Xerox 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Smarter. Simpler. Personal. Colorful.

Annual Report 2004

Smarter. Simpler. Personal. Colorful.

Annual Report 2004

Table of contents

-

Page 1

Smarter. Simpler. Personal. Colorful. Annual Report 2004 -

Page 2

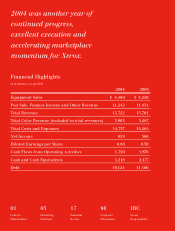

... Xerox. Financial Highlights ($ in millions, except EPS) 2004 Equipment Sales Post Sale, Finance Income and Other Revenue Total Revenue Total Color Revenue (included in total revenues) Total Costs and Expenses Net Income Diluted Earnings per Share Cash Flows from Operating Activities Cash and Cash... -

Page 3

... rehash the past, I want to take this opportunity to share our plans for the future. Poised for Growth As the story of the Xerox turnaround gets written, I'm conï¬dent that it will say that while we were focused on reducing costs, boosting productivity and slashing debt, we were equally focused on... -

Page 4

... reduce costs and improve workï¬,ows. Using Xerox Lean Six Sigma methodology, we analyze in detail all of the documentintensive processes our customers use to run their businesses. We identify the exact costs of the way our customers manage printing, copying, faxing and scanning functions... -

Page 5

..., imaging, content management and outsourcing services that help our customers reduce costs through processes that deliver the right information, in the right form, at the right time. Although we manage our business in three areas, we go to market as one Xerox. The umbrella for much of what we do... -

Page 6

... at a time when others were writing our obituary. It's something we will never forget. Ever. By the way, just about every Xerox person around the world is a shareowner. We are all in this together. We are all focused on creating shareholder value and we're making good progress. Xerox's share price... -

Page 7

Delivering Solutions Xerox has answered our customers' call to action through customized solutions, integrated, innovative technology and our unparalleled expertise in document management. In the pages that follow, you'll see a few examples of the thousands of customers Xerox is helping to ï¬nd ... -

Page 8

... Xerox Global Services developed a "paperless" system for library patrons to connect with BPL's libraries and extensive online resources. In partnership with several technology providers, Xerox created the Access Brooklyn Card (ABC) - a "smart" library card that can be used to reserve computers, pay... -

Page 9

Through digital imaging, consulting and content management, Xerox Global Services is a burgeoning growth opportunity. Revenue from these value-added services grew 20 percent last year and is expected to continue climbing at a double-digit pace over the next ï¬ve years. 7 -

Page 10

..., they turn the ideas into attention-grabbing marketing materials with response rates that are the envy of any direct marketing campaign. Vestcom's tool of the trade: the Xerox iGen3® Digital Production Press, a 100 page-per-minute full-color printer that is capable of personalizing each and every... -

Page 11

In 2004, 8 billion pages were printed on Xerox production color systems. On average, iGen3 customers print 400,000 color pages per machine per month with several customers exceeding print volumes of 1 million pages per month. 9 -

Page 12

...a Xerox Phaser® solid ink printer right at the Cingular retail store - that's 1,000 stores in the U.S. and Puerto Rico. By eliminating inventory costs and the expense of reprinting dated materials, Xerox provides Cingular with real-time communication that equates to really signiï¬cant cost savings... -

Page 13

Response rates increase more than 500 percent when marketing pieces are printed in color with personalized content targeting the customer's interests and requirements. -

Page 14

...full-color brochures that highlight a home's best features. The WorkCentre Pro is more than a printer; it also copies, faxes, scans and emails - an all-in-one device that handles all the document needs from ï¬rst listing to ï¬nal closing. Agents order their customized materials through Xerox's Web... -

Page 15

Color helps sell up to 80 percent more than materials printed in black and white and people are 55 percent more likely to pick up a full-color piece of mail ï¬rst. 13 -

Page 16

... contract, Xerox is now responsible for Sun's entire ï¬,eet of document devices in Europe and South Africa, managing the maintenance and supplies contracts not only for Xerox systems but also for products from other vendors. And, Xerox people serve as the frontline of support when Sun employees... -

Page 17

Companies typically spend about $100 per month per employee for printing, copying, faxing and scanning. Xerox reduces these monthly costs on average by $25 per employee. 15 -

Page 18

Delivering Results... 16 -

Page 19

... Statements of Common Shareholders' Equity 42 Notes to the Consolidated Financial Statements 89 Reports of Management 90 Report of Independent Registered Public Accounting Firm 92 Quarterly Results of Operations 93 Five Years in Review 94 Ofï¬cers 95 Directors 96 Corporate Information 17 -

