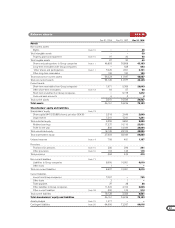

Volvo 1998 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

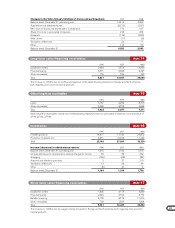

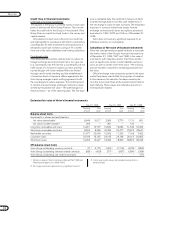

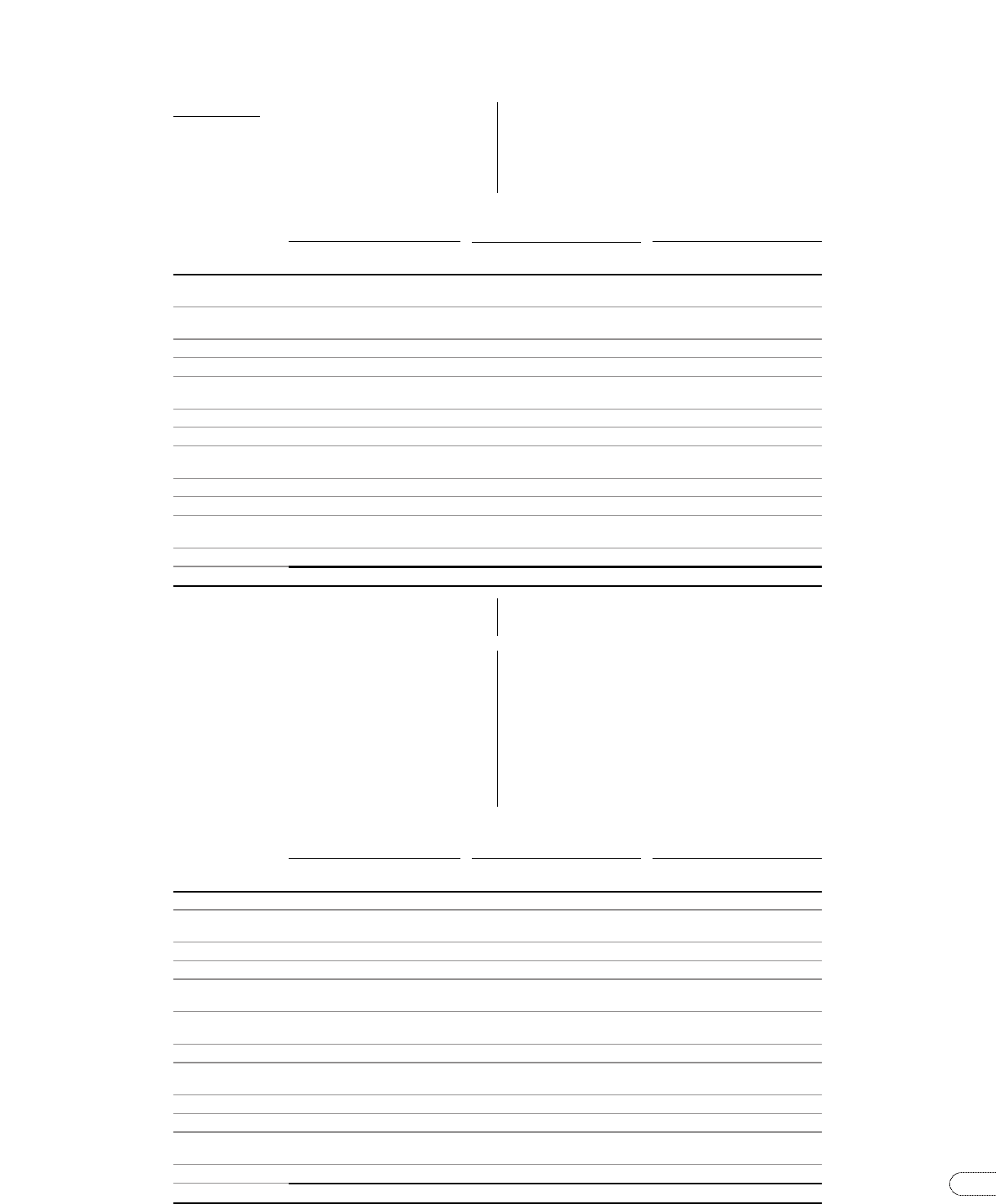

Total outstandning currency contracts

December 31 1996 December 31 1997 December 31 1998

Notional Carrying Estimated Notional Carrying Estimated Notional Carrying Estimated

amount amount fair value amount amount fair value amount amount fair value

Foreign exchange

contracts

– receivable

position 56,238 15 3,492 40,349 248 2,006 71,381 145 2,189

– payable position 50,303 (4) (1,477) 84,591 (447) (3,762) 93,215 (491) (3,524)

