Volvo 1998 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

NOTE S

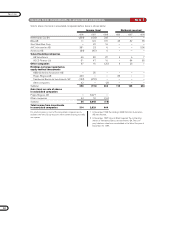

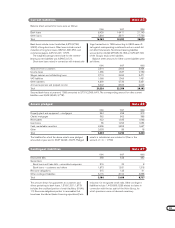

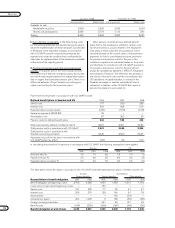

At December 31, 1998, future rental income from noncan-

cellable financial and operational leases (minimum leasing

fees) amounted to 27,272 (19,991; 13,051), of which

26,670 (19,322; 12,745) pertains to sale-financing com-

panies. Future rental income is distributed as follows:

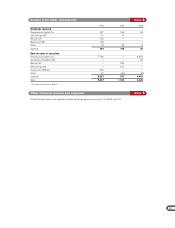

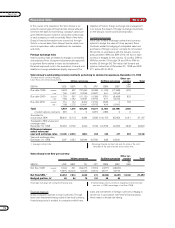

At December 31, 1998, future rental payments related

to noncancellable leases amounted to 7,042 (6,356;

7,269), of which 2,944 (2,548; 2,170) in sales-financing

companies. Rental expenses in 1998 amounted to 1,826

(2,002; 1,782).

Future rental payments are distributed as follows:

Rental payments

1999 2,130

2000 1,617

2001 1,246

2002 1,007

2003 597

2004 and later 445

Total 7,042

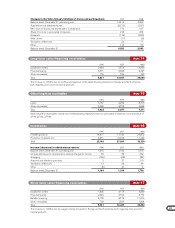

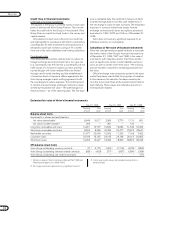

In accordance with a resolution adopted at the Annual

General Meeting, the fee paid to the Board of Directors

is a fixed amount of SEK 2,975,000, to be distributed as

decided by the Board. The Chairman of the Board,

Håkan Frisinger, receives a fee of SEK 850,000 and the

vice Chairman of the Board, Lars Ramqvist, receives a

fee of SEK 500,000.

In 1998, Leif Johansson, President and Chief Executive

Officer, received 7,804,260 in salary and other benefits

amounting to SEK 1,430,838. Other benefits include

a single payment of SEK 1,160,000 to compensate

a capital loss selling the former apartment in Stockholm.

His bonus for 1997 was SEK 692,300 (SEK 1,000,000

on an annual basis), of which SEK 230,766 was paid in

cash during 1998 and the rest saved. For 1998 the bonus

is maximum 30% of the annual salary. Leif Johansson is

eligible to take early retirement on pension at age 55.

A pension is earned gradually over the years up to the

employee’s retirement age and is fully earned at age 55.

During the period between the ages of 55 and 65, he

would receive a pension equal to 70% of his pension-

qualifying salary, and a pension amounting to 50% of his

pension-qualifying salary after reaching the age of 65.

Leif Johansson has a twelve months notice of termination

from AB Volvo and six months on his own initiative.

If Leif Johansson’s employment is terminated by AB

Volvo, he is entitled to a severance payment equal to two

years’ salary, plus bonus.

In 1998, Sören Gyll, President and Chief Executive

Officer up to and including April 22, 1997, received SEK

3,000,000 in salary regarding the operational year 1997,

SEK 325,000 in board fee and other benefits amounting

to SEK 456,077. Sören Gyll continued to serve the Group

until December 31, 1997 and then retired on pension.

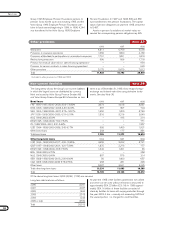

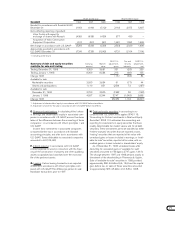

The Group Executive Committee, members of the

executive committees of subsidiaries and a number of

key persons receive bonuses in addition to salaries.

Bonuses are based on the performance of the Volvo

Group and/or of the executive’s company, in accordance

with the bonus system established by the Volvo Board in

1993 and revised in 1996, 1997 and 1998. A bonus

may, in principle, amount to a maximum of 50% of an

executive’s annual salary.

The employment contracts of certain senior executives

contain provisions for severance payments when em-

ployment is terminated by the Company, as well as rules

governing pension payments to executives who take

early retirement. The rules governing early retirement

provide that, when employment is terminated by the

Company, an employee is entitled to severance pay equal

to the employee’s monthly salary for a period of 12 or 24

months, depending on age at date of severance. In certain

contracts, replacing contracts concluded earlier, an em-

ployee is entitled to severance payments amounting to

the employee’s monthly salary for a period of 30 to 42

months. In agreements concluded after the spring of

1993, severance pay is reduced, in the event the employee

gains employment during the severance period, in an

amount equal to 75% of income from new employment.

An early-retirement pension may be received when the

employee reaches age 60. A pension is earned gradually

over the years up to the employee’s retirement age and

is fully earned at age 60. From that date until reaching

the normal retirement age, the retiree will receive 70%

of the qualifying salary.

In February 1996, Skandia and Trygg-Hansa (insurance

companies) offered approximately 100 senior executives

in the Volvo Group an opportunity to acquire call options

on AB Volvo’s Series B shares. At the close of the sub-

scription period approximately 90% of the executives

had accepted the offer. The call options, which expire

March 3, 2001, entitle the holder to acquire one Volvo

Series B share for each option held. The option price,

based on a market valuation, was fixed at SEK 21.15

and the exercise price is SEK 200. Members of the

Group Executive Committee were offered an opportunity

to acquire 6,000 or 10,000 options each. Other senior

executives could acquire 4,000 or 6,000 options each.

A total of 514,000 options were subscribed.

In October 1998 Volvo announced a new options pro-

gram, to be effective in April 1999. Approximately 100

senior executives were offered an opportunity to partici-

pate in the options program, which includes options on

AB Volvo Series B shares. 95% of the executives has

accepted the offer.

The call options, which can be exercised until April

2004, give a holder the right to acquire one Series B

Volvo share for each option held. The price of the options

is based on a market valuation. The number of options

will equal part of the executive’s bonus earned.

The options are financed 50% by the company and

50% from the option holder’s bonus.

Operational leasing Financial leasing

1999 4,646 4,627

2000 3,934 4,207

2001 2,513 3,349

2002 1,090 1,503

2003 374 587

2004 or later 241 201

Total 12,798 14,474

Leasing Note 28

Personnel Note 29