Volvo 1998 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

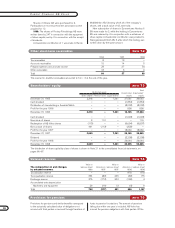

Volvo Group Volvo Cars

Net sales 212.9 103.8

Operating income 19.0 3.8

Operating margin, % 14.2 3.7

1 Excluding items affecting comparability.

91

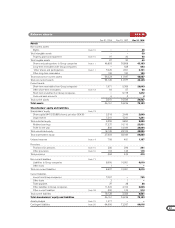

Pro forma balance sheet and key ratios

The pro forma balance sheet shows the position of the

Volvo Group as of December 31, 1998, adjusted to

reflect the effects of the divestment of Volvo Cars (see

pages 6-8). The purpose of the pro forma balance sheet

is to illustrate the immediate effects on the consolidated

financial position due to the divestment of Volvo Cars.

The capital gain for accounting purposes on the sale

amounts to SEK 26.2 billion. The sale reduces the

operating capital in the Volvo Group by SEK 18.3 billion

and increases net financial assets by SEK 46.7 billion.

Total assets within sales-financing operations is being

reduced by SEK 35.7 billion.

Further adjustments are reclassifications of receiv-

ables and liabilities between Volvo Cars and other Volvo

Group companies.

VOLVO GROUP AFTER THE DIVESTMENT OF VOLVO CARS

Pro forma

Volvo Group

Volvo Group Divestment of after divestment

Dec 31 1998 Volvo Cars Adjustments and adjustment

Assets

Intangible non-current assets 5.8 0.0 0.0 5.8

Tangible non-current assets 58.5 30.6 0.2 28.1

Financial non-current assets 35.1 16.6 11.0 29.5

Inventories 32.1 11.3 0.0 20.8

Short-term receivables 52.7 30.6 32.1 54.2

Marketable securities 7.2 0.0 – 7.2

Cash and bank accounts 13.0 7.1 39.6 45.5

Total assets 204.4 96.2 82.9 191.1

Shareholders' equity and liabilities

Shareholders' equity168.1 18.8 39.1 88.4

Minority interests 0.9 0.1 – 0.8

Provisions 28.1 12.9 6.2 21.4

Loans 64.2 37.2 28.3 55.3

Other liabilities 43.1 27.2 9.3 25.2

Shareholders' equity and liabilities 204.4 96.2 82.9 191.1

Net financial assets/liabilities 14.8 (0.9) 45.8 61.5

1 Since the definitive tax effect of the sale cannot yet be calculated,

a standard rate of 28% is applied to the accounting gain in the

pro forma balance sheet.

Volvo Group pro forma balance sheet SEK billion

Key ratios 1998 SEK billion