Volvo 1998 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

NOTE S

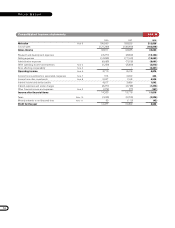

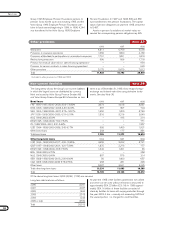

Taxes Note 10

Income after financial items was distributed as follows:

1996 1997 1998

Sweden 10,476 8,828 7,089

Outside Sweden 3,437 4,464 4,070

Share of income of associated companies 290 (116) 460

Total 14,203 13,176 11,619

Tax expenses was distributed as follows:

1996 1997 1998

Current taxes:

Sweden (615) (133) (975)

Outside Sweden (1,532) (2,145) (1,553)

Subtotal (2,147) (2,278) (2,528)

Deferred taxes:

Sweden 574 (366) (72)

Outside Sweden (184) 42 (279)

Subtotal 390 (324) (351)

Associated companies (68) (103) (60)

Total taxes (1,825) (2,705) (2,939)

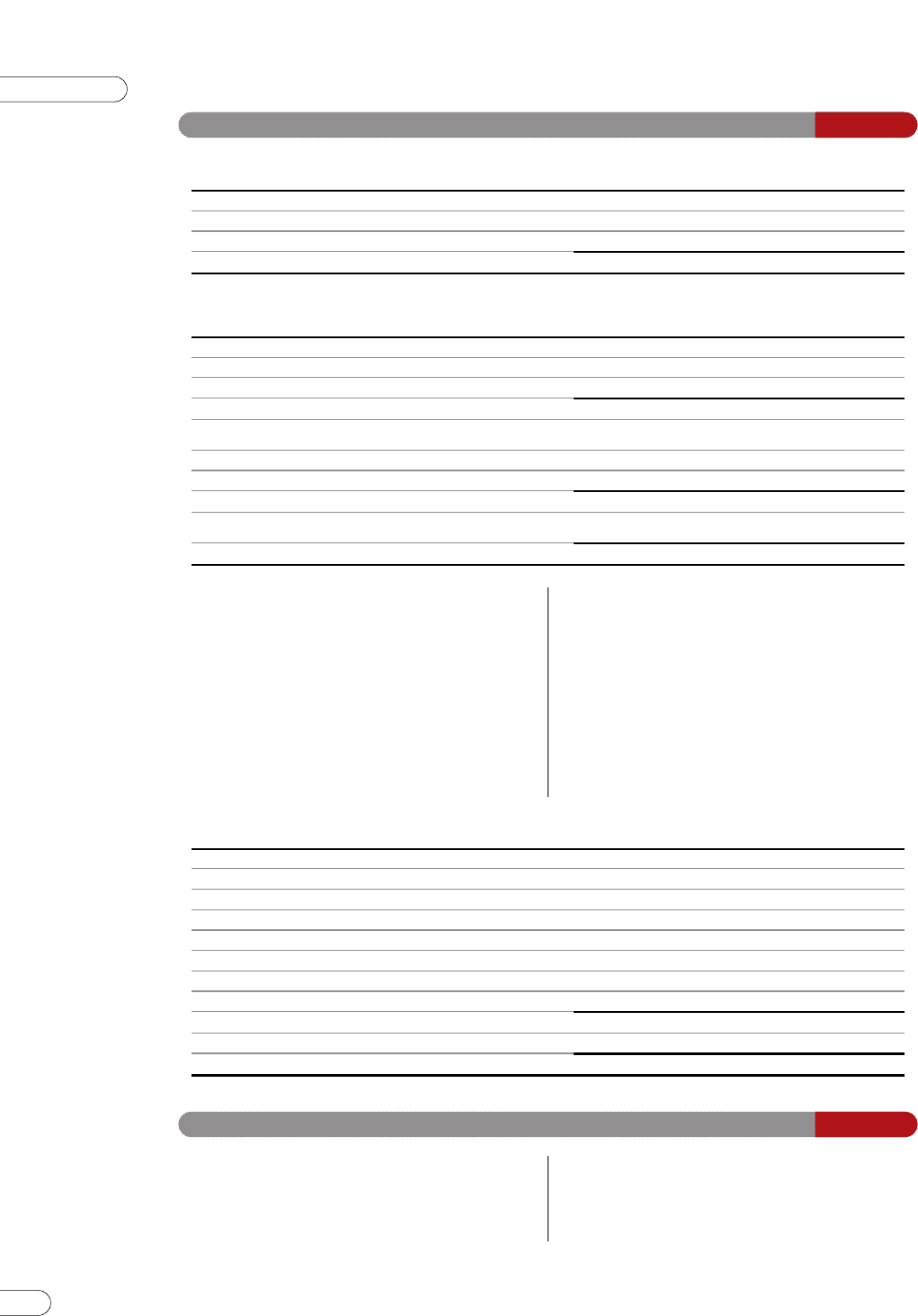

Tax expense pertains mainly to current taxes in Swedish

as well as in foreign companies.

Provision has been made for estimated tax charges

that may arise as a result of prior tax audits in the Volvo

Group. Claims for which no provision has been deemed

necessary are equal to an expense of approximately

1,442 (699; 528). This amount is included among con-

tingent liabilities.

Deferred taxes pertain mainly to an estimated tax on

the change in untaxed reserves, taking into account tax-

loss carryforwards and temporary differences.

At December 31, 1998, the Group had tax-loss carry-

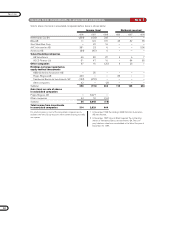

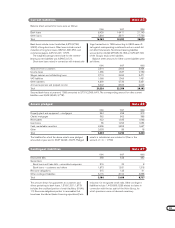

1996, % 1997, % 1998, %

Swedish corporate income tax rate 28 28 28