Page 20

... and color offerings. We operate in competitive markets and our customers demand improved solutions, such as the ability to print offset quality color documents on demand; improved product functionality, such as the ability to print, copy, fax and scan from a single device; and lower prices for... -

Page 21

...: ($ in millions) Sales Less: Supplies, paper and other sales Equipment Sales Service, outsourcing and rentals Add: Supplies, paper and other sales Post sale and other revenue Year Ended December 31, 2004 2003 2002 $ 7,259 (2,779) $ 4,480 $ 7,529 2,779 $10,308 $ 6,970 (2,720) $ 4,250 $ 7,734 2,720... -

Page 22

...of available veriï¬able objective evidence of equipment fair value based on cash selling prices during the applicable period. The cash selling prices are compared to the range of values included in our lease accounting systems. The range of cash selling prices must be reasonably consistent with the... -

Page 23

...fair value at the end of the lease term and are established with due consideration to forecasted supply and demand for our various products, product retirement and future product launch plans, end of lease customer behavior, remanufacturing strategies, competition and technological changes. Accounts... -

Page 24

..., $364 million, and $168 million for the years ended December 31, 2004, 2003 and 2002, respectively. Pension cost is included in several income statement components based on the related underlying employee costs. Pension and post-retirement beneï¬t plan assumptions are included in Note 12 to the... -

Page 25

... and WorkCentre® Pro digital multifunction systems, DocuColor color multifunction products, color laser, solid ink and monochrome laser desktop printers, digital and light-lens copiers and facsimile products. The DMO segment includes our operations in Latin America, Central and Eastern Europe, the... -

Page 26

...utilizes next generation color technology which we expect will expand the digital color print on demand market. 2004 production monochrome equipment sales grew as light-production installations, driven by the success of the Xerox 2101 copier/printer and strong demand for the Xerox Nuvera 100 and 120... -

Page 27

..., WorkCentre and WorkCentre Pro systems, which were launched in the second quarter 2003, expand our market reach and include new entry-level conï¬gurations at more competitive prices. DMO: Equipment sales in DMO consist primarily of segment 1 devices and ofï¬ce printers. Equipment sales in 2004... -

Page 28

supplies and service revenue. DMO 2003 post sale and other revenue declined 14 percent from 2002, due largely to a lower rental equipment population at customer locations and related page volume declines. Other: 2004 post sale and other revenue declined 1 percent from 2003, as declines in SOHO were ... -

Page 29

... offset the impact of lower prices, higher pension and other employee beneï¬t costs and product mix. 2003 sales gross margin declined 0.9 percentage points from 2002, with over half of the decline due to Xerox iGen3 digital color production press ongoing engineering costs and the remainder due to... -

Page 30

... which are currently leased beyond 2008. Worldwide employment declined by approximately 3,000 in 2004, to approximately 58,100, primarily reï¬,ecting reductions as part of our restructuring programs. Worldwide employment was approximately 61,100 and 67,800 at December 31, 2003 and 2002, respectively... -

Page 31

... v. Retirement Income Guarantee Plan (RIGP) litigation. Legal and regulatory matters for 2002 includes $27 million of expenses related to certain litigation, indemniï¬cations and associated claims, as well as the $10 million penalty incurred in connection with our settlement with the SEC. Loss... -

Page 32

... the increase in equipment sale revenue in 2004, higher cash usage related to inventory of $100 million to support new product launches and increased tax payments of $46 million due to increased income. In addition, there was lower cash generation from the early termination of interest rate swaps of... -

Page 33

... in Xerox South Africa, XES France and Germany and other minor investments, partially offset by capital and internal use software spending of $250 million. Financing: Cash usage from ï¬nancing activities for the year ended December 31, 2004 of $1.3 billion included payments of scheduled maturities... -

Page 34

... and provide cash management services. With $3.2 billion of cash and cash equivalents on hand at December 31, 2004, borrowing capacity under our 2003 Credit Facility of $700 million (less $15 million utilized for letters of credit) and funding available through our secured funding programs, we... -

Page 35

...operations, cash on hand, capital markets offerings and securitizations. In the United States, Canada, the U.K., and France, we are currently funding a signiï¬cant portion of our customer ï¬nancing activity through secured borrowing arrangements with GE and Merrill Lynch. In The Netherlands, Spain... -

