Volvo 1998 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

Projected benefit obligation, accumulated obligation and

fair value of plan assets for the pension plans with accu-

mulated benefit obligation in excess of plan asset were

147, 171 and 48 at December 1998 and 67, 111 and 0

at December 1997.

Other post-retirement benefit plans

In addition to its pension plans, the Company and certain

of its subsidiaries and associated companies sponsor

unfunded plans, mainly in the U.S., to provide health care

and other benefits for retired employees who meet min-

imum age and service requirements. The plans are gener-

ally contributory, with retiree contributions being adjusted

periodically, and contain other cost-sharing features such

as deductibles and coinsurance. The estimated cost for

health-care benefits is recognized on an accrual basis in

accordance with the requirements of SFAS 106,

"Employers’ Accounting for Postretirement Benefits

Other than Pensions."

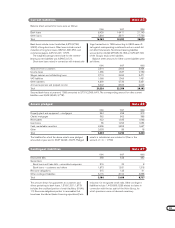

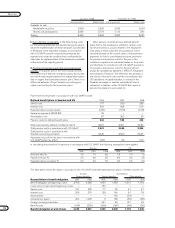

The net post-retirement benefit expenses include the following components:

1996 1997 1998

Benefits earned during the year 44 42 46

Interest expense 87 97 77

Reported insurance profits and losses (2) (4) 12

Costs attributable to restructuring 25 1 –

Net post-retirement benefit expenses 154 136 135

A change of one percentage point per year in health-

care costs would change the accumulated post-retire-

ment benefit obligation as of December 31, 1997 by

approximately 189, and the net postretirement benefit

expense by approximately 20. In 1998, an increase of

1% would increase the accumulated value of obligations

by about 189 and increase costs by about 19; a decrease

of 1% would reduce the accumulated value of obligations

by about 156 and cut costs by about 18.

Calculations made as of December 31, 1998 show an

annual increase of 9.5% in the weighted average per

capita costs of covered healt-care benefits; it is assumed

that the percentage will decline gradually to 6.0% in

2005 and then remain at that level.

The discount rate used in determining the accumulat-

ed postretirement benefit obligation as of December 31,

1998 was 6.75 % (7.0; 7.5).

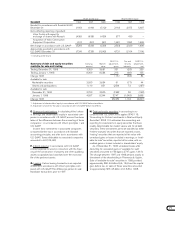

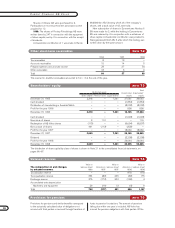

Supplementary U.S. GAAP information

Classification. In accordance with SFAS 95, “cash and

cash equivalents” comprise only funds with a maturity of

three months or less. Some of Volvo’s liquid funds (see

Notes 19 and 20) do not meet this requirement.

Consequently, in accordance with SFAS 95, changes in

this portion of liquid funds should be reported as invest-

ment activities.

Cash flow analysis. Actual interest and taxes paid

during 1998 amounted to 3,897 (3,943; 3,944) and

2,485 (1,454; 2,569).

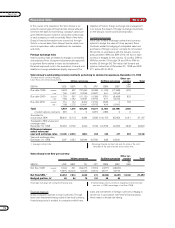

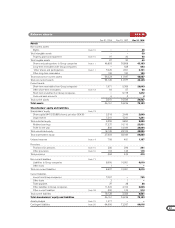

Sweden United States

Pension benefits Pension benefits Other benefits

Fair value of plan assets 11997 1998 1997 1998 1997 1998

Fair value of plan assets at beginning of year 4,287 4,859 1,408 1 ,951 – –

Lump sums not yet paid at beginning of year – – 132 (3) – –

Market value adjustment – – (16) – – –

Actual return on plan assets 203 348 336 272 – –

Employer contribution 369 312 146 77 – –

Foreign exchange translation – – 205 48 – –

Benefits paid – – (260) (145) – –

Fair value of plan assets at end of year 4,859 5,519 1 ,951 2 ,200 – –

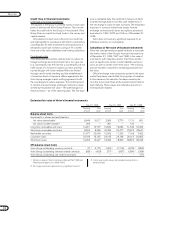

Sweden United States

Pension benefits Pension benefits Other benefits

Funded status 1997 1998 1997 1998 1997 1998

Funded status 591 (37) (34) (180) (1,154) (1,238)

Unrecognized actuarial loss (gain) 629 1,028 50 87 (107) (136)

Unrecognized transition (asset) obligation (166) (141) – – 288 276

Unrecognized prior service cost – 608 44 177 – –

Adjustment to minimum liability (631) – – (3) – –

Net amount recognized 423 1 458 60 81 (973) (1,098)

1 Assets in pension funds, estimated at fair value.