Xerox 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

where the charge was originally recorded and included

$28 million in both Cost of Sales and Selling, adminis-

trative and general expenses and $11 million in

Research and Development expenses. Of the total

compensation expense originally recorded, $34 mil-

lion and $33 million was recognized in 2002 and 2001,

respectively. As such, 2002 benefited by the reversal of

$33 million of excess compensation expense that was

originally recorded in 2001. There is no corresponding

earnings per share improvement in 2002 since the

EPS calculation requires deduction of dividends

declared from reported net income in arriving at net

income available to common shareholders. See Note

12 to the Consolidated Financial Statements for a more

complete discussion of the ESOP.

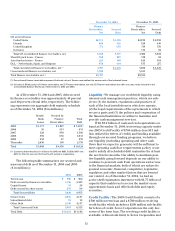

Gross Margin: Gross margins by revenue classifica-

tion were as follows:

Year Ended December 31,

2004 2003 2002

Total gross margin 40.6% 42.0% 42.4%

Sales 35.4% 36.4% 37.3%

Service, outsourcing and rentals 42.8% 44.3% 44.5%

Finance income 63.1% 63.7% 59.9%

2004 gross margin of 40.6 percent declined

1.4 percentage points from 2003. Approximately

0.8 percentage points of the decline is due to product

mix impacts from a greater proportion of lower

gross margin products in the Office and Production

segments. Approximately 0.6 percentage points of the

decline reflects the impact from DMO results. The

declines in DMO relate to Brazil’s revenue, which has

declined faster than declines in its cost levels and

product mix to lower gross margin products in various

DMO geographies. Lower prices were approximately

offset by productivity improvements.

2004 sales gross margin of 35.4 percent declined

1percentage point from 2003. Approximately 0.4 per-

centage points of the decline results from product mix

and DMO results contributed 0.6 percentage points to

the decline. Additionally, productivity improvements

offset lower prices and other variances.

2004 service, outsourcing, and rentals gross mar-

gin of 42.8 percent declined 1.5 percentage points from

2003. The majority of the decline is attributed to prod-

uct mix in the Office and Production segments as well

as DMO results. Productivity and cost improvements

offset lower prices for the year.

The 2003 gross margin of 42.0 percent declined

0.4 percentage points from 2002. During 2003, we

completed the R&D phase of the XeroxiGen3 digital

color production press development and, therefore,

beginning in July 2003 ongoing engineering costs

associated with initial commercial production were

included in cost of sales. Xerox iGen3 digital color

production press ongoing engineering costs of

$30 million, the absence of the $28 million prior

year favorable ESOP adjustment and the absence

of $50 million in prior year licensing revenue each

contributed 0.2 percentage points to the 2003 gross

margin decline. During 2003, manufacturing and

service productivity improvements more than offset

the impact of lower prices, higher pension and other

employee benefit costs and product mix.

2003 sales gross margin declined 0.9 percentage

points from 2002, with over half of the decline due to

Xerox iGen3 digital color production press ongoing

engineering costs and the remainder due to product

mix as we increased our penetration of the digital light

production market. In 2003, manufacturing productivi-

ty more than offset the impact of planned lower prices.

2003 service, outsourcing and rentals margin declined

0.2 percentage points from 2002. Improved productivi-

ty and product mix more than offset lower prices and

higher pension and other employee expenses. 2002

also included a 0.4 percentage point benefitfrom a

$50 million licensing agreement and a 0.3 percentage

point benefitdue to favorable ESOP adjustments.

2004 Finance income gross margins decreased

0.6 percentage points from 2003due to interest costs

specificto equipment financing. Equipment financing

interest expense is determined based on a combination

of actual interest expense incurred on financing debt,

as well as our estimated cost of funds, applied against

the estimated level of debt required to support our

finance receivables. The estimate is based on an

assumed ratio which ranges from 80-90% of our aver-

age finance receivables. This methodology has been

consistently applied for all periods presented. 2003

Finance income gross margins increased 3.8 percent-

age points from 2002, in line with declining interest

costs specific to equipment financing.

Research and Development: 2004 R&D expense of

$760 million was $108 million lower than the prior

year, primarily due to improved efficiencies as we cap-

ture benefits from our platform development strategy

as well as the commercial launch of the Xerox iGen3.

We continue to invest in technological development,

particularly in color, and believe that our R&D spend-

ing is at an adequate level to remain technologically

competitive. We expect 2005 R&D spending to approx-

imate 5 percent of total revenue. Our R&D is strategi-

cally coordinated with that of Fuji Xerox, which

invested $704 million and $724 million in R&D in 2004

and 2003, respectively.

2003 R&D spending of $868 million was $49 mil-

lion lower than 2002, primarily due to a $30 million

reduction associated with the commercial launch of

the XeroxiGen3 digital color production press and