Volvo 1998 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

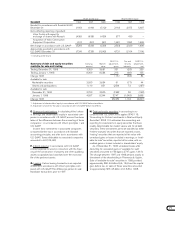

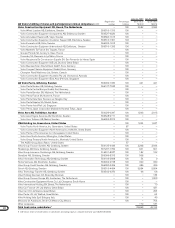

Holdings of shares and participations are specified on page 88-90. Changes in holdings of shares and participations

are shown below.

Group companies Non-Group companies

1997 1998 1997 1998

Balance December 31, previous year 46,893 39,868 7,025 1,051

Acquisitions 1,014 3,131 152 1,049

Divestments (613) (1,101) (6,114) –

Shareholder contribution 818 4,203 — 76

Write-downs (8,244) (908) (12) (45)

Balance December 31, current year 39,868 45,193 1,051 2,131

Volvo Truck North America Inc was acquired from Volvo

Truck Corporation for 568 and Volvo Information Techno-

logy North America Inc was acquired from Volvo Informa-

tion Technology AB for 5. The companies were then con-

veyed to VNA Holding Inc as a shareholder contribution

and increased the book value in that company.

Shareholder contributions were made to Volvo Group

Finance Sweden AB with 1,550. December 31, 1998

the holding was written down with 854. Volvo Group

Finance Europe BV was acquired for 1,003 from Volvo

Group Finance Sweden AB. Mexicana de Autobuses SA

de CV was acquired for 764.

As part of the restructuring of the market companies

in Great Britain, six companies were acquired internally in

the Group for a total of 763, including Volvo Car Finance

UK Ltd, Volvo Car UK Ltd and Volvo Penta UK Ltd.

Certain restructuring was also carried out in Denmark,

whereby Volvo Holding Danmark A/S was acquired for 1

and a shareholders’ contribution of 46 was paid to incre-

ase the book value. Volvo Personvogne Danmark A/S

was acquired for 20, after which shares with a net worth

of 86 were transferred to Volvo Holding Danmark A/S

as a shareholder contribution.

Additional shares in Group companies were acquired

for 7. Danafjord AB, with a book value of 508, was sold

to Sotrof AB.

Shareholder contributions, which increased book values

were also made to Volvo Bus Corporation, 1,650, Volvo

Aero AB, 172, Volvo International Holding BV, 70, Volvo

Holding Italia SpA, 45, Volvo Business Services AB, 10

and to Sykria AB, 1.

The holding in Volvo Information Technology AB was

written down with 54.

1997: The shares in Volvo Personvagnar Holding AB

were written down by 8,026 in connection with dividends

received. Fortos Ventures AB was purchased from Volvo

Personvagnar Holding AB for 550. The shares were writ-

ten down by 210 in connection with dividends received.

VAC North America Inc was acquired from Volvo Aero

AB for 316 and Volvo Group Treasury North America Inc

was acquired from Volvo Group Finance Sweden AB for

148. The acquired companies were then conveyed,

together with Volvo Group North America Inc, 34, to

VNA Holding Inc as a shareholder contribution and

increased the book value in that company.

Volvo Transport AB was sold to Volvo Transport

Holding AB for 88.

A shareholder contribution of 25 was made to the

newly formed company Volvo Teknisk Utveckling AB, fol-

lowing which the shares of the company were sold to Volvo

Technology Transfer AB, also a newly formed company.

Shareholder contributions that increased book values

were made to Volvo Technology Transfer AB, 74, Celero

Support AB, 24, and Volvo Aero AB, 196. The holding in

Volvo Technology Transfer AB was written down by 8 at

year-end.

1996: All of the shares of Swedish Match AB were

acquired from AB Fortos for 8,000, following which the

shares were distributed to AB Volvo’s shareholders.

Volvo Car Corporation was sold for 6,546 to AB Fortos,

whose name was then changed to Volvo Personvagnar

Holding AB. Sotrof AB, whose holdings among other

included the remaining shares of Pharmacia & Upjohn

Inc, was acquired within the Group for 9,854.

AB Volvo purchased 80% of the shares of Volvo

Construction Equipment North America Inc from Volvo

Construction Equipment NV for 1,054, following which

the holding was conveyed to VNA Holding Inc, a newly

formed holding company for part of the operations in

North America, as a shareholder contribution. A share

reserve of 500 was transferred from the holding in Volvo

Truck Corporation to VNA Holding Inc The book value of

VNA Holding amounted thereafter to 556.

The value of the holding of shares in Volvo Truck

Corporation acquired from Renault SA in 1994 declined

by 67 in connection with payment of the remaining por-

tion of the purchase price.

Volvo Bus Corporation was purchased from Volvo

Truck Corporation for 154 and the holding was written

down by 35.

Shareholder contributions that increased book values

were made with 360.

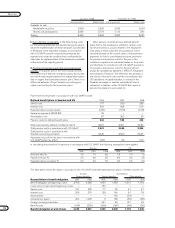

Shares and participations in non-Group companies

Shares from Henlys Group Plc were aqcuired for 376

and from Deutz AG for 670. Participations in Blue Chip

Jet HB were subscribed from Pharmacia & Upjohn for 3

and infusion of capital, which increased the book value,

were given with 76. The participations were written down

by 45, which corresponds to the result share of the year.

The shares in Stockholm Stock Exchange were sold.

1997: Bilia AB shares with a book value of 3 were

sold in connection with exercise of call options.

Shares of Renault SA carried on the books at 6,080

were sold.

Participations in the newly formed partnership, Blue

Chip Jet HB, were subscribed for 138 (of which 58 by

an aircraft) and written down by 7.

The holding in Euroventures BV was reduced by 4 in

connection with the reduction of the company’s share

capital. Within the Group shares were sold with a total

book value of 32.

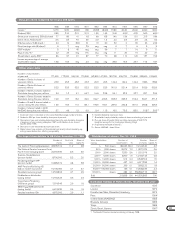

Investments in shares and participations Note 11