Xerox 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

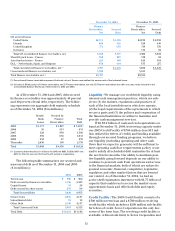

Loan Covenants and Compliance: AtDecember 31,

2004, we were in full compliance with the covenants

and other provisions of the 2003 Credit Facility, the

senior notes and the Loan Agreement and expect to

remain in full compliance for at least the next twelve

months. Any failure to be in compliance with any

material provision or covenant of the 2003 Credit

Facility or the senior notes could have a material

adverse effect on our liquidity and operations. Failure

to be in compliance with the covenants in the Loan

Agreement, including the financial maintenance

covenants incorporated from the 2003 Credit Facility,

would result in an event of termination under the

Loan Agreement and in such case GECC would not be

required to make further loans to us. If GECC were to

make no further loans to us and assuming a similar

facility was not established, it would materially

adversely affect our liquidity and our ability to fund

our customers’ purchases of our equipment and this

could materially adversely affect our results of opera-

tions. We have the right at any time to prepay without

penalty anyloans outstanding under or terminate the

2003 Credit Facility.

Capital Markets Offerings and Other: In August

2004, we issued $500 million aggregate principal

amount of Senior Notes due 2011 at par value and, in

September 2004, weissued an additional $250 million

aggregate principal amount Senior Notes due 2011 at

104.25 percent of par. These notes, which are discussed

further in Note 9 to the Consolidated Financial

Statements, form a single series of debt. Interest on

the Senior Notes accrues at the annual rate of 6.875

percent and, as a result of the premium we received

on the second issuance of Senior Notes, have a weight-

ed average effective interest rate of 6.6 percent. The

weighted average effective interest rate associated

with the Senior Notes reflects our recently improved

liquidity and ability to access the capital markets on

more favorable terms.

In December 2004, we completed the redemption

of our liability to the Xerox trust issuing trust preferred

securities. In lieu of cash redemption, holders of sub-

stantially all of the securities converted $1.0 billion

aggregate principal amount of securities into 113 mil-

lion shares of our common stock. As a result of this

conversion and redemption, there is no remaining

outstanding principal. This redemption, which had

no impact on diluted earnings per share, is discussed

further in Note 10 to the Consolidated Financial

Statements.

Credit Ratings: Our credit ratings as of February 21,

2005 were as follows:

Senior

Unsecured

Debt Outlook Comments

Moody’s (1) (2) Ba2 Stable The Moody’s rating was

upgraded from B1 in

August 2004.

S&P B+ Stable The S&P rating on Senior

Secured Debt is BB-. The

outlook was upgraded to

stable in January 2005.

Fitch BB Positive The Fitch rating was

upgraded to a positive

outlook in February 2005.

(1) In December 2003, Moody’s assigned to Xerox a first time SGL-1 rating.

This rating was affirmed in August 2004.

(2) In August 2004, Moody’s upgraded the long-term senior unsecured debt

rating of Xerox from B1 to Ba2, a two notch upgrade. The corporate rat-

ing was upgraded to Ba1 and the outlook is stable.

Both our ability to obtain financing and the related

cost of borrowing are affected byour credit ratings,

which are periodically reviewed by the major rating

agencies. Our current credit ratings are below invest-

ment grade and we expect our access to the public

debt markets to be limited to the non-investment

grade segment until our ratings have been restored.