Volvo 1998 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

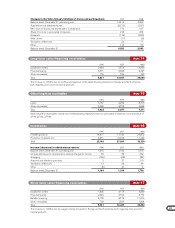

59

to SEK 0.2 billion, which is being amortized over 20

years, arose in connection with the acquisition. In 1998

BTM Capital, a wholly owned subisdiary of Bank of

Tokyo-Mitsubishi Ltd, aquired 5% in AGES, which meant

a decrease to 57% regarding Volvo Aero’s ownership.

Volvo Car Finance Holding AB

At year-end 1995 Volvo Car Corporation established a

wholly owned subsidiary, Volvo Car Finance Holding AB,

to coordinate the sales-financing operations within Volvo

Car Corporation. The company is the parent company of

some of Volvo Cars’ sales-financing and insurance com-

panies in Europe and Australia.

Volvo Rahoitus Suomi Oy (former Devoco Oy)

In 1996 Volvo Car Corporation acquired 50% of the share

capital of Volvo Rahoitus Oy, following which Volvo Car

Corporation’s holding amounts to 75%. The remaining

25% is held by Volvo Truck Finance Holding. The com-

pany finances transactions involving both cars and trucks

in Finland.

Volvo India PVT Ltd

In 1996, Volvo India PVT Ltd was formed, a wholly owned

company by Volvo Truck Corporation. In June 1998 a

plant was opened and will eventually have a production

capacity of 4,000 trucks a year.

Volvo Truck Latvia S/A

Volvo Truck Latvia S/A was formed in 1996. The com-

pany, which is wholly owned by Volvo Truck Corporation,

markets trucks in Latvia.

Volvo Pakistan Ltd

Volvo Pakistan Ltd., in which Volvo Truck Corporation

holds a 51% interest, was formed in 1996. The company

manufactures trucks and is responsible for sales in

Pakistan.

Volvo Austria GmbH

In November 1996 Volvo Bus Corporation acquired the

remaining 25% shareholding in Steyr Bus GmbH from

Steyr-Daimler-Puch Ag. The company, whose name was

changed to Volvo Austria GmbH on January 1, 1997, is

owned 100% by Volvo Bus Corporation. Effective in

January 1997, the new distribution structure in Austria

was coordinated in Volvo Austria. As part of the new

structure, Volvo took over Denzel’s importer operations in

Austria and is integrating them with its European marke-

ting and distribution network for cars, trucks and buses.

Fortos Fastigheter AB

In 1996 all of the shares of Fortos Fastigheter AB were

sold to Fabege AB. The sale resulted in a capital gain of

SEK 39 million. In addition, Volvo received newly issued

Fabege shares.

Swedish Match AB

As approved at Volvo’s Annual General Meeting on April

24, 1996, all the shares of the wholly owned subsidiary

Swedish Match AB were distributed to Volvo’s share-

holders in May 1996.

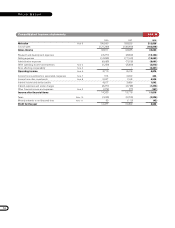

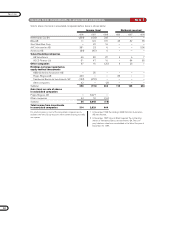

Net sales per business and market area are shown in tables on page 12.

Other operating expenses include losses on forward and

options contracts of 640 (1,180; gain of 1,100).

Amortization of goodwill and provision for bonuses to

employees amounting to 338 (196; 195) and 160 (231;

300), respectively, are included in Other operating

expenses.

Operating income in 1998 was charged with items

affecting comparability amounting to 2,331 (–; –) pertain-

ing to the approved restructuring aimed at adapting the

industrial structure and the distribution and market

organizations. Approximately 1,300 of the total amount

is attributable to contractual pensions and excess person-

nel, approximately 600 to writedowns of assets, 348 in

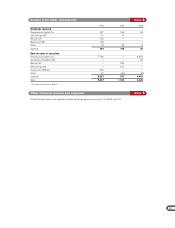

1996 1997 1998

Intangible assets 266 253 574

Property, plant and equipment 4,247 4,731 5,753

Assets under operating leases 838 1,812 3,299

Total 5,351 6,796 9,626

Operating income excluding items affecting comparability

by business area is shown in a table on page 13.

Depreciation is included in operating income and is spe-

cified by type of asset as shown below:

capital gain on the sale of Trucks’ rear-axle plant in

Lindesberg and the remainder, approximately 800, to

other restructuring costs. Cars accounted for 681 of the

costs, Trucks for 46, Buses 422, Construction Equipment

910, Marine and Industrial Engines 158 and other op-

erations for 114.

Net sales Note 3

Other operating income and expenses Note 4

Items affecting comparability Note 5

Operating income Note 6