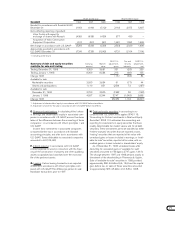

Volvo 1998 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

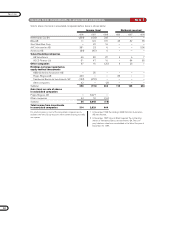

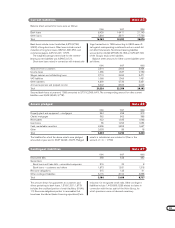

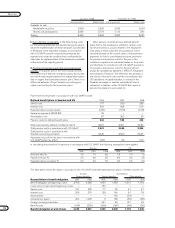

Balance sheet amounts for loans were as follows:

1996 1997 1998

Bank loans 8,429 14,411 21,143

Other loans 5,834 3,871 17,733

Total 14,263 18,282 38,876

Bank loans include current maturities, 4,379 (2,748;

2,082), of long-term loans. Other loans include current

maturities of long-term loans, 3,825 (1,498; 651), and

commercial papers, 9,472 (1,291; 1,757).

The weighted average interest rate for the interest-

bearing current liabilities was 6.5% (5.0; 5.1).

Short-term loans raised in connection with interest arbi-

trage transactions in 1996 amounting to 2,893 were off-

set against corresponding investments and as a result did

not affect total assets. Noninterest-bearing liabilities

accounted for 42,499 (37,595; 32,189), or 52% (67; 69)

of the Group’s total current liabilities.

Balance sheet amounts for Other current liabilities were

as follows:

1996 1997 1998

Advances from customers 2,514 2,603 3,464

Income taxes 1,436 1,637 2,739

Wages, salaries and withholding taxes 3,710 3,690 3,471

VAT liabilities 1,068 1,366 1,431

Other liabilities 4,899 4,736 5,451

Accrued expenses and prepaid income 6,602 8,306 9,626

Total 20,229 22,338 26,182

Secured bank loans at year-end 1998 amounted to 3,731 (2,369; 641). The corresponding amount for other current

liabilities was 3,048 (4,563; 2,778).

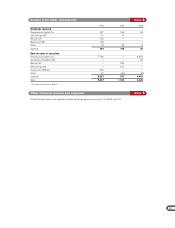

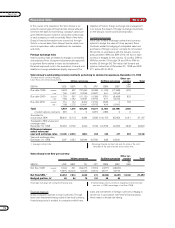

1996 1997 1998

Property, plant and equipment – mortgages 544 298 313

Chattel mortgages 362 862 388

Receivables 922 1,335 1,948

Inventories 36 1,266 1,054

Cash, marketable securities 2,636 2,893 1,667

Other 2,003 89 18

Total 6,503 6,743 5,388

The liabilities for which the above assets were pledged

amounted at year-end to 6,567 (9,924; 4,527). Pledged

assets in subsidiaries are included in Other in the

amount of — (— ; 1,750).

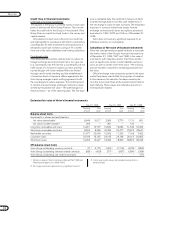

1996 1997 1998

Discounted bills 368 628 482

Guarantees:

Bank loans and trade bills – associated companies 316 22 8

Bank loans – customers and others 1,873 1,531 1,318

Recourse obligations 515 123 91

Other contingent liabilities 3,116 3,102 4,838

Total 6,188 5,406 6,737

The amount shown for guarantees to customers and

others pertaining to bank loans, 1,318 (1,531; 1,873)

includes the unutilized portion of credit facilities, 50 (46;

11). Recourse obligations pertain to receivables that

have been transferred (sales-financing operations), less

reduction for recognized credit risks. Other contingent

liabilities include 1,442 (699; 528) related to claims in

connection with the tax audit of the Volvo Group, for

which provisions were not deemed necessary.

Current liabilities Note 25

Assets pledged Note 26

Contingent liabilities Note 27