Volvo 1998 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1998

Change in net financial assets

Definitions

16

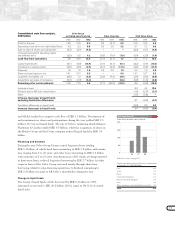

Cash flow analysis

Excluding sales financing operations, the Volvo Group’s operating cash flow

amounted to SEK 1.0 billion (7.6) (see accompanying table). The significantly

lower figure, compared with 1997, was due primarily to the fact that the trend of

profitability was not adequate to offset a less favorable trend of working capital

tied up in operations as a result of higher volumes of business. High net invest-

ments in property, plant and equipment mainly attributable to production

retooling also had an effect. The amount of working capital tied up in operations,

excluding the effects of changes in foreign exchange rates, changes in the compos-

ition of the Group, and items affecting comparability, increased by SEK 0.2 billion

during the year (decrease 5.0). The increase in capital tied up in inventories and

receivables was offset in part by higher trade payables and other operating liabil-

ities and provisions. Items affecting comparability totaling SEK 2.3 billion, which

are reported in income for the year as a result of approved restructuring measures,

did not affect the year’s cash flow to any significant degree.

The rate of growth in Volvo’s sales financing operations continued to be high,

resulting in a negative cash flow within sales financing of SEK 18.9 billion (1997:

negative cash flow of SEK 20.8 billion) after net investments. For a more detailed

presentation of Volvo’s sales-financing operations, see pages 38–39.

Capital expenditures

Capital expenditures for property, plant and equipment increased to SEK 10.5

billion (9.9). Capital expenditures in Volvo Cars amounted to SEK 5.6 billion

(5.5), of which the greater part pertained to continuing investments in the new,

large platform in the form of changes in the production process in Göteborg and

Ghent, to investments in type-specific tools in suppliers’ plants, and to invest-

ments in the supply of components. Capital expenditures in commercial products

amounted to SEK 4.1 billion, of which SEK 2.6 billion (2.4) pertains to Volvo

Trucks, which during the year changed production processes to the new FM series,

carried out capacity enhancement and environmental improvement measures

within the assembly and component channels and established a new cab plant in

Curitiba, Brazil.

Investments in leasing assets amounted to SEK 12.7 billion (9,8), of which

SEK 11.8 billion pertained to sales-financing operations, primarily those in

North America and Great Britain. Long-term receivables increased in a net

amount of SEK 9.9 billion (6.0), of which SEK 9.4 billion (7.2) was attributable

to continuing expansion of the loan portfolio in the sales-financing business,

notably in the form of installment credits and financial leasing.

Acquisitions and divestments

Acquired and divested operations in 1998 resulted in a negative cash flow of

SEK 5.6 billion, net (1997: negative cash flow of SEK 1.3 billion), of which the

acquisition of the assets of Samsung Heavy Industries´ divison for construction

equipment accounted for SEK 3.9 billion. The acquisitions of Carrus, Nova BUS

Capital expenditures

2

6

4

0

SEK billion

96 97 98

Commercial Products

Cars

SEK billion

Cash flow from operations 10.3

Capital expenditures (10.4)

Investments in leasing assets (0.9)

Disposals 1.5

Long-term operational receivables, net 0.5

Operating cash flow, Volvo Group

excluding sales financing 1.0

Dividend to AB Volvo’s shareholders (2.2)

Acquired and divested operations 1(5.0)

Shares and participations, net 5.5

Infusion of capital to sales-

financing companies, net (2.2)

Other including changes in exchange rates (1.4)

Total change (4.3)

1) Of which, purchase amount SEK 5.0 billion and net

financial debt in acquired and divested companies

SEK 0.0 billion.

Operating cash flow,

excluding sales financing

Cash flow from year’s operations with

deductions for net investments in property,

plant and equipment, leasing assets and

long-term operating receivables.

BOARD OF DIRECTORS’ REPORT

1996 1997 1998

Cars 4.4 5.5 5.6

Commercial Products 3.3 3.7 4,1

Other 0.5 0.7 0.8

Volvo Group, total 8.2 9.9 10.5