Volvo 1998 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

In accordance with the Swedish Companies Act, distribu-

tion of dividends is limited to the lesser of the unrestric-

ted equity shown in the consolidated or Parent Company

balance sheets after proposed appropriations to restric-

ted equity. Unrestricted equity in the Parent Company at

December 31, 1998 amounted to 49,995.

As of December 31, 1998, Volvo related foundation’s

holdings in Volvo were 1.3% of the share capital and

3.2% of the voting rights.

As shown in the consolidated balance sheet as of

December 31, 1998, unrestricted equity amounted to

48,307 (41,309; 40,652). It is estimated that 5 of this

amount will be allocated to restricted reserves.

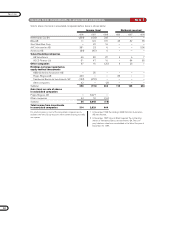

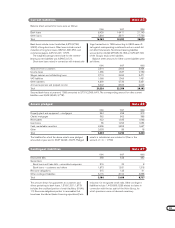

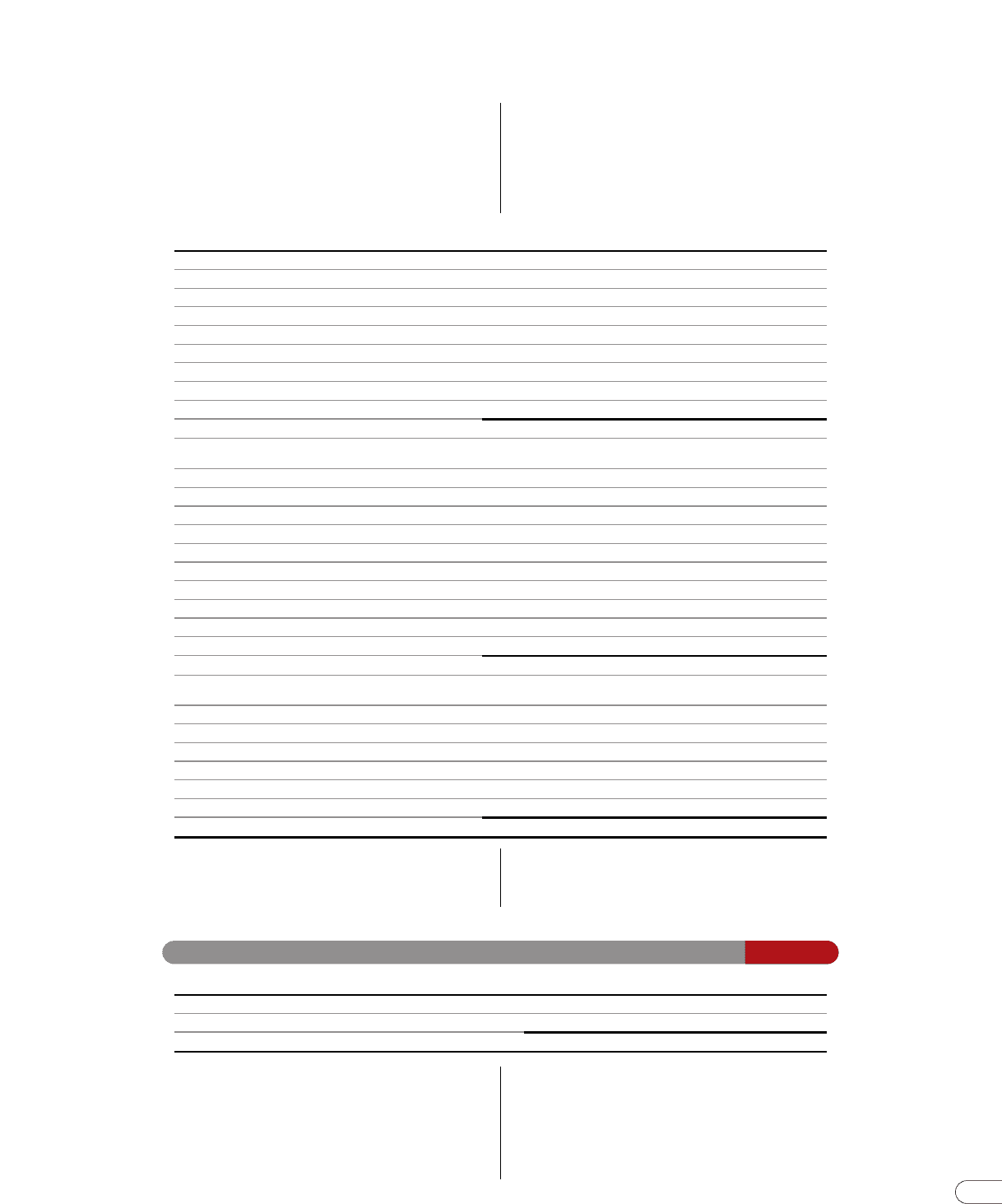

Restricted Unrestricted

Change in shareholders’ equity Share capital reserves reserves Total equity

Balance December 31, 1995 2,318 14,264 34,618 51,200

Cash dividend — — (1,854) (1,854)

Distribution of shareholding in Swedish Match — — (4,117) (4,117)

Profit for the year — — 12,477 12,477

Effect of equity method of accounting 1— 373 (373) —

Transfer between unrestricted and restricted equity — 439 (439) —

Translation differences — (222) 87 (135)

Exchange differences on loans and futures contracts 2— — 40 40

Other changes — 52 213 265

Balance December 31, 1996 2,318 14,906 40,652 57,876

Cash dividend — — (1,993) (1,993)

Redemption of shares (113) — (5,694) (5,807)

Bonus issue of shares 441 (113) (328) —

Profit for the year — — 10,359 10,359

New issue of shares 3 113 — 116

Effect of equity method of accounting 1— (34) 34 —

Transfer between unrestricted and restricted equity — 92 (92) —

Translation differences — 1,396 (528) 868

Exchange differences on loans and futures contracts 2— — (665) (665)

