Volvo 1998 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

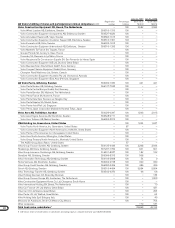

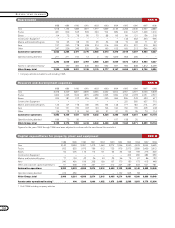

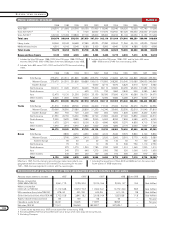

ELEVEN-YEAR SUMMARY

1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998

Year's operations

Profit (loss) for the year 4,940 4,787 (1,020) 682 (3,320) (3,466) 13,230 9,262 12,477 10,359 8,638

Depreciation and amortization 2,293 2,685 3,021 3,129 3,119 3,777 5,107 5,656 5,351 6,796 9,626

Write-downs of shareholdings and fixed assets — — 674 725 315 — 574 1,817 — — —

Income from equity method

investments after taxes — (337) (704) (899) 417 2,815 (1,274) (730) (222) 220 (400)

Dividend received from associated companies — 225 277 675 700 717 160 404 119 145 634

Gain on sales of securities (47) (126) (116) (2,026) (131) (504) (4,243) (1,180) (8,169) (4,068) (4,469)

Gain on sales of subsidiaries — — — — — — — (3,032) — — (366)

Minority interests after taxes 103 35 (26) (439) (1,286) 356 365 45 (99) 112 42

(Increase)

decrease in Receivables (1,221) (1,892) (966) (1,347) 1,484 (2,732) (3,538) (962) (4,777) (7,452) (6,592)

current assets: Inventories (2,840) 571 (1,897) 1,611 2,373 2,209 (2,687) (516) (547) (2,575) (1,306)

Increase (decrease) in current

operating liabilities and other provisions 1,351 58 2,639 608 1,859 6,312 5,915 570 (618) 7,280 6,888

Increase (decrease) in deferred

tax liabilities 14 98 (812) (521) (2,207) (989) (1,373) (267) 23 711 (669)

Cash flow from year's operations 4,593 6,104 1,070 2,198 3,323 8,495 12,236 11,067 3,538 11,528 12,026

Investments (increase)

Property, plant Fixed assets (4,641) (6,504) (4,598) (2,874) (2,915) (3,465) (4,274) (6,491) (8,200) (9,863) (10,549)

and equipment Leasing vehicles — (400) (1,200) (1,000) (1,352) (1,678) (2,495) (2,585) (3,851) (9,773) (12,654)

etc: Disposals 274 747 180 1,243 299 770 1,460 1,351 1,958 1,855 2,777

Investments in shares and participations, net (1,849) (1,635) (5,456) (7,238) (224) 464 8,182 1,953 14,080 10,669 5,504

Long-term receivables, net (3,008) 36 (28) (102) (1,620) (280) (1,563) (1,953) (2,804) (6,031) (9,884)

Acquisitions and sales of companies (166) (49) (964) (210) 323 393 — (4,420) (878) (1,303) (5,622)

Remaining after net investments (4,797) (1,701) (10,996) (7,983) (2,166) 4,699 13,546 (1,078) 3,843 (2,918) (18,402)

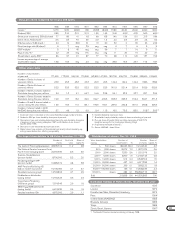

Financing, dividends, etc

Increase (decrease) in short-term

bank loans and other loans 1,781 8,288 5,124 (1,542) (298) (5,104) (6,233) (3,993) 5,151 995 18,872

Increase (decrease) in long-term loans

and provisions for pensions 839 (1,445) 2,797 2,847 3,745 (753) (2,011) 6,166 (1,844) 3,404 1,043

(Increase) decrease in restricted

deposits in Bank of Sweden (2,313) (1,259) 3,221 2,031 39 2 — — — — —

Increase (decrease) in minority interests 41 (105) (87) 5,282 122 15 145 (37) 45 (21) 68

Dividends paid to AB Volvo shareholders (815) (1,086) (1,203) (1,203) (1,203) (601) (601) (1,512) (1,854) (1,993) (2,208)

Dividends paid to minority shareholders — — — (157) (81) — (132) (3) (33) (83) (59)

Redemption of shares — — — — — — — — — (5,807) —

New issue — — — — — — — — — 116 —

Settlement of loan to Renault — — — — — — (1,422) — (1,536) — —

Other 691 (355) (342) (7) 78 93 23 46 (121) (22) —

Increase (decrease) of liquid funds

excluding translation differences (4,573) 2,337 (1,486) (732) 236 (1,649) 3,315 (411) 3,651 (6,329) (686)

Translation differences in liquid funds — — — — 1,817 1,331 (308) (732) (296) 271 307

(Increase) decrease in investments in bonds (2,292) 501 601 1,926 928 — — — — — —

Increase (decrease) in liquid funds (6,865) 2,838 (885) 1,194 2,981 (318) 3,007 (1,143) 3,355 (6,058) (379)

Liquid funds, December 31 15,632 18,470 17,585 18,779 21,760 21,442 24,449 23,306 26,661 20,603 20,224

1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998

Volvo Group, total 15,434 16,875 17,865 17,654 16,857 19,489 24,156 27,248 25,997 26,951 30,064

As from 1992 the effects of major acquisitions and divestments of subsid-

iaries as well as the distribution of the shares in Swedish Match in 1996

have been excluded from other changes in the balance sheet. Furthermore,

the effects of changes in exchange rates at translation of foreign subsidia-

ries have been excluded, since these effects do not influence cash flow.

Cash flow analysis SEK M

Salaries, wages and other remuneration (including social costs) SEK M