Foreign exchange swaps

– receivable

position 83,301 4 2,623 27,268 — 1,416 27,568 57 865

– payable position 81,565 (1) (2,517) 26,045 — (1,604) 32,491 (384) (880)

Options - purchased

– receivable

position 11,163 33 1,075 5,135 — 379 4,745 — 193

– payable position 34 — — 4,156 — (147) 324 — (5)

Options – written

– receivable

position — — — 2,080 — 57 2,867 — 38

– payable position 5,806 — (17) 4,274 — (61) 3,147 — (42)

Total 47 3,179 (199) (1,716) (673) (896)

The notional amount of the derivative contracts represents the

gross contract amount outstanding. To determine the estimated

fair value, the major part of the outstanding contracts have been

marked-to-market. Discounted cash flows has been used in

some cases.

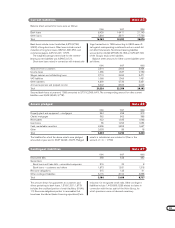

Interest-rate risks

Interest-rate risks relate to the risk that changes in interest-

rate levels affect the Group’s profit. By matching fixed-

interest periods of financial assets and liabilities, Volvo

reduces the effects of interest-rate changes. Interest-

rate swaps are used to shorten the interest-rate periods

of the Group’s long-term loans. Exchange-rate swaps

make it possible to borrow in foreign currencies in differ-

ent markets without incurring currency risk.

Volvo also holds standardized futures and forward rate

agreements. The majority of these contracts are used to

secure interest levels for short-term borrowing or placement.

Liquidity risks

Volvo ensures maintenance of a strong financial position

by continuously keeping a certain percentage of sales in

liquid assets. A proper balance between short- and long-

term borrowing, as well as the ability to borrow in the

form of credit facilities, are designed to ensure longer-

term financing.

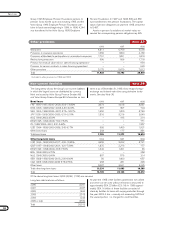

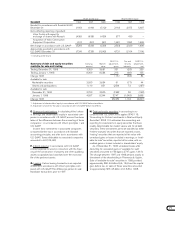

Volvo Group outstanding interest related contracts

December 31 1996 December 31 1997 December 31 1998

Notional Carrying Estimated Notional Carrying Estimated Notional Carrying Estimated

amount amount fair value amount amount fair value amount amount fair value

Interest-rate swaps

– receivable

position 10,349 — 335 20,322 9 875 14,705 10 497

– payable position 15,416 (34) (462) 28,142 (25) (1,760) 32,775 (240) (639)

Forwards and futures

– receivable

position 153,553 — 303 165,186 — 435 240,245 — 1,781

– payable

position 170,670 — (550) 190,866 (17) (465) 262,968 (54) (1,855)

Options purchased, caps and floors

– receivable

position 727 1 3 521 — 2 — — —

– payable position 8 (8) (8) 159 — — — — —

Options written, caps and floors

– receivable

position 300 — — — — — — — —

– payable position 88 (44) (44) 88 (44) (44) 420 (50) (50)

Total (85) (423) (77) (957) (334) (266)

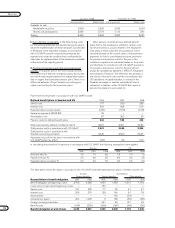

Equity exposure

In conjunction with translation of the Group’s assets and

liabilities in foreign subsidiaries to Swedish kronor, a risk

arises that the currency rate will have an effect on the

consolidated balance sheet. In accordance with the

Group’s currency policy, net investments (shareholders’

equity) in foreign subsidiaries and associated companies

are hedged up to 50%. Hedging is mainly done through

borrowing in the same currency as the net investments.

At year-end 1998, net assets in subsidiaries and as-

sociated companies outside Sweden amounted SEK

28 billion, of which 12% was hedged.