Xerox 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

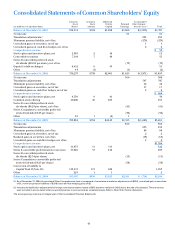

Consolidated Statements of Common Shareholders’ Equity

Common Common Additional Accumulated

Stock Stock Paid-In Retained Other Compre-

(in millions, except share data) Shares Amount Capital Earnings hensive Loss(1) Total

Balance at December 31, 2001 722,314 $724 $1,898 $1,008 $(1,833) $1,797

Net income 91 91

Translation adjustments(2) 234 234

Minimum pension liability, net of tax (279) (279)

Unrealized gain on securities, net of tax 11

Unrealized gains on cash flow hedges, net of tax 6 6

Comprehensive income $53

Stock option and incentive plans, net 2,385 2 10 12

Convertible securities 7,118 7 48 55

Series B convertible preferred stock

dividends ($10.94 per share), net of tax (73) (73)

Equity for debt exchanges 6,412 6 45 51

Other 44 (1) (1) (2)

Balance at December 31, 2002 738,273 $738 $2,001 $1,025 $(1,871) $1,893

Net income 360 360

Translation adjustments 547 547

Minimum pension liability, net of tax 42 42

Unrealized gain on securities, net of tax 17 17

Unrealized gains on cash flowhedges, net of tax 2 2

Comprehensive income $968

Stock option and incentive plans, net 9,530 9 41 50

Common stock offering 46,000 46 405 451

Series B convertible preferred stock

dividends ($6.25 per share), net of tax (41) (41)

Series C mandatory convertible preferred

stock dividends ($3.23 per share) (30) (30)

Other 81 1 (2) 1 –

Balance at December 31, 2003 793,884 $794 $2,445 $1,315 $(1,263) $3,291

Net income 859 859

Translation adjustments 453 453

Minimum pension liability, net of tax 86 86

Unrealized gain on securities, net of tax 22

Realized gain on securities, net of tax (18) (18)

Unrealized gains on cash flowhedges, net of tax 22

Comprehensive income $1,384

Stock option and incentive plans, net 11,433 11 111 122

Series B convertible preferred stock conversion 37,040 37 446 483

Series B convertible preferred stock

dividends ($2.54 per share) (15) (15)

Series C mandatory convertible preferred

stock dividends ($6.25 per share) (58) (58)

Conversion of Liability to

Capital Trust II (Note 10) 113,415 113 922 1,035

Other 225 1 1 2

Balance at December 31, 2004 955,997 $956 $3,925 $2,101 $ (738) $6,244

(1) As of December 31, 2004, Accumulated Other Comprehensive Loss is composed of cumulative translation adjustments of $(524), unrealized gain on securities

of $1, minimum pension liabilities of $(218) and cash flow hedging gains of $3.

(2) Includes reclassification adjustments for foreign currency translation losses of $59, that were realized in 2002 due to the sale of businesses. These amounts

were included in accumulated other comprehensive loss in prior periods as unrealized losses. Refer to Note 18 for further discussion.

The accompanying notes are an integral part of the Consolidated Financial Statements.