Volvo 1998 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

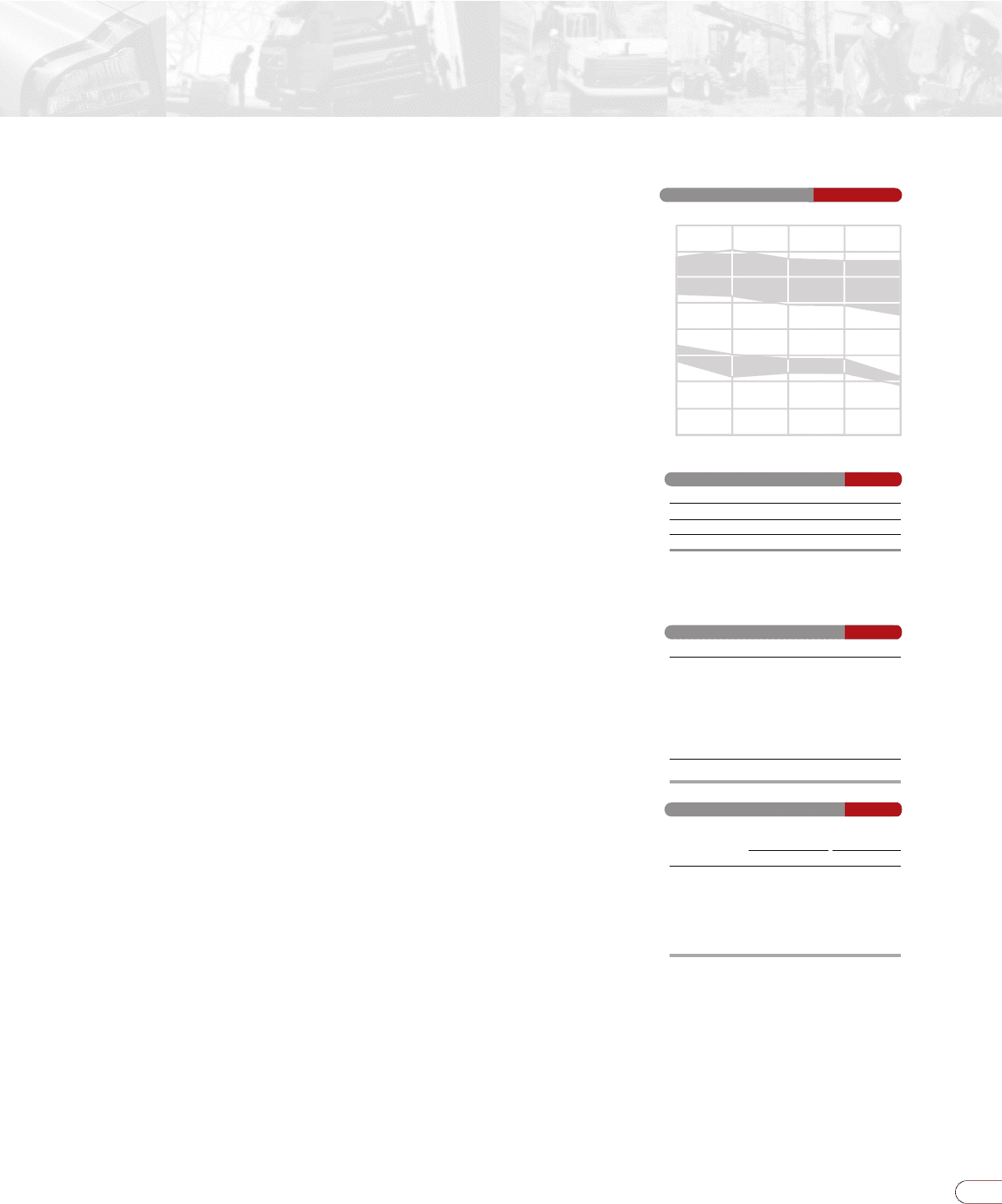

Total market development trucks ³ 16 tons

Number of new trucks, registered, thousands

98

969594

100

200

300

400

500

700

600

Western Europe

North America

Japan

Other

665

171

205

53

236

97

665

207

236

32

190

Total

SEK M 1996 1997 1998

Net sales 44,275 50,840 63,837

Operating income1878 1,812 3,061

Operating margin, %12.0 3.6 4.8

1 Excluding items affecting comparability during

1998. Including items affecting comparability of

SEK 46 M, operating income amounted to SEK

3,015 M and operating margin to 4.7%.

Key ratios Trucks

1996 1997 1998

Western Europe 32,310 31,040 37,810

Eastern Europe 2,660 3,430 4,540

North America 16,850 20,900 29,310

South America 4,980 6,970 6,020

Asia 4,850 4,710 3,760

Other countries 2,030 1,930 1,840

Total 63,680 68,980 83,280

Volvo heavy trucks Market share,

registrations %

1997 1998 1997 1998

United States 17,290 24,060 9.7 11.5

Great Britain 4,420 5,600 16.7 18.3

France 4,130 5,590 13.5 14.5

Brazil 4,510 4,090 23.3 23.1

Germany 3,090 3,880 7.5 7.7

Number of vehicles invoiced Trucks

Largest markets Trucks

Trucks

Global demand for trucks leveled off at an historically high level in 1998. Large

increases in demand in Western Europe and North America compensated for

declines in Asia, Eastern Europe and South America and the total world market

for heavy trucks in 1998 was unchanged from the preceding year. The Western

European market for heavy trucks, which was characterized by severe compe-

tition, amounted to a record level of 207,000 vehicles (171,000). Demand was

also strong in the North American market, which amounted to 236,000 trucks

(205,000) in the heavy class. A certain softening of demand was noted in certain

parts of Western Europe in January and February 1999, but the level of demand

in North America remained high.

Competitors

Volvo is the world’s third-largest manufacturer of heavy trucks with total

weights of more than 16 tons. Sales are carried out in more than 100 countries

on all continents. There are eight competitors with annual production of more

than 30,000 heavy trucks; of these, Mercedes and the American company Paccar

are larger than Volvo. During 1998, Volvo was the second-largest make of heavy

trucks in Europe, while it ranked fifth in North America. Volvo is the sixth-

largest producer of trucks in the medium-weight class, 7 to 16 tons, in Europe.

Objectives in 1999

Volvo Trucks’ objective in 1999 is among others to establish a common product

base on all continents, which will involve building a larger number of models for

more markets, using the same modular concept.

The introduction of the FM family of trucks that was launched in 1998 will

also continue. As a result of the FM family’s increased competitiveness in the

construction and regional distribution sectors Volvo is creating prospects to

obtain larger shares of the market in the heavy-truck segment, notably in

Europe.

In addition, Trucks’ ambitions for 1999 include improved productivity,

increased distribution efficency as well as reducing product costs and the costs

for purchased materials. Moreover, aggressive efforts are being made in market

business and product development.

Greater economies of scale create conditions for consistent profitability

The trend towards increased economies of scale in Trucks, through products

based on the global modular concept and use of a maximum number of common

components, continued in 1998 with the launch of the FM family. 78% of the

Volvo FM’s components are the same as those used in the Volvo FH series,

which constitutes the base of the modular concept.

Further gains from coordinating operations with those of Volvo’s other

business areas represent another step towards greater economies of scale. The

new D7C engine, modified versions of which are also being used in Volvo buses,

is a concrete example of this.