Page 36

... to fund our customers' purchases of our equipment and this could materially adversely affect our results of operations. We have the right at any time to prepay without penalty any loans outstanding under or terminate the 2003 Credit Facility. Capital Markets Offerings and Other: In August 2004, we... -

Page 37

... an information management contract with Electronic Data Systems Corp. ("EDS") to provide services to us for global mainframe system processing, application maintenance and support, desktop services and helpdesk support, voice and data network management, and server management. On July 1, 2004, we... -

Page 38

...type and amount of derivative hedges outstanding, as well as ï¬,uctuations in the currency and interest rate market during the period. We enter into limited types of derivative contracts, 36 including interest rate and cross currency interest rate swap agreements, foreign currency spot, forward and... -

Page 39

...At December 31, 2004, a 10 percent change in market interest rates would change the fair values of such ï¬nancial instruments by approximately $378 million. Forward-Looking Cautionary Statements This Annual Report contains forward-looking statements and information relating to Xerox that are based... -

Page 40

... (13) 876 15,265 2002 $ 6,752 8,097 1,000 15,849 4,233 4,494 401 917 4,437 670 - 593 15,745 Revenues Sales Service, outsourcing and rentals Finance income Total Revenues Costs and Expenses Cost of sales Cost of service, outsourcing and rentals Equipment ï¬nancing interest Research and development... -

Page 41

...,591 Assets Cash and cash equivalents Accounts receivable, net Billed portion of ï¬nance receivables, net Finance receivables, net Inventories Other current assets Total Current Assets Finance receivables due after one year, net Equipment on operating leases, net Land, buildings and equipment, net... -

Page 42

... and other charges Cash payments for restructurings Contributions to pension beneï¬t plans Early termination of derivative contracts (Increase) decrease in inventories Increase in on-lease equipment Decrease in ï¬nance receivables Decrease (increase) in accounts receivable and billed portion of... -

Page 43

...of tax Unrealized gains on cash ï¬,ow hedges, net of tax Comprehensive income Stock option and incentive plans, net Convertible securities Series B convertible preferred stock dividends ($10.94 per share), net of tax Equity for debt exchanges Other Balance at December 31, 2002 Net income Translation... -

Page 44

..., but not limited to: (i) allocation of revenues and fair values in leases and other multiple element arrangements; (ii) accounting for residual values; (iii) economic lives of leased assets; (iv) allowance for doubtful accounts; (v) inventory valuation; (vi) restructuring and related charges; (vii... -

Page 45

...FAS 123R eliminates the ability to account for share-based payments using Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees," and instead requires companies to recognize compensation expense using a fair-value based method for costs related to share-based payments... -

Page 46

... and services is recognized as follows: 44 Equipment: Revenues from the sale of equipment, including those from sales-type leases, are recognized at the time of sale or at the inception of the lease, as appropriate. For equipment sales that require us to install the product at the customer location... -

Page 47

... the contracts. A substantial portion of our products are sold with full service maintenance agreements for which the customer typically pays a base service fee plus a variable amount based on usage. As a consequence, other than the product warranty obligations associated with certain of our low end... -

Page 48

...are accounted for as direct ï¬nancing leases or operating leases, as appropriate. Cash and Cash Equivalents: Cash and cash equivalents consist of cash on hand, including money-market funds, and investments with original maturities of three months or less. Restricted Cash and Investments: Several of... -

Page 49

.../or obsolete service parts inventory is based primarily on projected servicing requirements over the life of the related equipment populations. Land, Buildings and Equipment and Equipment on Operating Leases: Land, buildings and equipment are recorded at cost. Buildings and equipment are depreciated... -

Page 50

... minute. Products include the Xerox iGen3 digital color production press, Xerox Nuvera, DocuTech, DocuPrint, Xerox 2101 and DocuColor families, as well as older technology lightlens products. These products are sold predominantly through direct sales channels in North America and Europe to Fortune... -

Page 51

products, color laser, solid ink and monochrome laser desktop printers, digital and light-lens copiers and facsimile products. These products are sold through direct and indirect sales channels in North America and Europe to global, national and mid-size commercial customers as well as government, ... -

Page 52

... amended to allow for the inclusion of state and local governmental contracts in future fundings. Under this agreement, GE funds a signiï¬cant portion of new U.S. lease originations at overcollateralization rates, which vary over time, but are expected to approximate 10 percent at the inception of... -

