pre-tax).

Recent Accounting Pronouncements: See Note 1

of the Consolidated Financial Statements for a full

description of recent accounting pronouncements

including the respective dates of adoption and effects

on results of operations and financial condition.

Capital Resources and Liquidity

Cash Flow Analysis: The following summarizes our

cash flows for each of the three years ended December

31, 2004, as reported in our Consolidated Statements

of Cash Flows in the accompanying Consolidated

Financial Statements ($ in millions):

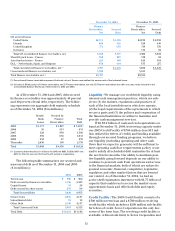

2004 2003 2002

Net cash provided by

operating activities $ 1,750 $ 1,879 $ 1,980

Net cash provided by

investing activities 203 49 93

Net cash used in

financing activities (1,293) (2,470) (3,292)

Effect of exchange rate

changes on cash 81 132 116

Increase (decrease) in cash

and cash equivalents 741 (410) (1,103)

Cash and cash equivalents

at beginning of year 2,477 2,887 3,990

Cash and cash equivalents

at end of year $ 3,218 $ 2,477 $ 2,887

Operating: For the year ended December 31, 2004,

operating cash flows were $1.8 billion, a decrease

of $129million over the same period in 2003. The

decrease primarily results from lower finance receiv-

able reductions of $159 million reflecting the increase

in equipment sale revenue in 2004, higher cash usage

related to inventory of $100 million to support new

product launches and increased tax payments of

$46million due to increased income. In addition,

there was lower cash generation from the early

termination of interest rate swaps of $62 million.

These cash outflows were partially offset by lower

pension plan contributions of $263million.

For the year ended December 31, 2003, operating

cash flows were $1.9 billion, a decrease of $101 mil-

lion over the same period in 2002. The decrease pri-

marily reflects increased pension plan contributions

of $534 million, lower finance receivable reductions of