Volvo 1998 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

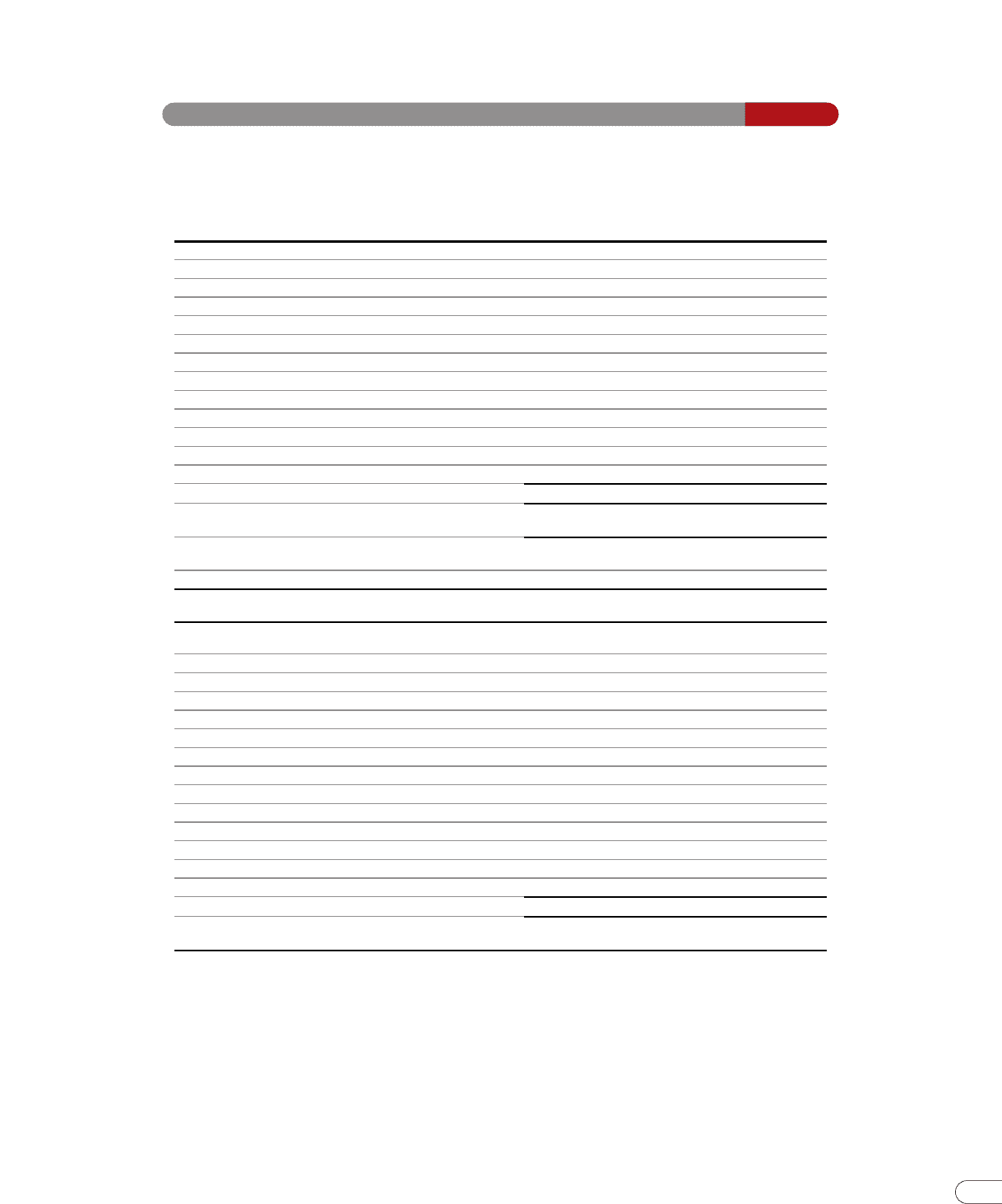

A summary of the Volvo Group’s approximate profit for the year and shareholders’ equity determined in accordance

with U.S. GAAP, is presented in the accompanying tables.

Application of U.S. GAAP would have the following approximate effect on consolidated profit for the year and share-

holders’ equity:

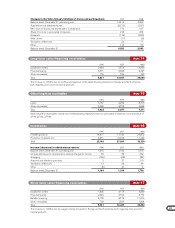

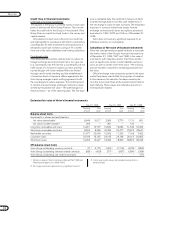

Profit for the year 1996 1997 1998

Profit for the year in accordance with Swedish accounting principles 12,477 10,359 8,638

Items increasing (decreasing) reported profit for the year

Foreign currency translation (A) (89) (4,994) 535

Income taxes (B) 494 122 (201)

Tooling costs (C) (312) — —

Business combinations (D) (529) (529) (530)

Shares and participations (E) 176 — 90

Interest costs (F) 15 28 20

Leasing (G) 49 46 (118)

Debt and equity securities (H) (147) 123 116

Items affecting comparability (I) — — 1,178

Pensions and other post-employment benefits (J) (95) 65 313

Tax effect of above U.S. GAAP adjustments 178 1,336 (609)

Net increase (decrease) in profit for the year (260) (3,803) 794

Approximate profit for the year

in accordance with U.S. GAAP 12,217 6,556 9,432

Approximate profit for the year per share,

SEK in accordance with U.S. GAAP 26.40 14.50 21.40

Weight average number of shares outstanding (in thousands) 463,558 452,540 441,521

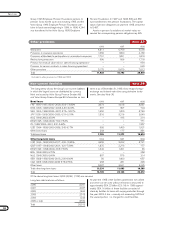

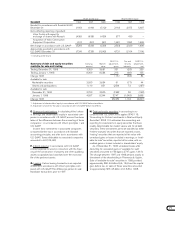

Shareholders’ equity 1996 1997 1998

Shareholders’ equity in accordance with

Swedish accounting principles 57,876 60,431 68,056

Items increasing (decreasing) reported shareholders’ equity

Foreign currency translation (A) 3,660 (1,163) (628)

Income taxes (B) 1,398 1,520 1,319

Tooling costs (C) — — —

Business combinations (D) 2,558 2,029 1,499

Shares and participations (E) (90) (90) —

Interest costs (F) 503 531 551

Leasing (G) (91) (51) (177)

Debt and equity securities (H) 1,604 3,962 133

Items affecting comparability (I) — — 1,178

Pensions and other post-employment benefits (J) 786 851 1,548

Other (203) (224) (226)

Tax effect of above U.S. GAAP adjustments (1,726) (1,184) (774)

Net increase in shareholders’ equity 8,399 6,181 4,423

Approximate shareholders’ equity

in accordance with U.S. GAAP 66,275 66,612 72,479

Profit for the year and Shareholders’ equity in accordance with U.S. GAAP Note 31