Xerox 2004 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

Prudential Insurance Company Common Stock:

In the first quarter of 2002, we sold common stock of

Prudential Insurance Company, associated with that

company’s demutualization. In connection with this

sale, we recognized a pre-tax gain of $19 that is included

in Other Expenses, net, in the accompanying

Consolidated Statements of Income.

Flextronics Manufacturing Outsourcings: In the

fourth quarter of 2001, we entered into purchase and

supply agreements with Flextronics, a global electronics

manufacturing services company. Under the agreements,

Flextronics purchased related inventory, property and

equipment. Pursuant to the purchase agreement, we

sold our operations in Toronto, Canada; Aguascalientes,

Mexico, Penang, Malaysia, Venray, The Netherlands

and Resende, Brazil to Flextronics in a series of

transactions, which were completed in 2002. In total,

approximately 4,100 Xeroxemployees in certain of

these operations transferred to Flextronics. Total

proceeds from the sales in 2002 and 2001 were $167,

plus the assumption of certain liabilities.

Under the supply agreement, Flextronics manu-

factures and supplies equipment and components,

including electronic components, for the Office seg-

ment of our business. This represents approximately

50 percent of our overall worldwide manufacturing

operations. The initial term of the Flextronics supply

agreement is through December 2006 subject to our

right to extend for two years. Thereafter it will auto-

matically be renewed for one-year periods, unless

either party elects to terminate the agreement. We

haveagreed to purchase from Flextronics most of our

requirements for certain products in specified product

families. We also must purchase certain electronic

components from Flextronics, so long as Flextronics

meets certain pricing requirements. Flextronics must

acquire inventory in anticipation of meeting our fore-

casted requirements and must maintain sufficient

manufacturing capacity to satisfy such forecasted

requirements. Under certain circumstances, we

may become obligated to repurchase inventory that

remains unused for more than 180 days, becomes

obsolete or upon termination of the supply agreement.

Our remaining manufacturing operations are primarily

located in Rochester, NY for our high end production

products and consumables and Wilsonville, OR for

consumable supplies and components for the Office

segment products.

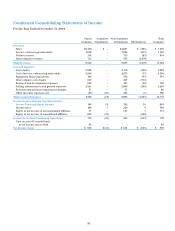

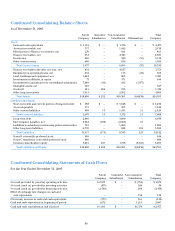

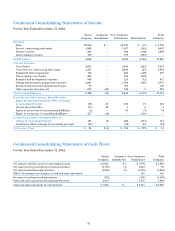

Note 19 – Financial Statements of

Subsidiary Guarantors

The Senior Notes due 2009, 2010, 2011 and 2013

are jointly and severally guaranteed by Intelligent

Electronics, Inc. and Xerox International Joint

Marketing, Inc. (the “Guarantor Subsidiaries”),

each of which is wholly-owned by Xerox Corporation

(the “Parent Company”). The following supplemental

financial information sets forth, on a condensed con-

solidating basis, the balance sheets, statements of

income and statements of cash flows for the Parent

Company, the Guarantor Subsidiaries, the non-

guarantor subsidiaries and total consolidated Xerox

Corporation and subsidiaries as of December 31, 2004

and December 31, 2003 and for the years ended

December 31, 2004, 2003 and 2002.