Volvo 1998 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

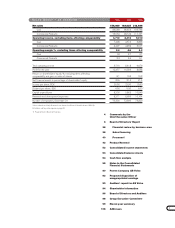

The financial year 1998

During 1998, several strategic acquisitions and structural transactions

were carried out within the Volvo Group. Sales development was

favorable and increased, also excluding acquisitions, in all business

areas. The year was characterized by product renewal, including the

Volvo S80, the Volvo FM truck series, the Volvo 5000 and 7000 city

buses and a new generation of compact wheel-loaders.

Unsatisfactory profitability forced actions to reduce costs.

The financial turbulence that caused major economic and political problems in

a number of Southeast Asian countries continued in a negative spiral in 1998,

resulting in lower production, rising unemployment and low private consump-

tion in the region. Also in Japan the financial situation worsened during the

latter part of the year, despite massive stimulus packages and the establishment

of governmental emergency banking measures. Also the Western world was

affected, primarily in industries that experienced fewer exports to Asia and stiff-

ening competition in domestic markets as a result of the devaluations of Asian

currencies. At the beginning of 1999, the Brazilian currency was also devaluated

which could mean that several Latin American currencies will come under

pressure, with the risk of a recession in the region during 1999.

GDP rose in Western Europe by 3% during 1998. Interest rates fell, employ-

ment improved and stock exchanges recovered, which combined contributed to

stronger private consumption. Profit levels in export industries weakened as

a result of the Asian crisis.

The private sector in the US was characterized by high consumption, despite

signs of weakened income and employment trends. Inflation continued to

decline and interest rates were reduced further. GDP increased by 4% but the

growth softened towards year-end.

Despite the Asian crisis, the transport-vehicle industry experienced good

growth during the first half of 1998. During the latter part of the year, when the

financial crisis became more pervasive than expected, the increase in demand for

the year as a whole slackened, declining 3% in the passenger car market. The

global demand for trucks stagnated, but at an historically high level.

Increased integration and acquisitions

in the field of commercial products

The market’s demand for complete transportation solutions, new technologies

and uniform legal requirements results in increasing integration in the commercial

vehicles industry. Concurrently, a heavy concentration is under way in the

industry and in the customer segment. This creates opportunities for Volvo to

participate in the structural transformation of the industry through acquisitions

and to secure its position through improved efficiency based on synergy gains

among the Trucks, Buses, Construction Equipment and Marine and Industrial

Engines business areas.