Xerox 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

improved R&D productivity, partially offset by higher

pension and other employee benefit expenses.

Selling, Administrative and General Expenses:

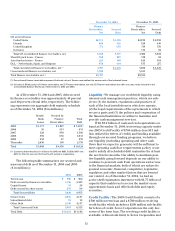

SAG expense information was as follows ($ in millions):

Year Ended December 31,

2004 2003 2002

Total Selling, administrative

and general expenses $4,203 $4,249 $4,437

SAG as a percentage of revenue 26.7% 27.1% 28.0%

2004 SAG expense of $4.2 billion declined $46 mil-

lion from 2003 as bad debt expense reductions of

approximately $115 million and G&A efficiencies were

partially offset byincreased selling and marketing

expenses as well as unfavorable currency impacts of

$141 million. 2003 SAG expense of $4.2 billion declined

$188million from 2002including adverse currency

impacts of $172 million and $70 million of higher pen-

sion and other employee benefit costs. 2003 SAG reduc-

tions reflect improved productivity and employment

reductions associated with our cost base restructuring

and lower bad debt expenses of $109 million.

Bad debt expense included in SAG was $110 mil-

lion, $224 million and $332 million in 2004, 2003 and

2002, respectively. The 2004 reduction reflects

improved collections performance, receivables aging

and write-off trends. Bad debt expense as a percent of

total revenue was 0.7 percent, 1.4 percent and 2.1 per-

cent for 2004, 2003 and 2002, respectively.

Restructuring Programs: For the three years ended

December 31, 2004, we have engaged in a series of

restructuring programs, resulting in $932 million in

charges related to downsizing our employee base,

exiting certain activities, outsourcing some internal

functions and engaging in other actions designed to

reduce our cost structure. In 2004, we recorded

restructuring charges of $86million, primarily consist-

ing of ongoing restructuring actions. These ongoing

initiatives included downsizing our employee base

and the outsourcing of certain internal functions.

The initiatives are not individually significant and

primarily include severance actions and impact all

geographies and segments. We expect prospective

annual savings associated with 2004actions to be

approximately $88 million. Restructuring and asset

impairment charges of $176million and $670 million

in 2003and 2002, respectively, primarily related to

severance and employee benefits related to worldwide

severance actions as well as certain costs related to the

consolidation of excess facilities. The remaining

restructuring reserve balance at December 31, 2004

for all programs was $117 million. The reserve

balance for Ongoing Programs as of December 31, 2004

was $93 million, the majority of which will be spent in

2005. The reserve balance for the Legacy programs as

of December 31, 2004 was $24 million and the majori-

ty of this balance relates to our exit from facilities in

Europe and the United States, which are currently

leased beyond 2008.

Worldwide employment declined by

approximately 3,000 in 2004, to approximately 58,100,

primarily reflecting reductions as part of our restruc-

turing programs. Worldwide employment was approx-

imately 61,100 and 67,800 at December 31, 2003 and

2002, respectively.

Gain on Affiliate’s Sale of Stock: In 2003, we

recorded cumulative gains on an affiliate’s sale of

stock of $13 million reflecting our proportionate

share of the increase in equity of ScanSoft Inc., an

equity investment. The gain resulted from ScanSoft’s

issuance of stock in connection with its acquisition of

Speechworks, Inc. ScanSoft is a developer of digital

imaging software that enables users to leverage the

power of their scanners, digital cameras and other

electronic devices. As discussed in Note 18 to the

Consolidated Financial Statements, in April 2004,

wecompleted the sale of our ownership interest

in ScanSoft.

Other Expenses, Net: Other expenses, net for the

three years ended December 31, 2004 consisted of the

following ($ in millions):

Year Ended December 31,

2004 2003 2002

Non-financing interest expense $363 $522 $495

Interest income (75) (65) (77)

Net currency losses 73 11 77

Legal and regulatory matters 9242 37

Amortization of intangible assets 37 36 36

Loss (gain) on early

extinguishment of debt —73 (1)

Business divestiture and

asset sale (gains) losses (61) 13 (1)

Minorities’ interests in

earnings of subsidiaries 863

All other, net 15 38 24

$369 $876 $593

Non-financing interest expense: 2004non-financ-

ing interest expense was $159million lower than 2003

primarily due to lower average debt balances as a

result of the full year effect of the June 2003recapital-

ization and other scheduled term debt repayments.

2003 non-financing interest expense was $27 million

higher than 2002, primarily reflecting 2003 net losses

of $13 million from the mark-to-market valuation of

our interest rate swaps compared to gains of $12 million

in 2002. 2003 non-financing interest expense also