Xerox 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

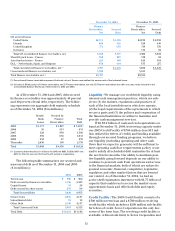

As discussed above, in preparing our financial

statements for the three years ended December 31,

2004, we estimated our provision for excess and

obsolete inventories based primarily on forecasts

of production and service requirements. This

methodology has been consistently applied for all

periods presented. During the three year period

ended December 31, 2004, inventory reserves for net

realizable value adjustments as a percentage of gross

inventory varied by approximately one percentage

point. Holding all other assumptions constant, a

one percentage point increase or decrease in our net

realizable value adjustments would change the 2004

provision by approximately $13 million.

Pension and Post-retirement Benefit Plan

Assumptions: We sponsor pension plans in various

forms in several countries covering substantially

all employees who meet eligibility requirements.

Post-retirement benefit plans cover primarily U.S.

employees for retirement medical costs. Several statis-

tical and other factors that attempt to anticipate future

events are used in calculating the expense, liability and

asset values related to our pension and post-retirement

benefitplans. These factors include assumptions we

make about the discount rate, expected return on plan

assets, rate of increase in healthcare costs, the rate of

future compensation increases and mortality, among

others. For purposes of determining the expected

return on plan assets, we utilize a calculated value

approach in determining the value of the pension plan

assets, as opposed to a fair market value approach. The

primary difference between the two methods relates to

asystematic recognition of changes in fair value over

time (generally two years) versus immediate recogni-

tion of changes in fair value. Our expected rate of

return on plan assets is then applied to the calculated

asset value to determine the amount of the expected

return on plan assets to be used in the determination of

the net periodic pension cost. The calculated value

approach reduces the volatility in net periodic pension

cost that results from using the fair market value

approach. The difference between the actual return on

plan assets and the expected return on plan assets is

added to, or subtracted from, any cumulative

differences that arose in prior years. This amount is a

component of the unrecognized net actuarial (gain)

loss and is subject to amortization to net periodic pen-

sion cost over the average remaining service lives of

the employees participating in the pension plan.

As a result of cumulative historical asset returns

being lower than expected asset returns and declining

interest rates, 2005 net periodic pension cost will

increase. The total unrecognized actuarial loss as of

December 31, 2004 was $1.99 billion, as compared to

$1.87billion at December 31, 2003. The change from

December 31, 2003 relates to a decline in the discount

rate, partially offset by improved asset returns as com-

pared to expected returns. The total unrecognized

actuarial loss will be amortized in the future, subject

to offsetting gains or losses that will change the future

amortization amount. We have recently utilized a

weighted average expected rate of return on plan

assets of 8.1 percent for 2004 expense, 8.3 percent

for 2003 expense and 8.8 percent for 2002 expense,

on a worldwide basis. In estimating this rate, we

considered the historical returns earned by the plan

assets, the rates of return expected in the future and

our investment strategy and asset mix with respect to

the plans’ funds. The weighted average rate we will

utilize to calculate our 2005 expense will be 8 percent.

Another significant assumption affecting our pension

and post-retirement benefit obligations and the net

periodic pension and other post-retirement benefit

cost is the rate that weuse to discount our future

anticipated benefit obligations. In estimating this rate,

we consider rates of return on high quality fixed-

income investments over the period to expected pay-

ment of the pension and other benefits. The weighted

average rate we will utilize to measure our pension

obligation as of December 31, 2004and calculate our

2005 expense will be 5.6 percent, which is a decrease

from 5.8 percent used in determining 2004 expense.

As a result of the reduction in the discount rate, the

lower cumulativeactual return on plan assets during

the prior three years and certain other factors, our

2005net periodic pension cost is expected to be

$40million higher than 2004.

On a consolidated basis, we recognized net

periodic pension cost of $350 million, $364 million,

and $168million for the years ended December 31,

2004, 2003 and 2002, respectively. Pension cost is

included in several income statement components

based on the related underlying employee costs.

Pension and post-retirement benefit plan assumptions

are included in Note 12 to the Consolidated Financial

Statements. Holding all other assumptions constant, a

0.25 percent increase or decrease in the discount rate

would change the 2005 projected net periodic pension

cost by approximately $34 million. Likewise, a 0.25 per-

cent increase or decrease in the expected return on

plan assets would change the 2005 projected net

periodic pension cost by approximately $14 million.

Income Taxes and Tax Valuation Allowances:

We record the estimated future tax effects of temporary

differences between the tax bases of assets and liabili-

ties and amounts reported in our Consolidated Balance

Sheets, as well as operating loss and tax credit carryfor-

wards. We follow very specific and detailed guidelines

in each tax jurisdiction regarding the recoverability of

anytax assets recorded in our Consolidated Balance