Difference in tax rate in various countries 1 2 4

Capital gains (losses) (22) (13) (8)

Utilization of tax-loss carryforwards (4) (2) (2)

Losses for which no benefit has been recognized 8 2 3

Non-deductable expenses 3 2 1

Amortization of goodwill 0 0 1

Other, net (1) 1 (1)

Tax rate for the Group, excluding equity method 13 20 26

Equity method 0 1 (1)

Tax rate for the Group 13 21 25

forwards amounting to approximately 3,000. Of this

amount, approximately 500 has been recognized in cal-

culating deferred tax liabilities.

Tax-loss carryforwards amounting to approximately

2,500 can thus be utilized to reduce tax expense in futu-

re years. Of this amount, 500 expires within five years.

Tax-loss carryforwards in Sweden are not restricted

time-wise.

The Swedish corporate income tax rate is 28%. The

table below shows the principal reason for the difference

between this rate and the Group’s tax rate, based on

income after financial items.

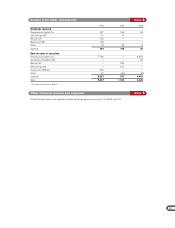

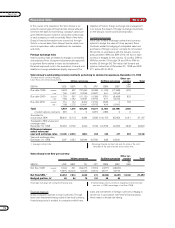

Minority interests in profit (loss) and in equity consist

mainly of Henlys Group’s participation in Prévost Car Inc

and Nova BUS Corp (49%) and the minority interests in

The AGES Group, ALP (43%). Up to and including

September 1998 minority interests in profit (loss) also

included Hitachi Construction Machinery Company’s par-

ticipation in Euclid-Hitachi Heavy Equipment Inc (40%),

and up to and including June 1997, General Motors’ hol-

ding in Volvo Trucks North America Inc (13%).

Minority interests Note 11