Xerox 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

Cash Flow Hedges: During 2004, pay fixed/receive

variable interest rate swaps with notional amounts of

£200 million ($385) associated with the Xerox Finance

Limited GE Capital borrowing were designated and

accounted for as cash flow hedges. The swaps were

structured to hedge the LIBOR interest rate of the debt

by converting it from a variable rate instrument to a

fixed rate instrument. No ineffective portion was

recorded to earnings during 2004.

Derivatives Marked-to-Market Results: While the

remainder of our portfolio of interest rate derivative

instruments is intended to economically hedge inter-

est rate risks to the extent possible, differences

between the contract terms of these derivatives and

the underlying related debt reduce our ability to

obtain hedge accounting in accordance with SFAS No.

133. This results in mark-to-market valuation of these

derivatives directly through earnings, which accord-

ingly leads to increased earnings volatility.During

2004 and 2003, we recorded net gains of $4 and net

losses of $13, respectively, from the mark-to-market

valuation of interest rate derivatives for which we did

not apply hedge accounting.

Terminated Swaps: During 2004, we terminated

interest rate swaps with a notional value of $1.1 billion

and a net fair asset value of $68. Interest rate swaps

with a notional value of $600 and a fair value of $55

had previously been designated as fair value hedges

against the Senior Notes due 2009. Accordingly, the

corresponding $55 fair value adjustment to the Senior

Notes will be amortized to interest expense over the

remaining term of the notes and amounted to $9 dur-

ing 2004. During 2003, we terminated interest rate

swaps with a notional value of $2.0 billion and a net

fair asset value of $136. The remaining derivatives

terminated in 2004 as well as those terminated in 2003

had not been previously designated as hedges and

accordingly those terminations had no impact on

earnings as they were being marked to market

through earnings each period.

Foreign Exchange Risk Management: In cases

where we issue foreign currency denominated debt,

we may enter into cross-currency interest rate swap

agreements whereby we swap the proceeds and related

interest payments with a counterparty. In return, we

receive and effectively denominate the debt in local

functional currencies. In addition, we may also utilize

forward exchange contracts to hedge the currency

exposure for interest payments on foreign currency

denominated debt. These derivatives may be designated

as fair value hedges or cash flow hedges depending on

the nature of the risk being hedged.

We also utilize forward exchange contracts and

purchased option contracts to hedge against the poten-

tially adverse impacts of foreign currency fluctuations

on foreign currency denominated assets and liabili-

ties. Generally, changes in the value of these currency

derivatives are recorded in earnings together with the

offsetting foreign exchange gains and losses on the

underlying assets and liabilities.

We also utilize currency derivatives to hedge antic-

ipated transactions, primarily forecasted purchases of

foreign-sourced inventory. These contracts generally

mature in six months or less. Although these contracts

are intended to economically hedge foreign currency

risks to the extent possible, differences between the

contract terms of our derivatives and the underlying

forecasted exposures reduce our ability to obtain

hedge accounting in accordance with SFAS No. 133.

Accordingly, the changes in value for these derivatives

are recorded directly through earnings.

During 2004, 2003, and 2002, we recorded aggre-

gate exchange losses of $73, $11 and $77, respectively.

Net currency losses primarily result from the spot/for-

ward premiums on foreign exchange forward

contracts, the re-measurement of unhedged foreign

currency-denominated assets and liabilities and the

mark-to-market impact of economic hedges of antici-

pated transactions for which wedo not qualify for

cash flowhedge accounting treatment.

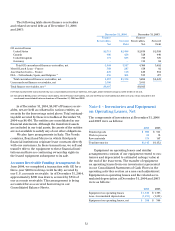

At December 31, 2004, we had outstanding

forward exchange and purchased option contracts

with gross notional values of $5,040. The following is

asummary of the primary hedging positions and cor-

responding fair values held as of December 31, 2004:

Fair

Gross Value

Notional Asset

Currency Hedged (Buy/Sell) Value (Liability)

Euro/Pound Sterling $1,817 $ 41

Yen/US Dollar 895 38

Pound Sterling/Euro 441 (5)

US Dollar/Euro 371 (29)

Canadian Dollar/Euro 230 (2)

US Dollar/Pound Sterling 203 —

Yen/Euro 190 (1)

Kronor/Pound Sterling 173 3

Swiss Franc/Pound Sterling 131 1

Euro/Canadian Dollar 108 1

Canadian Dollar/US Dollar 100 5

All Other 381 (3)

Total $5,040 $ 49