Page 53

.... Refer to Note 9 for further information on interest rates. New lease originations, including the bundled service and supply elements, are transferred to a wholly-owned consolidated subsidiary which receives funding from GE. The funds received under this agreement are recorded as secured borrowings... -

Page 54

... originate lease contracts directly with our customers. In these transactions, we sell and transfer title to the equipment to these ï¬nancial institutions and have no continuing ownership rights in the leased equipment subsequent to its sale. Accounts Receivable Funding Arrangement: In June 2004... -

Page 55

... at December 31, 2004. We have an information technology contract with Electronic Data Systems Corp. ("EDS") through June 30, 2009. Services to be provided under this contract include support of global mainframe system processing, application maintenance, desktop and helpdesk support, voice and data... -

Page 56

... have a lead time of three months. Purchases from and sales to Fuji Xerox for the three years ended December 31, 2004 were as follows: 2004 Sales Purchases $ 143 $1,135 2003 $ 129 $ 871 2002 $ 113 $ 727 In addition to the payments described above, in 2004, 2003 and 2002, we paid Fuji Xerox $27, $33... -

Page 57

... programs in the fourth quarter 2002. The provision consisted of $312 for severance and related costs, $45 of net costs associated with lease terminations and future rental obligations and $45 for asset impairments. The severance and related costs related to the elimination of approximately 4,700... -

Page 58

... on the liabilities. Major Cost Reporting: Cumulative amount incurred as of December 31, 2003 Severance and related costs Lease cancellation and other costs Asset impairments Total Provisions $483 51 45 $ 579 Amount incurred for the year ended December 31, 2004 $ 84 8 1 $ 93 Cumulative amount... -

Page 59

... relating to the 1997 sale of The Resolution Group ("TRG"). In addition to our net investment, Income taxes payable also includes amounts for tax liabilities associated with our discontinued operations. Ridge Re: We provide aggregate excess of loss reinsurance coverage (the "Reinsurance Agreement... -

Page 60

... were outstanding at December 31, 2004. Xerox is the only borrower of the term loan. The revolving credit facility is available, without sub-limit, to Xerox and certain foreign subsidiaries of Xerox, including Xerox Canada Capital Limited, Xerox Capital (Europe) plc and other qualiï¬ed foreign... -

Page 61

...three years ended December 31, 2004 follows: 2004 Cash (payments) proceeds on notes payable, net $ (6) Net cash proceeds from issuance of long-term debt (1) 974 Cash payments on long-term debt (2,390) $ (1,422) (1) Includes payment of debt issuance costs. 2003 $ 22 1,580 (5,646) $ 2002 (33) 1,053... -

Page 62

... as of December 31, 2004. As of December 31, 2004, the interest rates on these swaps ranged from approximately 5.28% to 5.68% and are based on the 6 month LIBOR rate plus an applicable margin. We have guaranteed (the "Guarantee"), on a subordinated basis, distributions and other payments due on the... -

Page 63

... those loans are ï¬xed. As a result, these funding arrangements create natural match funding of the ï¬nancing assets to the related debt. At December 31, 2004 and 2003, we had outstanding single currency interest rate swap agreements with aggregate notional amounts of $2.8 billion and $2.5 billion... -

Page 64

... Hedges: During 2004, pay ï¬xed/receive variable interest rate swaps with notional amounts of £200 million ($385) associated with the Xerox Finance Limited GE Capital borrowing were designated and accounted for as cash ï¬,ow hedges. The swaps were structured to hedge the LIBOR interest rate of the... -

Page 65

... remaining debt. These combined strategies converted the hedged cash ï¬,ows to U.S. dollar denominated payments and qualiï¬ed for cash ï¬,ow hedge accounting. During 2004 and 2003, certain forward contracts were used to hedge the interest payments on Euro denominated debt of $377. The derivatives... -

Page 66

... plan assets Employer contribution Plan participants' contributions Currency exchange rate changes Divestitures Beneï¬ts paid/settlements Fair value of plan assets, December 31 Funded status (including under-funded and non-funded plans) Unamortized transition assets Unrecognized prior service cost... -

Page 67

... an employee's work life, or (iii) the individual account balance from the Company's prior deï¬ned contribution plan (Transitional Retirement Account or "TRA"). Pension Beneï¬ts 2004 Components of Net Periodic Beneï¬t Cost Deï¬ned beneï¬t plans Service cost Interest cost (1) Expected return on... -

