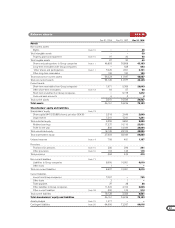

Volvo 1998 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

NOTE S

Other cur-

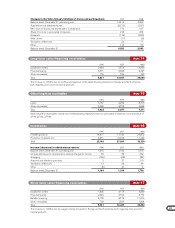

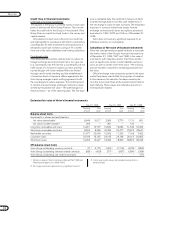

Inflow currencies Outflow currencies rencies Total

Net

SEK M USD GBP ITL JPY DEM BEF SEK

Due date 1999 amount 2,434 497 757,690 20,085 (1,109) (17,298) 1,232

rate17.69 12.43 0.0045 0.0697 4.61 0.2163

Due date 2000 amount 1,759 367 191,150 19,286 (731) (8,498) 823

rate17.84 12.62 0.0047 0.0705 4.71 0.2244

Due date 2001 amount 761 154 8,400 14,700 (309) 0 793

rate 17.98 12.75 0.0047 0.0733 4.94 0.0000

Total 4,954 1,018 957,240 54,071 (2,149) (25,796) 2,848

of which options contracts 345 0 0 9,974 (183) 0 0

Translated to

actual value, SEK238,619 12,713 4,330 4,038 (10,172) (5,562) 3,141 47,107

Translated to SEK at year-end

exchange rates,

December 31, 1998 39,954 13,763 4,690 3,785 (10,378) (6,039) 2,848 48,623

Difference between

actual value and

year-end exchange rates (1,335) (1,050) (360) 253 206 477 293 (1,516)

Year-end exchange rates,

December 31, 1998 8.07 13.52 0.0049 0.0700 4.83 0.2341

1 Average contract rate 2 Average forward contract rate and, for options, the most

favorable of the year-end rate and contract rate.

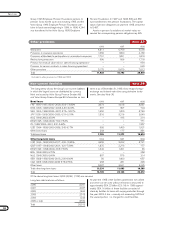

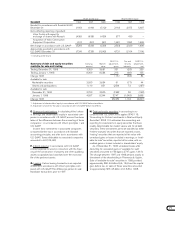

Volvo Group’s net flow per currency

Other cur-

Inflow currencies Outflow currencies rencies Total

Net

SEK M USD GBP ITL JPY DEM BEF SEK

Net flow 1998 amount 3,044 591 999,975 13,302 (1,877) (28,630)

rate37,9676 13,2215 0,0046 0,0610 4,5317 0,2196

Net flow SEK, 324,253 7,814 4,600 811 (8,506) (6,287) (1,232) 21,453

Hedged portion, % 480 84 76 151 59 60

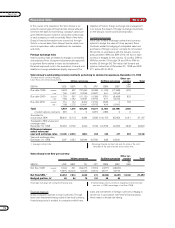

In the course of its operations the Volvo Group is ex-

posed to various types of financial risks. Group-wide pol-

icies form the basis for each Group company’s action pro-

gram. Monitoring and control is conducted continuously

in each company as well as centrally. Most of the Volvo

Group’s financial transactions are carried out through

Volvo’s in-house bank, Volvo Group Finance, which con-

ducts its operations within established risk mandates

and limits.

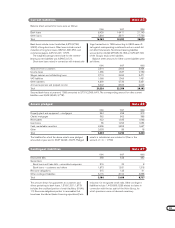

Foreign exchange risks

Volvo’s currency risks are related to changes in contracted

and projected flows of payments (commercial exposure),

to payment flows related to loans and investments

(financial exposure), and to the revaluation of assets and

liabilities in foreign subsidiaries (equity exposure). The

objective of Volvo’s foreign exchange risk management

is to reduce the impact of foreign exchange movements

on the Group’s income and financial position.

Commercial exposure

Volvo uses forward exchange contracts and currency

options to hedge the value of future payment flows.

Contracts related to hedging of anticipated sales and

purchases of foreign currency normally do not exceed

36 months. In accordance with the Group’s currency

policy, between 40% and 80% of the net flow in each

currency is hedged for the coming 12 months, 20% to

60% for months 13 through 24 and 0% to 40% for

months 25 through 36. The value of all forward and

options contracts as of December 31, 1998 was SEK

47.1 billion (51.9; 40.2).

3 Average exchange rate during the financial year. 4 Outstanding currency contracts, regarding commercial expo-

sure due in 1999, percentage of net flow 1998.

Volvo Group’s outstanding currency contracts pertaining to commercial exposure, December 31, 1998

The table shows contracts hedging

future flows of commercial payments.

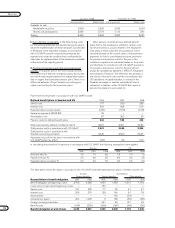

Financial exposure

Group companies operate in local currencies. Through

loans and investments being mainly in the local currency,

financial exposure is avoided. In companies which have

loans and investments in foreign currencies, hedging is

carried out in accordance with Volvo’s financial policy,

which means a limited risk-taking.

Financial risks Note 30