Volvo 1998 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

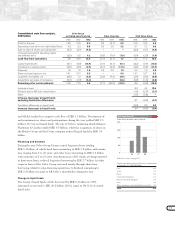

Operating income

Group operating income amounted to SEK 6.7 billion (8.4), after SEK 2.3 billion

of items affecting comparability.

Excluding items affecting comparability, operating income increased by

SEK 0.6 billion, to SEK 9.0 billion.

Operating income of commercial products in total developed well, rising SEK

1.2 billion to SEK 5.6 billion. Higher volumes, favorable price trends for Trucks

in North America and costs savings in production were the main reasons for the

earnings improvement. This was partially offset by higher administration costs,

investments in product development and launches of new products.

Operating income of Cars, excluding items affecting comparability, declined

to SEK 3.8 billion (4.5). Higher volumes and cost-reduction measures in produc-

tion and purchasing could not offset the adverse effects of the weakening

demand in Southeast Asia, higher product development costs, increased price

pressures and the costs of production start-up and introduction of the Volvo S80.

The Group’s operating margin, which declined during the year, amounted to

3.1% (4.6). Excluding items affecting comparability, the operating margin was

4.2%.

Excluding items affecting comparability, the operating margin declined in all

business areas except Trucks. Volvo’s objective, to have an operating margin

exceeding 5%, was achieved by Construction Equipment and Aero.

Distributed by Cars and commercial products, operating margin was 3.7% and

5.1%, respectively.

Volvo Group consolidated

income statements, SEK billion 1996 1997 1998

Net sales 156.1 183.6 212.9

Cost of sales (121.3) (139.0) (163.9)

Gross income 34.8 44.6 49.0

Research and development expenses (8.3) (8.7) (10.1)

Selling expenses (14.9) (17.2) (19.0)

Administrative expenses (6.7) (7.0) (8.1)

Other operating income and expenses (1.2) (3.3) (2.8)

Items affecting comparability — — (2.3)

Operating income 3.7 8.4 6.7

Income from investments in associated companies 0.3 2.9 0.4

Income from other investments 9.0 1.2 4.5

Interest income and similar credits 4.8 3.5 1.5

Interest expenses and similar charges (3.2) (2.7) (1.4)

Other financial income and expenses (0.4) (0.1) (0.1)

Income after financial items 14.2 13.2 11.6

Taxes (1.8) (2.7) (2.9)

Minority interests 0.1 (0.1) (0.1)

Profit for the year 12.5 10.4 8.6

Income per share, SEK 26.90 22.90 19.60

1996 1997 1998

Cars 1.5 4.5 3.8

Commercial

Products 2.6 4.5 5.6

Trucks 0.9 1.8 3.1

Buses 0.3 0.6 0.4

Construction Equipment 1.2 1.4 1.5

Marine and

Industrial Engines (0.0) 0.2 0.1

Aero 0.2 0.5 0.5

Other companies

and eliminations (0.4) (0.6) (0.4)

Operating income

excluding items

affecting comparability 3.7 8.4 9.0

Items affecting comparability – – (2.3)

Operating income 3.7 8.4 6.7

Other

Com- and

mercial elimi-

Cars Products nations Total

Operating income 1997 4.5 4.5 (0.6) 8.4

Increased volumes 0.5 1.5 2.0

Change in product

and market mix etc 0.6 2.4 3.0

Higher research and

development expenses (0.8) (0.6) (1.4)

Higher selling and

administrative expenses (0.6) (2.0) (2.6)

Conversion costs for

production of Volvo S80 (0.8) – (0.8)

Other 0.4 (0.2) 0.2 0.4

Operating income,

excluding items affect-

ing comparability 3.8 5.6 (0.4) 9.0

Items affecting

comparability (0.7) (1.5) (0.1) (2.3)

Operating income 1998 3.1 4.1 (0.5) 6.7

Operating income by business area

Change of operating income SEK billion

SEK billion