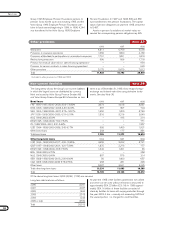

Volvo 1998 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

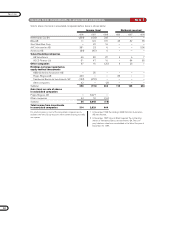

NOTE S

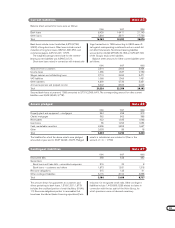

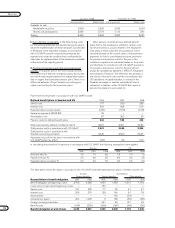

1996 1997 1998

Warranties 4,811 5,769 6,599

Provisions in insurance operations 1,650 1,890 2,139

Provisions attributable to participations in associated companies 1,701 1,851 1,819

Restructuring measures 596 556 1,718

Provison for residual value risks in sales-financing operations1– – 954

Provision for service contracts in sales-financing operations1– – 629

Other provisions 3,175 5,679 7,012

Total 11,933 15,745 20,870

1 Included in other provisons in 1996 and 1997.

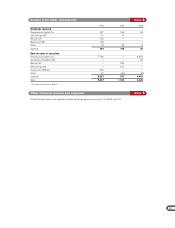

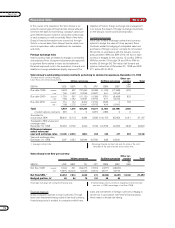

The listing below shows the Group’s non-current liabilities

in which the largest loans are distributed by currency.

Most are issued by Volvo Group Finance Sweden AB

and Volvo Group Finance Europe BV. Information on loan

terms is as of December 31, 1998. Volvo hedges foreign-

exchange and interest-rate risks using derivative instru-

ments. See also Note 30.

Bond loans 1996 1997 1998

FRF 1995–1997/2000–2009, 3.93–7.632% 3,674 4,618 3,887

DKK 1996–1998/2002–2005, 4.30–6.00% 357 357 704

SEK 1992–1998/2000–2007, 3.75–12.51% 1,450 1,300 3,749

JPY 1995–1998/2000–2005, 0.19–5.10% 1,316 3,216 2,640

NLG 1996/2003, 3.54% – 195 214

DEM 1995–1996/2000, 7.50–7.52% – – 771

ITL 1988/2000–2001, 5.31-5.42% – – 1.357

USD 1984–1998/2000-2008, 3.45-6.17% 955 1,409 1,921

Other bond loans 203 177 381

Total bond loans 7,955 11,272 15,624

Other long-term loans 1996 1997 1998

USD 1990–1998/2000-2017, 4.00-13.65% 2,655 3,222 3,721

GBP 1997–1998/2000-2001, 6.31-7.86% 1,875 2,273 777

DEM 1994–1998/2000, 4.55–7.60% 1,442 1,491 46

BRL 1996/2000, 6.70% – – 258

NLG 1996/2000, 6.60% 857 575 214

SEK 1988–1998/2000-2013, 2.00-9.00% 50 1,400 657

CAD 1995-1998/2000-2008, 5.78-9.76% 258 281 490

Other loans 3,097 2,621 4,225

Total other long-term loans 10,234 11,863 10,388

Total 18,189 23,135 26,012

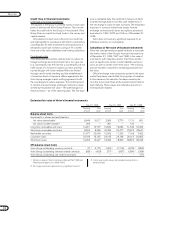

Long-term debt matures as follows:

2000 8,207

2001 4,027

2002 1,460

2003 2,313

2004 1,223

2005 or later 8,782

Total 26,012

At year-end 1998 credit facilities granted but not utilized

and which can be used without restrictions amounted to

approximately SEK 22 billion (22; 16). In 1998 approxi-

mately SEK 16 billion of these facilities consisted of

stand-by facilities for loans with varying maturities through

the year 2003. A fee – normally not exceeding 0.25% of

the unused portion – is charged for credit facilities.

Of the above long-term loans, 2,823 (2,992; 1,109) was secured.

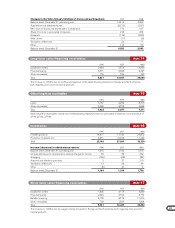

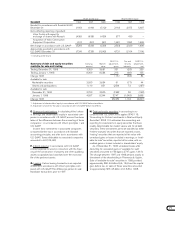

Group 1995 Employee Pension Foundation pertains to

pension funds earned up to and including 1995 and the

Volvo Group 1996 Employee Pension Foundation per-

tains to funds earned beginning in 1996. In 1996, 4,244

was transferred to the Volvo Group 1995 Employee

Pension Foundation. In 1997 and 1998, 396 and 339

was transferred to the pension foundations. The capital

value of pension obligations at year-end 1998 amounted

to 5,487.

Assets in pension foundations at market value, ex-

ceeded the corresponding pension obligations by 425.

Other provisions Note 23

Non-current liabilities Note 24