Xerox 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

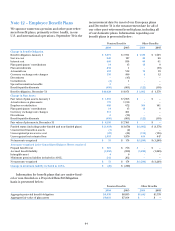

Information relating to the ESOP trust for the

three years ended December 31, 2004 follows:

2004 2003 2002

Dividends declared on

Convertible Preferred Stock $15 $41 $78

Cash contribution to the ESOP —14 31

Compensation expense —810

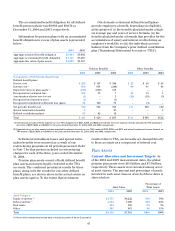

Note 13 – Income and Other Taxes

Income (loss) before income taxes for the three years

ended December 31, 2004 follows:

2004 2003 2002

Domestic income (loss) $426 $(299) $ 15

Foreign income 539 735 89

Income before income taxes $965 $ 436 $104

Provisions (benefits) for income taxes for the three

years ended December 31, 2004 follow:

200420032002

Federal income taxes

Current $ 26 $77 $39

Deferred 114 (132) (35)

Foreign income taxes

Current 178144145

Deferred 21 72 (141)

State income taxes

Current (19) (17) (2)

Deferred 20 (10) (2)

$340 $134 $ 4

Areconciliation of the U.S. federal statutory

income tax rate to the consolidated effective income

tax rate for the three years ended December 31, 2004

follows:

2004 2003 2002

U.S.federal statutory

income tax rate 35.0% 35.0% 35.0%

Nondeductible expenses 3.4 5.0 17.6

Effect of tax law changes (1.5) 1.0 (15.3)

Change in valuation allowance

for deferred tax assets 1.3 (3.8) 14.0

State taxes, net of federal benefit 1.3 (2.7) (2.3)

Audit and other tax

return adjustments 0.7 7.6 (53.7)

Tax-exempt income (0.7) (1.0) (9.3)

Dividends on Series B

convertible preferred stock (0.6) (3.1) (22.7)

Other foreign, including earnings

taxed at different rates (2.4) (7.0) 43.8

Other (1.3) (0.3) (3.3)

Effectiveincome tax rate 35.2% 30.7% 3.8%

The 2004 consolidated effective income tax rate of

35.2 percent was comparable to the U.S. federal statu-

tory income tax rate. The effective income tax rate

reflects the impact of nondeductible expenses and

unrecognized tax benefits primarily related to recur-

ring losses in certain jurisdictions where we continue

to maintain deferred tax asset valuation allowances.

This tax expense was partially offset by tax benefits

from other foreign adjustments, including earnings

taxed at different rates, tax law changes and other

items that are individually insignificant.

The difference between the 2003 consolidated

effective income tax rate of 30.7 percent and the U.S.

federal statutory income tax rate relates primarily to

tax benefits arising from the reversal of valuation

allowances on deferred tax assets following a re-

evaluation of their future realization due to improved

financial performance, other foreign adjustments,

including earnings taxed at different rates, the impact

of dividends on Series B Convertible Preferred Stock

and state tax benefits. Such benefits were partially

offset bytax expense for audit and other tax return

adjustments, as well as recurring losses in certain

jurisdictions where wecontinue to maintain deferred

tax asset valuation allowances.

The difference between the 2002consolidated

effectiveincome tax rate of 3.8 percent and the U.S.

federal statutory income tax rate relates primarily to

the recognition of tax benefits from the favorable reso-

lution of a foreign tax audit, tax law changes as well

as the retroactivedeclaration of Series B Convertible

Preferred Stock dividends. Such benefits were offset,

in part, by tax expense recorded for the ongoing

examination in India, the sale of our interest in

Katun Corporation as well as recurring losses in

certain jurisdictions where we are not providing tax

benefits and continue to maintain deferred tax asset

valuation allowances.

On a consolidated basis, we paid a total of $253,

$207, and $442 in income taxes to federal, foreign and

state jurisdictions in 2004, 2003 and 2002, respectively.

Total income tax expense (benefit) for the three

years ended December 31, 2004 was allocated as

follows:

2004 2003 2002

Income taxes on income $340 $134 $ 4

Common shareholders’ equity (1) (20) 123 (173)

Total $320 $257 $(169)

(1) For tax effects of items in accumulated other comprehensive loss and

tax benefits related to stock option and incentive plans.