Volvo 1998 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

and MASA resulted in a negative cash flow of SEK 1.3 billion. Divestments of,

and investments in, shares and participations during the year yielded SEK 5.5

billion (10.7) in net liquid funds. The sale of Volvo’s remaining shareholding in

Pharmacia & Upjohn yielded SEK 6.5 billion, while the acquisition of shares in

the Henlys Group and the Deutz company reduced liquid funds by SEK 1.0

billion.

Financing and dividend

During the year Volvo Group Finance raised long-term loans totaling

SEK 5.2 billion, of which bond loans amounting to SEK 3.2 billion with matur-

ities ranging from 2 to 10 years, and other loans amounting to SEK 2.0 billion

with maturities of 2 to 15 years. Amortizations in 1999, which are being reported

as short-term loans, reduced long-term borrowing by SEK 2.7 billion. In other

respects, loans of the Volvo Group increased mainly through short-term

borrowing related to sales-financing operations. A dividend amounting to

SEK 2.2 billion was paid to AB Volvo’s shareholders during the year.

Change in liquid funds

The Group’s liquid funds, which decreased by SEK 0.4 billion in 1998,

amounted at year-end to SEK 20.2 billion (20.6), equal to 9% (11) of consoli-

dated sales.

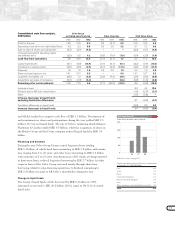

Consolidated cash flow analysis, Volvo Group

SEK billion excluding sales financing Sales financing Total Volvo Group

1996 1997 1998 1996 1997 1998 1996 1997 1998

Profit for the year 12.5 10.5 8.3 0.0 (0.1) 0.3 12.5 10.4 8.6

Depreciation and other non cash-related items 4.2 5.2 6.6 0.9 2.0 3.2 5.1 7.2 9.8

Gain on sales of shares and subsidiaries (8.2) (4.1) (4.8) ———(8.2) (4.1) (4.8)

Increase (decrease) of operating capital

and deferred taxes (2.9) 5.0 0.2 (3.0) (7.0) (1.8) (5.9) (2.0) (1.6)

Cash flow from operations 5.6 16.6 10.3 (2.1) (5.1) 1.7 3.5 11.5 12.0

Capital expenditures (8.1) (9.8) (10.4) (0.1) (0.1) (0.1) (8.2) (9.9) (10.5)

Investments in leasing assets (0.8) (0.5) (0.9) (3.1) (9.3) (11.8) (3.9) (9.8) (12.7)

Disposals 1.8 1.0 1.5 0.2 0.9 1.3 2.0 1.9 2.8

Shares and participations, net 14.1 10.7 5.5 ——0.0 14.1 10.7 5.5

Long-term receivables, net (0.8) 1.2 (0.5) (2.0) (7.2) (9.4) (2.8) (6.0) (9.9)

Acquisitions and sales of companies (0.9) (1.3) (5.0) ——(0.6) (0.9) (1.3) (5.6)

Remaining after net investments 10.9 17.9 0.5 (7.1) (20.8) (18.9) 3.8 (2.9) (18.4)

Increase in loans 3.3 4.4 19.9

Dividend paid to AB Volvo shareholders (1.9) (2.0) (2.2)

Other (1.5) (5.8) —

Increase (decrease) in liquid funds

excluding translation differences 3.7 (6.3) (0.7)

Translation differences on liquid funds (0.3) 0.3 0.3

Increase (decrease) in liquid funds 3.4 (6.0) (0.4)

Capital expenditures approved but not yet implemented

at December 31, 1998, SEK billion

Cars 11.1

Trucks 4.7

Buses 0.6

Construction Equipment 0.7

Marine and Industrial Engines 0.0

Aero 0.6

Other companies and undistributed investments 0.3

Total 18.0

Self-financing ratio

100

50

200

150

0

%

96 97

Volvo Group excluding sales financing

98

Definition in note 1 on page 57.