Page 68

...building block" approach in determining the long-term rate of return for plan assets. Historical markets are studied and long-term relationships between equities and ï¬xed income are assessed. Current market factors such as inï¬,ation and interest rates are evaluated before long-term capital market... -

Page 69

...a period of time. Berger Litigation: Our Retirement Income Guarantee Plan ("RIGP") represents the primary U.S. pension plan for salaried employees. In 2003, we recorded a $239 provision for litigation relating to the court approved settlement of the Berger v. RIGP litigation. The settlement is being... -

Page 70

Information relating to the ESOP trust for the three years ended December 31, 2004 follows: 2004 Dividends declared on Convertible Preferred Stock Cash contribution to the ESOP Compensation expense $15 - - 2003 $ 41 14 8 2002 $ 78 31 10 Note 13 - Income and Other Taxes Income (loss) before income ... -

Page 71

... of 2004 ("the Act"), we will reassess these plans. It is not practicable to estimate the amount of additional tax that might be payable on the foreign earnings. As a result of the March 31, 2001 disposition of one-half of our ownership interest in Fuji Xerox, the investment no longer qualiï¬ed as... -

Page 72

... speciï¬ed in the particular contract, which procedures typically allow us to challenge the other party's claims. In the case of lease guarantees, we may contest the liabilities asserted under the lease. Further, our obligations under these agreements and guarantees may be limited in terms of time... -

Page 73

... issue product warranties. Our arrangements typically involve a separate full service maintenance agreement with the customer. The agreements generally extend over a period equivalent to the lease term or the expected useful life under a cash sale. The service agreements involve the payment of fees... -

Page 74

...in possession of materially adverse, non-public information; and (iii) caused the individual plaintiffs and the other members of the purported class to purchase common stock of the Company at inï¬,ated prices. The amended consolidated complaint seeks unspeciï¬ed compensatory damages in favor of the... -

Page 75

..., it is not possible to estimate the amount of loss or range of possible loss that might result from an adverse judgment or a settlement of this matter. In Re Xerox Corp. ERISA Litigation: On July 1, 2002, a class action complaint captioned Patti v. Xerox Corp. et al. was ï¬led in the United States... -

Page 76

... investments in the Xerox Stock Fund in the Xerox 401(k) Plans (either salaried or union) during the proposed class period, May 12, 1997 through November 15, 2002, and allegedly exceeds 50,000 persons. The defendants include Xerox Corporation and the following individuals or groups of individuals... -

Page 77

... the individual defendants' own misconduct; and (iii) for the costs and disbursement of the action and such other relief as the court deems just and proper. On December 19, 2003, the Company and individual defendants moved to dismiss the complaint. On November 10, 2004, the Court issued an opinion... -

Page 78

... of contract and breach of ï¬duciary duty against KPMG. Additionally, plaintiffs claimed that KPMG is liable to Xerox for contribution, based on KPMG's share of the responsibility for any injuries or damages for which Xerox is held liable to plaintiffs in related pending securities class action... -

Page 79

...to their respective settlements with the SEC and related legal fees, and adding a demand for injunctive relief with respect to that indemniï¬cation. On September 12, 2003, Xerox and the individuals ï¬led an answer to the third consolidated and amended derivative action complaint. Discovery in this... -

Page 80

...related to the improper activities addressed by the report. The matter is now pending in the Indian Ministry of Company Affairs. The Company has reported these developments and furnished a copy of the portion of the report received by Xerox Modicorp Ltd. to the U.S. Department of Justice and the SEC... -

Page 81

... 21 6 $21 Stock Options 68,829 14,286 (5,668) (598) 76,849 45,250 2002 Average Option Price $ 29 10 34 5 $ 26 Employee Stock Options Outstanding at January 1 Granted Cancelled Exercised Outstanding at December 31 Exercisable at end of year Stock Options 97,839 11,216 (8,071) (9,151) 91,833 65,199... -

Page 82

..., with related preferred stock dividend requirements and outstanding common shares adjusted accordingly. It also assumes that outstanding common shares were increased by shares issuable upon exercise of those stock options for which market price exceeds the exercise price, less shares which could... -

Page 83

... a high rate of income tax. Italy Leasing Business: In April 2002, we sold our leasing business in Italy to a company now owned by GE for $200 in cash plus the assumption of $20 of debt. This sale is part of an agreement under which GE, as successor, provides ongoing, exclusive equipment ï¬nancing... -

