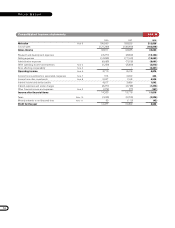

Volvo 1998 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

NOTE S

Foreign currencies

In preparing the consolidated financial statements, all

items in the income statements of foreign subsidiaries

(except subsidiaries in highly inflationary economies) are

translated to Swedish kronor at the average exchange

rates during the year (average rate). All balance sheet

items except net income are translated at exchange

rates at the respective year-ends (year-end rate). The

differences in consolidated shareholders’ equity arising

as a result of variations between year-end exchange

rates are charged or credited directly to shareholders’

equity and classified as restricted or unrestricted reserves.

The difference arising in the consolidated balance sheet

as a result of the translation of net income in foreign

subsidiaries to Swedish kronor at average rates is char-

ged or credited to unrestricted reserves. Movements in

exchange rates change the book value of foreign associ-

ated companies. This difference affects restricted reser-

ves directly.

When foreign subsidiaries and associated companies

are divested, the accumulated translation difference is

reported as a realized gain/loss and, accordingly, affects

the capital gain.

Financial statements of subsidiaries operating in highly

inflationary economies are translated to Swedish kronor

using the temporal method. Monetary items in the balance

sheet are translated at year-end rates and nonmonetary

balance sheet items and corresponding income state-

ment items are translated at rates in effect at the time

of acquisition (historical rates). Other income statement

items are translated at average rates. Translation differ-

ences are credited to, or charged against, income in the

year in which they arise.

In the individual Group companies as well as in the

consolidated accounts, receivables and liabilities in

foreign currency are valued at year-end exchange rates.

In appropriate cases, receivables and liabilities are valued

at the underlying forward rate. In the individual Swedish

Group companies, unrealized exchange gains on long-

term receivables and liabilities are allocated to an

exchange reserve, which is included in untaxed reserves.

Gains and losses pertaining to hedges are reported at

the same time as gains and losses of the items hedged.

Received premiums or payments for currency options,

which hedge currency flows in business transactions are

reported as income/expense during the contract period.

Gains/losses on outstanding currency futures at year-

end, which were entered into to hedge future commercial

currency flows, are reported at the same time as the

commercial flow is realized. For other currency futures

outstanding, a valuation is made whereby a provision for

unrealized losses is made to the extent they exceed

unrealized gains.

In valuing loans whose original currency denomination

has been changed as a result of currency swap con-

tracts, the loan amount is accounted for translated to

Swedish kronor taking into account the swap contracts.

Exchange differences on loans and other financial

instruments in foreign currency, which are used to hedge

net assets in foreign subsidiaries and associated com-

panies, are offset against translation differences in the

shareholders’ equity of the respective companies.

Exchange gains and losses on payments during the

year and on the valuation of assets and liabilities in

foreign currencies at year-end are credited to, or

charged against, income before taxes and minority inter-

ests in the year they arise. The more important exchange

rates employed are shown above.

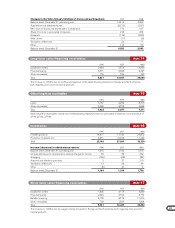

Other financial instruments

Interest and currency rate swaps are used to change the

underlying loans structure and are reported as hedges

against such loans.

Interest-rate instruments used as part of the manage-

ment of the Group’s short-term investments are valued

together with these instruments in accordance with the

portfolio method. Provisions are made for unrealized losses

in excess of the unrealized gains within the portfolio.

Interest-rate instruments that do not fullfil the criteria

of hedge accounting are valued at the closing date at

which time provisions for unrealized losses are made.

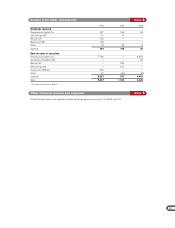

Capital expenditures for property, plant and

equipment

Capital expenditures for property, plant and equipment

include investments in buildings, machinery and equip-

ment, as well as in intangible assets. Investments per-

taining to assets under operating leases are not included.

Depreciation and amortization of tangible and

intangible non-current assets

Depreciation is based on the historical cost of the

assets, reduced in appropriate cases by write-downs,

and estimated economic life. Capitalized type-specific

tools are generally depreciated over 2 to 8 years. The

depreciation period for assets under operating leases is

normally 3 to 5 years. Machinery is generally depreciated

over 5 to 20 years, and buildings over 25 to 50 years,

while the greater part of land improvements are depreci-

ated over 20 years. In connection with its participation in

aircraft engine projects with other companies, Volvo Aero

in certain cases compensates these companies for part

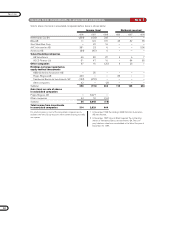

Exchange rates Average rate Year-end rate

Country Currency 1996 1997 1998 1996 1997 1998

Belgium BEF 0.217 0.214 0.2196 0.215 0.213 0.2341

Denmark DKK 1.158 1.158 1.1897 1.156 1.155 1.2685

Finland FIM 1.463 1.476 1.4930 1.482 1.453 1.5885

France FRF 1.312 1.310 1.3514 1.312 1.314 1.4400

Italy ITL 0.00436 0.0045 0.0046 0.00451 0.0045 0.0049

Japan JPY 0.0618 0.0631 0.0610 0.0593 0.0606 0.0700

The Netherlands NLG 3.982 3.921 4.0202 3.941 3.903 4.2865

Norway NOK 1.040 1.082 1.0520 1.066 1.072 1.0730

Great Britain GBP 10.486 12.496 13.2215 11.605 13.123 13.5200

Germany DEM 4.462 4.412 4.5317 4.423 4.398 4.8295

United States USD 6.712 7.629 7.9676 6.872 7.870 8.0650