Xerox 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

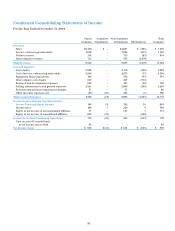

2004 2003 2002

Basic Earnings per common share:

Income from continuing operations before cumulative effect of

change in accounting principle $776$ 360 $ 154

Accrued dividends on:

Series C Mandatory Convertible Preferred Stock (57) (30) —

Series B Convertible Preferred Stock, net (16) (41) (73)

Adjusted income from continuing operations before cumulative effect

of change in accounting principle 703 289 81

Gain on sale of ContentGuard, net 83 — —

Cumulative effect of change in accounting principle ——(63)

Adjusted net income available to common shareholders $786$ 289 $ 18

Weighted average common shares outstanding 834,321 769,032 731,280

Basic earnings per share:

Income from continuing operations before cumulativeeffect

of change in accounting principle $0.84 $ 0.38 $ 0.11

Gain on sale of ContentGuard, net 0.10 ——

Cumulativeeffect of change in accounting principle ——(0.09)

Basic earnings per share $ 0.94 $ 0.38 $ 0.02

Diluted Earnings per common share:

Income from continuing operations before cumulative effect

of change in accounting principle $776$ 360 $ 154

ESOP expense adjustment, net (6) (35) (73)

Accrued dividends on Series C Mandatory Convertible Preferred Stock —(30) —

Interest on Convertible Securities, net of tax 51 — —

Adjusted income from continuing operations before cumulativeeffect

of change in accounting principle 821 295 81

Gain on sale of ContentGuard, net 83 ——

Cumulative effect of change in accounting principle ——(63)

Adjusted net income available to common shareholders $904$ 295 $ 18

Weighted Average Common Shares Outstanding 834,321 769,032 731,280

Common shares issuable with respect to:

Stock options 14,1988,273 5,401

Series B Convertible Preferred Stock 17,359 51,082 70,463

Convertible Securities 106,272 — —

Series C Mandatory Convertible Preferred Stock 74,797 ——

Adjusted Weighted Average Shares Outstanding 1,046,947 828,387 807,144

Diluted earnings per share:

Income from continuing operations before cumulativeeffect

of change in accounting principle $ 0.78 $ 0.36 $ 0.10

Gain on sale of ContentGuard, net of income taxes 0.08 ——

Cumulative effect of change in accounting principle ——(0.08)

Diluted earnings per share $ 0.86 $ 0.36 $ 0.02

Note 17 – Earnings Per Share

Basic earnings per share is computed by dividing

income available to common shareholders (the

numerator) by the weighted-average number of com-

mon shares outstanding (the denominator) for the

period. Diluted earnings per share assumes that any

dilutive convertible preferred shares, convertible

subordinated debentures, and convertible securities

outstanding were converted, with related preferred

stock dividend requirements and outstanding

common shares adjusted accordingly. It also assumes

that outstanding common shares were increased by

shares issuable upon exercise of those stock options

for which market price exceeds the exercise price,

less shares which could have been purchased by us

with the related proceeds. In periods of losses, diluted

loss per share is computed on the same basis as basic

loss per share as the inclusion of any other potential

shares outstanding would be anti-dilutive.

The detail of the computation of basic and diluted

EPS follows (shares in thousands):