Page 84

... electronics manufacturing services company. Under the agreements, Flextronics purchased related inventory, property and equipment. Pursuant to the purchase agreement, we sold our operations in Toronto, Canada; Aguascalientes, Mexico, Penang, Malaysia, Venray, The Netherlands and Resende, Brazil... -

Page 85

... For the Year Ended December 31, 2004 Parent Company Revenues Sales Service, outsourcing and rentals Finance income Intercompany revenues Total Revenues Cost and Expenses Cost of sales Cost of service, outsourcing and rentals Equipment ï¬nancing interest Intercompany cost of sales Research and... -

Page 86

... Assets Cash and cash equivalents Accounts receivable, net Billed portion of ï¬nance receivables, net Finance receivables, net Inventories Other current assets Total Current Assets Finance receivables due after one year, net Equipment on operating leases, net Land, buildings and equipment, net... -

Page 87

...Ended December 31, 2003 Parent Company Revenues Sales Service, outsourcing and rentals Finance income Intercompany revenues Total Revenues Cost and Expenses Cost of sales Cost of service, outsourcing and rentals Equipment ï¬nancing interest Intercompany cost of sales...61 - $ 673 Eliminations $ (60) (... -

Page 88

... Assets Cash and cash equivalents Accounts receivable, net Billed portion of ï¬nance receivables, net Finance receivables, net Inventories Other current assets Total Current Assets Finance receivables due after one year, net Equipment on operating leases, net Land, buildings and equipment, net... -

Page 89

...the Year Ended December 31, 2002 Parent Guarantor Non-Guarantor Company Subsidiaries Subsidiaries Revenues Sales Service, outsourcing and rentals Finance income Intercompany revenues Total Revenues Cost and Expenses Cost of sales Cost of service, outsourcing and rentals Equipment ï¬nancing interest... -

Page 90

...are not expected to be material. Our investment in Integic is currently accounted for on the equity method and is included in Investments in afï¬liates, at equity in our consolidated balance sheets. Integic is an information technology provider specializing in enterprise health and business process... -

Page 91

... as of December 31, 2004 has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting ï¬rm (independent auditors), as stated in their report which is included herein. Anne M. Mulcahy Chief Executive Ofï¬cer Lawrence A. Zimmerman Chief Financial Ofï¬cer Gary... -

Page 92

...and the results of their operations and their cash ï¬,ows for each of the three years in the period ended December 31, 2004 in conformity with accounting principles generally accepted in the United States of America. These ï¬nancial statements are the responsibility of the Company's management. Our... -

Page 93

...and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the ï¬nancial statements. Because of its inherent limitations, internal control over ï¬nancial reporting may... -

Page 94

...and $120 for the ï¬rst, second, third and fourth quarters of 2003, respectively. Costs and expenses include a gain of $38 from the sale of our investment in ScanSoft in the second quarter of 2004. Cost and expenses include a provision relating to the Berger v. Retirement Income Guarantee Plan (RIGP... -

Page 95

... per common share Year-end common stock market price Employees at year-end Gross margin Sales gross margin Service, outsourcing, and rentals gross margin Finance gross margin Working capital Current ratio Cost of additions to land, buildings and equipment Depreciation on buildings and equipment $15... -

Page 96

...Systems Group Business Group Operations Emerson U. Fullwood Vice President Chief of Staff and Marketing Xerox North America D. Cameron Hyde Vice President General Manager North American Agent Operations Xerox North America Gary R. Kabureck Vice President and Chief Accounting Ofï¬cer James H. Lesko... -

Page 97

... Ofï¬cer Xerox Corporation Stamford, Connecticut N. J. Nicholas, Jr. 1, 4 Investor New York, New York John E. Pepper 1, 2 Vice President Finance and Administration Yale University New Haven, Connecticut Retired Chairman and Chief Executive Ofï¬cer The Procter & Gamble Company Cincinnati, Ohio Ann... -

Page 98

... may contact: Darlene Caldarelli, Manager, Investor Relations [email protected] Ann Pettrone, Manager, Investor Relations Ann [email protected] Additional Information The Xerox Foundation and Community Involvement Program: 203 968-3333 Diversity programs and EEO-1 reports: 585... -

Page 99

... year and saved Xerox several hundred million dollars through remanufacturing and parts reuse. • Xerox encourages employees to volunteer in their communities through programs like Social Service Leave, which offers paid sabbaticals for community service; the Community Involvement Program, which... -

Page 100

Xerox Corporation 800 Long Ridge Road PO Box 1600 Stamford, CT 06904 www.xerox.com 2980-AR-04