Accumulated translation difference on the Renault holding 3— — (552) (552)

Other changes — 113 116 229

Balance December 31, 1997 2,649 16,473 41,309 60,431

Cash dividend — — (2,208) (2,208)

Profit for the year — — 8,638 8,638

Effect of equity method of accounting1— (466) 466 —

Transfer between unrestricted and restricted equity — 130 (130) —

Translation differences — 970 441 1,411

Exchange differences on loans and futures contracts 2— — (237) (237)

Other changes — (7) 28 21

Balance December 31, 1998 2,649 17,100 48,307 68,056

1 Mainly associated companies’ contributions to Group net in-

come, reduced by dividends received.

2 Hedged net investments in foreign subsidiaries and associat-

ed companies.

3 Difference pertains to Renault shares sold and, in connection

with the sale, has affected consolidated capital gains.

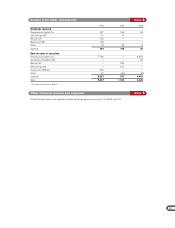

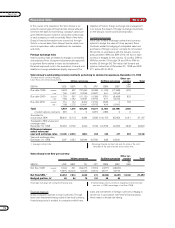

1996 1997 1998

Provisions for pensions 1,937 1,905 1,451

Provisions for other post-employment benefits 1,213 1,391 1,485

Total 3,150 3,296 2,936

Provisions for post-employment benefits Note 22

The amounts shown for Provisions for postemployment

benefits correspond to the actuarially calculated value of

obligations not insured with a third party or secured

through transfers of funds to pension foundations. The

amount of pensions falling due within one year is inclu-

ded. The Swedish Group companies have insured their

pension obligations with third parties.

Group pension costs in 1998 amounted to 3,567

(3,660; 3,446). The greater part of pension costs consist

of continuing payments to independent organizations

that administer pension plans.

In 1996 two Groupwide pension foundations for

employees in Swedish companies were formed to secure

commitments in accordance with the ITP plan. The Volvo