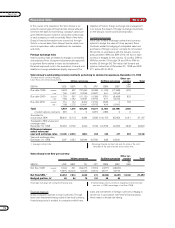

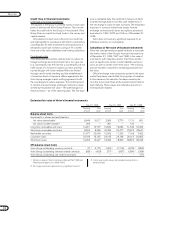

Volvo 1998 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

NOTE S

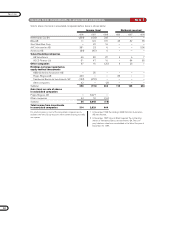

Acquisitions and divestments

Pharmacia & Upjohn, Inc

In 1996 Volvo sold 50,006,534 Pharmacia & Upjohn, Inc

shares. The capital gain amounted to SEK 7.8 billion and

Volvo’s holding in the company thereafter amounted to

3.9% of the share capital and voting rights. In 1998 Volvo

sold its remaining holding. The amount received was SEK

6.5 billion and the capital gain amounted to SEK 4.5 billion.

Verimation

In 1998 Volvo Aero’s subsidiary, AGES, and BTM Capital’s

subsidiary, Engine Lease Finance, ELF, formed a new

company to lease aircraft engines. ELF owns 46% of the

new company, and AGES 44%, while BTM Capital and

Volvo Aero each own 5%. In addition, BTM Capital ac-

quired a 5% interest in AGES and Volvo Aero acquired

a 5% interest in ELF.

Aviation Lease Finance, ALF

In 1998 Volvo Aero’s subsidiary, AGES, and BTM Capital’s

subsidiary, Engine Lease Finance, ELF, formed a new

company to lease aircraft engines. ELF owns 46% of the

new company, and AGES 44%, while BTM Capital and

Volvo Aero each own 5%. In addition, BTM Capital acqui-

red a 5% interest in AGES and Volvo Aero acquired a

5% interest in ELF.

Henlys Group Plc

In August 1998 Volvo acquired 10% of the share capital

and voting rights in Henlys Group Plc. Henlys owns the

leading manufacturers of bus bodies in Great Britain. Volvo

and Henlys jointly own the shares of Prévost, which manu-

factures buses in Canada, with 51% and 49%, respectively.

Deutz AG

In October 1998 Volvo and Deutz AG, a German manu-

facturer of diesel engines, concluded an agreement

covering cooperation in the field of diesel engines. Under

terms of the agreement Deutz will become a principal

supplier of small and medium-size diesel engines for

Volvo’s trucks, buses, construction equipment and marine

and industrial applications. In connection with the agree-

ment Volvo has acquired 10.5% of the share capital and

voting rights in Deutz.

ABB Olofström Automation AB

The entire shareholding, amounting to 49% of the share

capital and voting rights, was divested in 1998.

EBP Olofström AB

The entire shareholding, amounting to 23% of the share

capital and voting rights, was divested in 1998.

Arabian Vehicles and Trucks Industry Ltd

In 1998 Volvo acquired 25% of the voting rights and

share capital in Arabian Vehicles and Trucks in Saudi

Arabia. The company will assemble Volvo trucks and the

business will start in the second half of 1999.

The AGES Group, ALP

During 1996 Volvo Aero increased its holding in The

AGES Group, ALP (Air Ground Equipment Sales), an

American company, from 5% to 25%. In the beginning of

1997 the holding was increased to 60% and since then

AGES has been a Volvo subsidiary (see Note 2).

OmniNova Technology AB

In March 1997 Volvo Bus Corporation and TWR Group

Ltd., an English engineering company, formed a jointly

owned company to develop production processes for

buses, and to produce certain bus components. Volvo

Bus Corporation owns 35% of the company and TWR

65%; the company’s operations are located with those of

Autonova in Uddevalla.

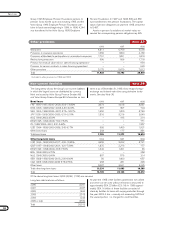

Régie Nationale des Usines Renault SA

(Renault SA)

In July 1997 Volvo divested its entire holding in Renault,

equal to 11.4% of both the share capital and voting

rights in the company. The proceeds amounted to 5,934

and the capital gain was 783.

Pripps Ringnes AB

At year-end 1996 Volvo owned 49% of the shares and

held a convertible debenture loan that would increase

the holding to 55%. In 1997 Volvo sold its holding in

Pripps Ringnes. Volvo received 4,515 from the sale plus

100 in dividends, and the transaction resulted in a capi-

tal gain of 3,027 in the Volvo Group.

SAS Sverige AB

In June 1997 Volvo sold its entire holding in SAS

Sverige AB, equal to 4.7% of the share capital and

voting rights. The amount of the sale was 319 and the

capital gain was 221.

Fabege AB

In 1997 Volvo divested its entire holding in Fabege AB,

equal to 8.3% of the share capital and 7.5% of the

voting rights. The capital gain was 19.

Merkavim Metal Works Ltd

In January 1996 Volvo Bus Corporation acquired 26.5%

of the share capital and voting rights in Merkavim Metal

Works Ltd, Israel. The company produces coaches, city

and inter-city buses, as well as articulated buses and

minibuses.

Investment AB Bure

In 1996 Volvo sold its entire holding, 17.7%, resulting in

a gain of 394.

Spira AB

The entire holding, 9.5%, was sold in 1996, producing

a capital gain of 10.

A specification of Group holdings of shares and partici-

pations appears on page 88. Call options with a total

exercise price of – (–; 5) have been issued on shares

with book values of – (–; 2).

The Volvo Group has transactions with some of its

associated companies. As of December 31, 1998, the

Group’s net receivables from associated companies

amounted to 6,260 (4,575; 6,909).

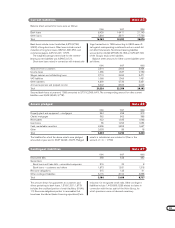

The market value of Volvo’s holdings of securities in

listed companies as of December 31, 1998 is shown

below.

Book value Market value

Bilia AB 572 644

Henlys Group 376 302

Deutz AG 670 485

Total 1,618 1,431

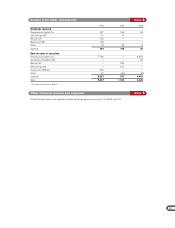

Shares and participations Note 13